Proving its critics wrong yet again, Tesla this week said it achieved production and delivery goals for the third quarter, exceeding expectations. After a long lull — thanks to the COVID crisis – M&A activity seems to be picking up, with Walmart reaching an agreement with Issa Brothers and TDR Capital to sell its UK unit Asda. Elsewhere, media reports revealed that Goldman Sachs has agreed to acquire the credit card business of General Motors for $2.5 billion.

In the IPO space, Colorado-based software firm Palantir Technologies and task management app Asana went public this week, eliciting a lot of interest from market watchers and the investing community.

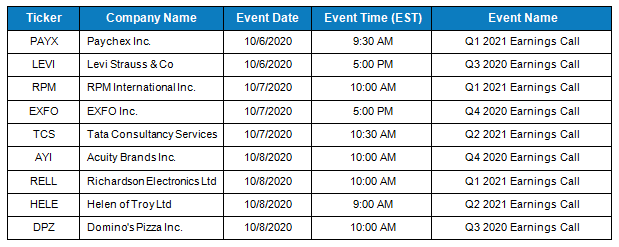

With the next earnings season about to start later this month, there are only a few announcements scheduled for the next week. Major announcements include Levi Strauss & Co and Paychex slated for Tuesday. Domino’s Pizza (DPZ) and Acuity Brands (AYI) will unveil their latest quarterly numbers on Thursday.

Key Earnings to Watch

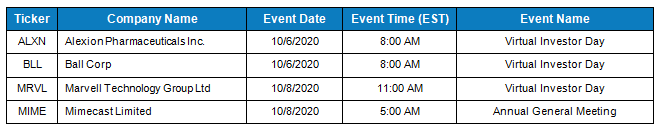

Key Investor Days to Watch

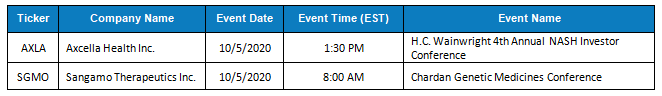

Key Corporate Conferences to Watch

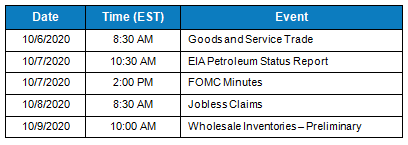

Key US Economic Events

Looking Back

The following are notable companies which have reported their earnings last week. In case if you have missed to catch up on their performance, click the respective links to skim through the transcripts to glean more insights.

Weibo Corporation (WB)

Micron Technology Inc. (MU)

PepsiCo Inc. (PEP)

Conagra Brands, Inc. (CAG)

Constellation Brands Inc. (STZ)

Bed Bath & Beyond Inc. (BBBY)

If you want to listen to how management responds to analyst questions and the tone they use, you can head over to our YouTube channel to listen to conference calls on the go.