Estimates

Tesla shares are trading at a significant discount compared to last year’s highs, presenting a potential opportunity for investors. With the company navigating short-term challenges, its ability to regain strength as market conditions improve remains a key factor to watch. Nevertheless, macroeconomic uncertainties, aggravated by the recent import tariffs, and increasing competition from traditional automakers entering the EV space remain a challenge to the company.

Q4 Outcome

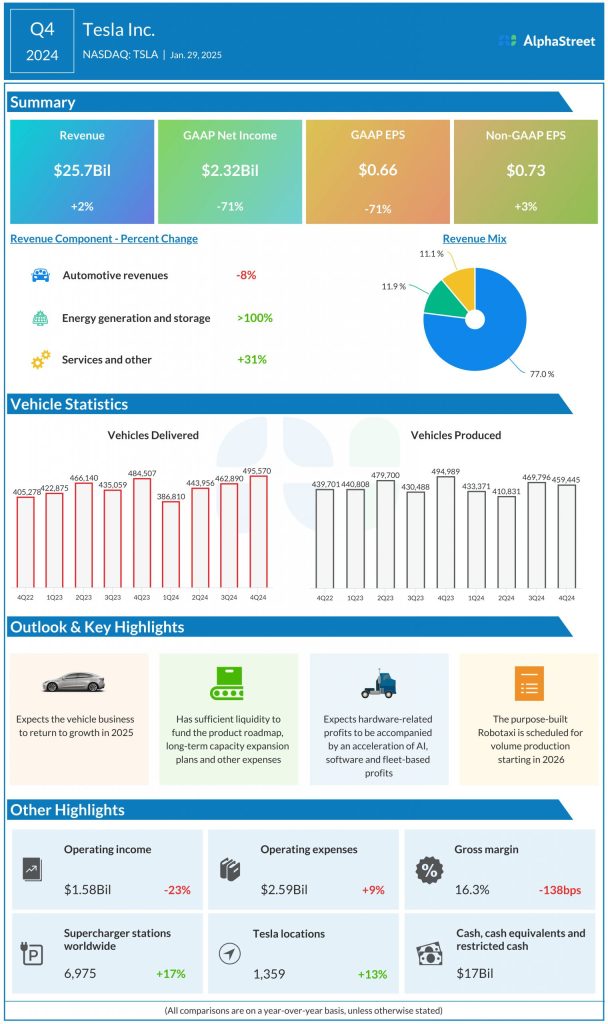

In the fourth quarter of 2024, Tesla’s revenues increased 2% year-over-year to $25.7 billion. An 8% sales drop in the core automotive segment was more than offset by strong growth in the energy and services businesses. Adjusted earnings per share rose 3% to $0.73. Meanwhile, Q4 earnings plunged 71% from the prior year to $2.32 billion or $0.66 per share. The company produced a lesser number of vehicles in the fourth quarter compared to the year-ago quarter, while deliveries increased modestly.

From Tesla’s Q4 2024 earnings call:

“While we feel confident in our team’s abilities to ramp production quickly, note that it is an unprecedented change, and we are not aware of anybody else taking the best-selling car on the planet and updating all factories at the same time. This changeover will result in several weeks of lost production in the quarter. As a result, margins will be impacted due to idle capacity and other ramp-related costs, as is common in any launch but will be overcome as production is ramped. We will be introducing several new products throughout 2025.”

Production

The Tesla leadership has expressed optimism that the vehicle business will return to growth in fiscal 2025. In a recent statement, Tesla said it produced a total of 362,615 vehicles in the first quarter and delivered 336,681 units. The number of Model 3 and Model Y units produced in the March quarter is 345,454. The company deployed 10.4 GWh of energy storage products in the first quarter.

On Tuesday, Tesla’s stock opened at $252.35 and traded higher mostly during the session. It has lost 36% in the past three-and-half months.