Sportswear company Under Armour (NYSE: UAA) reported a narrower net loss for the second quarter, aided by an increase in revenues. While the bottom-line surpassed the estimates, sales missed, driving the company’s stock lower in Tuesday’s pre-market session.

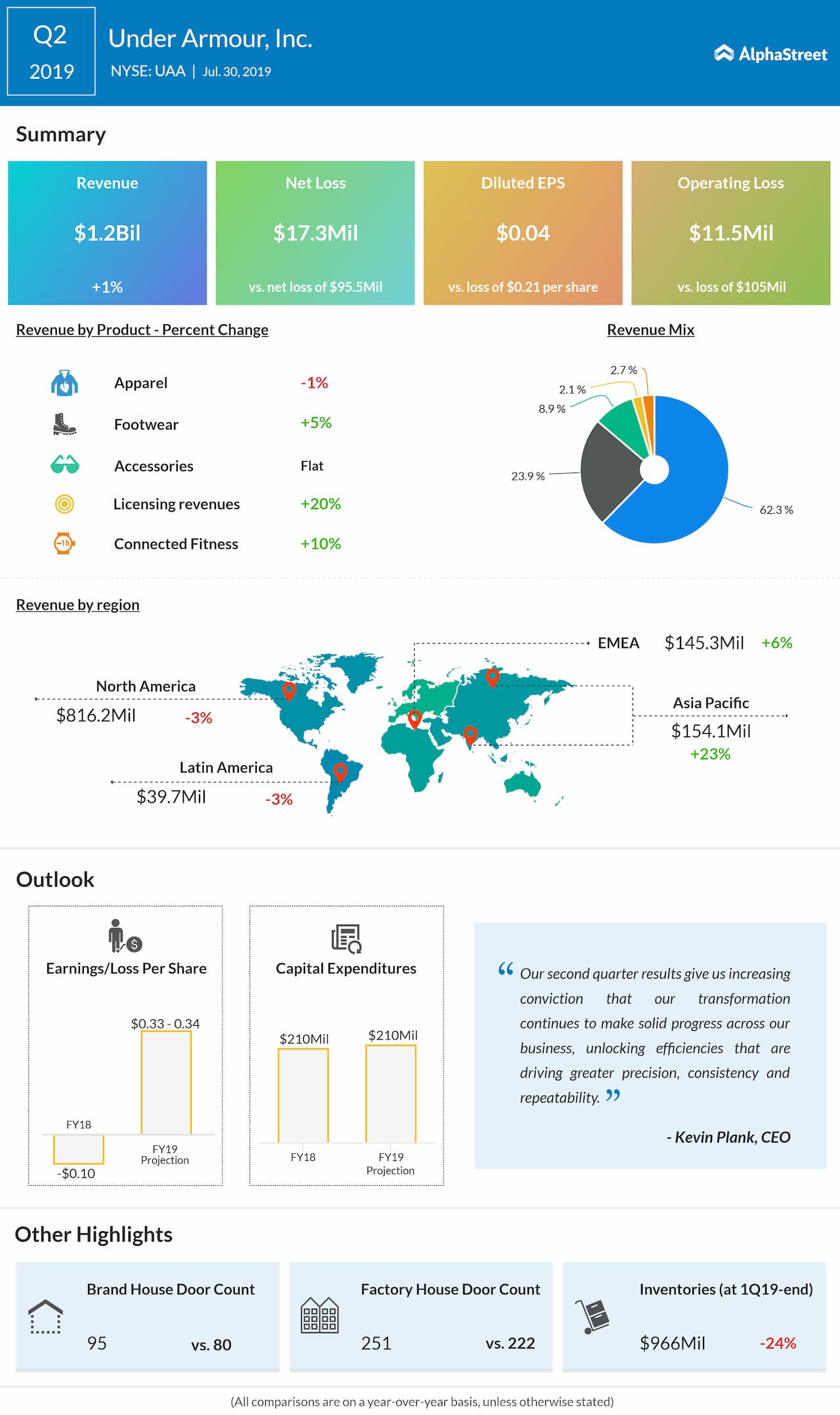

Second-quarter net loss narrowed to $17 million or $0.04 per share from $96 million or $0.21 per share in the same period of last year. Analysts were looking for a slightly wider loss. The results benefitted from improved product pricing and regional mix.

Revenues moved up 1% to $1.2 billion but missed the Street view. Wholesale revenue decreased by 1% while direct-to-consumer revenue rose 2%. North America revenue dipped 3% to $816 million, while international revenues rose 12% to $339 million. Apparel revenue was down 1% and footwear revenue up 5%, while accessories revenue remained unchanged.

North America revenue decreased 3% to $816 million, while international revenues rose 12% to $339 million

“By staying sharply focused on our long-term strategies – driving our premium athletic brand positioning through industry leading innovation, geographic expansion and creating deep connections with our consumers – we are on track to deliver against our expectations in 2019 ,” said CEO Kevin Plank.

Looking ahead, the company expects full-year revenue to grow 3-4%, reflecting a slight decline in North America and a low to mid-teen percentage rate increase in the international business. Gross margin is seen rising about 110-130 basis points.

Operating income is expected to be $230-$235 million, up from the previous estimate. The forecast for earnings per share is in the range of $0.33 to $0.34, which includes a negative impact from a minority interest in the company’s Japanese licensee. Full-year Capital expenditure is estimated at around $210 million.

Under Armour’s shares are currently trading at the highest level in about two-and-half years. The stock gained 54% since the beginning of the year. It closed the last trading session higher but fell sharply Tuesday morning.