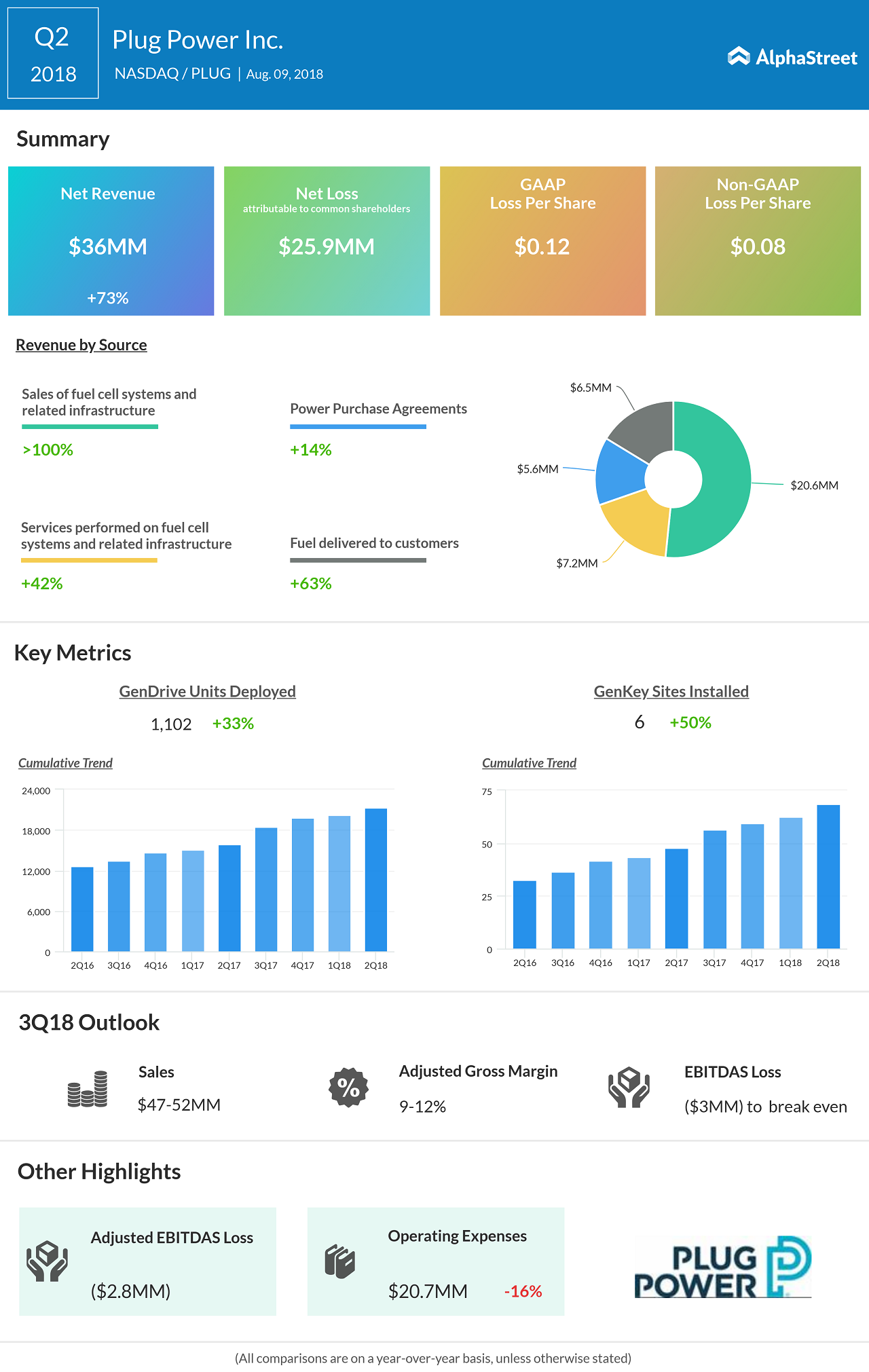

Last quarter, Plug Power Inc. (PLUG) posted a loss of $0.12 per share on revenues of $39.9 million, missing estimates — even after it posted an impressive top-line growth vs. a year ago.

This was the same period when the company started shipping its new GenDrive 2440-36R fuel cell system used in Class-2 electric forklifts.

Almost $20 million in total operating expenses affected the bottom-line, and this will also be in focus in the coming results.

However, since the US manufacturing sector has witnessed a resurgence under the Trump administration from how it was last year, we could see this translate to Power Plug. Be on the lookout for expense cuts and tax gains when the results are out on Thursday.