Revenue and profitability

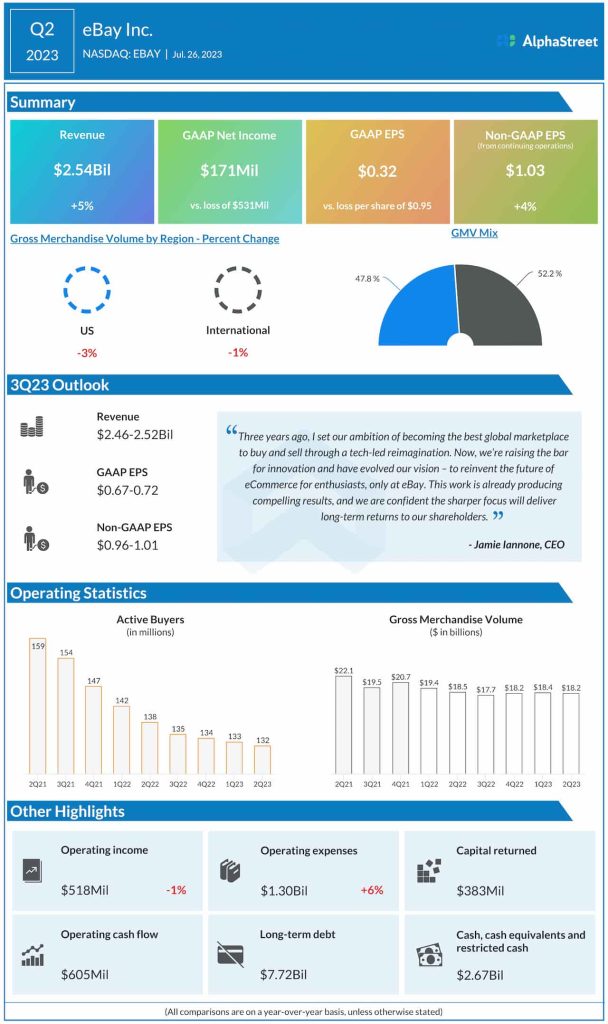

This growth was driven by investment in focus categories as well as a higher take rate due to the expansion of promoted listings, international shipping and payment services. Adjusted EPS also rose 5% to $1.03 in Q2.

Gross merchandise volume (GMV) was down 1% in Q2 to $18.2 billion, but reflected a sequential improvement from a decline of 3% seen in the first quarter. This improvement was driven by momentum within focus categories and a meaningful pickup in cross-border trade.

Growth in advertising

eBay is seeing growth in its advertising business. In Q2, total ad revenue grew 35%, with first-party ads increasing 49%. The company reached over 800 million live Promoted Listings in the quarter and its emerging Promoted Listings products grew over 30% sequentially. This growth was driven by the optimization of Promoted Listings standard and the expansion of emerging products like advanced and external Promoted Listings. eBay expects advertising revenue to surpass GMV for the foreseeable future.

Cash generation and capital returns

eBay generated $605 million of operating cash flow and $492 million of free cash flow from continuing operations in Q2 2023. The company ended the quarter with cash and non-equity investments of $5.3 billion. eBay repurchased $250 million of its common stock and paid cash dividends of $133 million in Q2.

Outlook

For the third quarter of 2023, eBay expects revenue to range between $2.46-2.52 billion, representing an organic FX-neutral YoY growth of 2-4%. GMV is expected to range between $17.6-18 billion, representing organic FX-neutral growth between negative 4% and negative 1% YoY. Adjusted EPS is expected to range between $0.96-1.01.