Stitch Fix, Inc. (NASDAQ: SFIX), a leading provider of online personal styling services, Tuesday said its second-quarter net loss widened despite an increase in revenues. The bottom-line matched analysts’ expectations, while revenues beat.

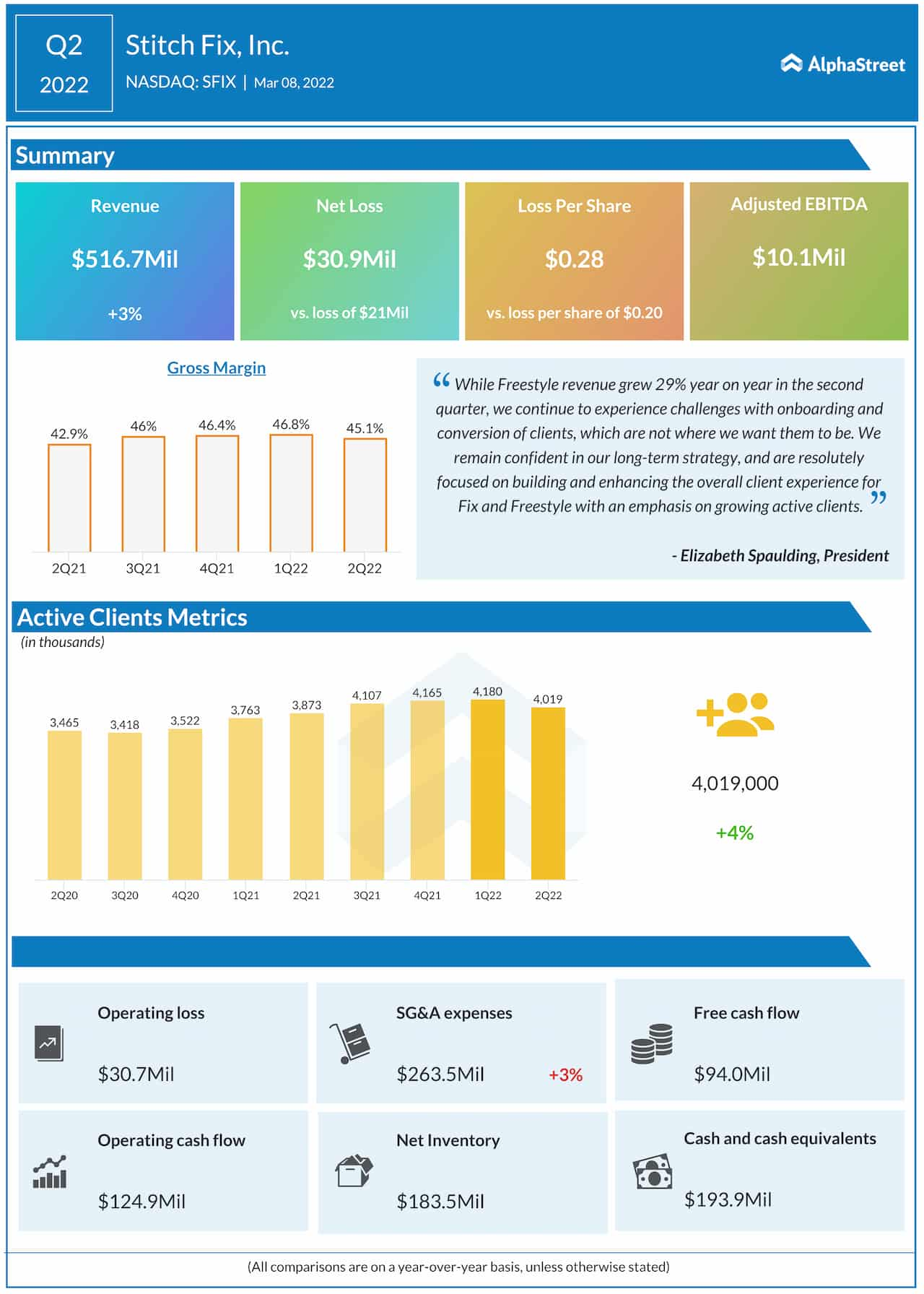

The San Francisco, California-based company had around 4.0 million active clients at the end of the second quarter. It reported a net loss of $30.9 million or $0.28 per share for the three-month period, which is wider than last year’s loss of $21.0 million or $0.20 per share. The latest number matched analysts’ forecasts.

Revenues moved up to $516.7 million in the January quarter from $504.1 million in the corresponding period of 2021. The top-line also beat the consensus estimate.

Read management/analysts’ comments on Stitch Fix’s Q2 earnings

Stitch Fix’s shares have lost 72% in the past six months. They closed Monday’s regular session higher but declined in the after-hours soon after the announcement.