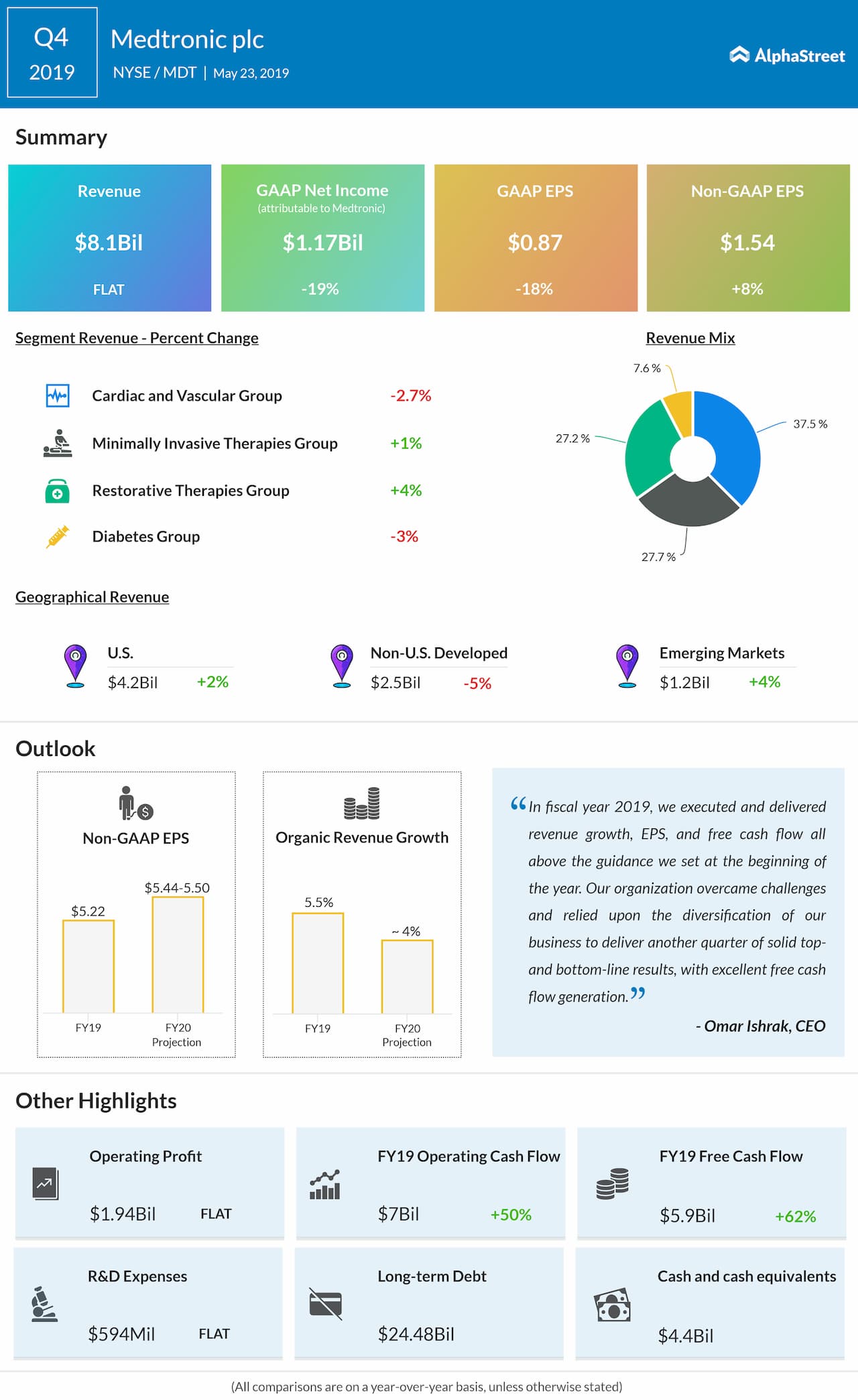

The company has been seeing revenue declines in its Cardiac

and Vascular Group for the past few quarters. Revenues in the Diabetes Group also

saw a drop last quarter. The performance of these segments will be an area to

watch. The Minimally Invasive Therapies Group and the Restorative Therapies

Group have posted revenue growth consistently over the past couple of quarters

and this trend can be expected to continue in the first quarter.

During the first quarter, Medtronic completed the acquisition of Titan Spine and updates on this topic will be noteworthy. The acquisition will help further Medtronic’s strategy to transform spinal procedures and improve outcomes. The deal is expected to be immaterial to fiscal year 2020 adjusted EPS.

Also see: Medtronic Q4 2019 Earnings Conference Call Transcript

ADVERTISEMENT

The company has also entered into various partnerships in

order to improve and diversify its product offerings and updates on this area

will be worth noting.

In the fourth quarter of 2019, Medtronic topped market expectations for revenue and earnings. Worldwide revenue was flat at $8.1 billion on a reported basis but rose 3.6% on an organic basis. Adjusted EPS grew 8% to $1.54. Revenues grew in the single digits range in the US and emerging markets but declined in non-US developed markets.

For fiscal year 2020, Medtronic has guided for organic revenue growth of 4% and adjusted EPS in the range of $5.44-5.50.

Shares of Medtronic have gained 13% thus far this year and 2% in the past one month. The majority of analysts have rated the stock as Buy and the average 12-month price target is $107.08.