Quarterly numbers

In the US, GMV remained relatively flat, with the Motors Parts & Accessories (P&A) category contributing the most to growth. As mentioned on its conference call, eBay witnessed some softness in January due to adverse weather conditions, which slightly offset the momentum it has been seeing in trading cards. The US business has benefited from improvement in volume trends for trading cards over the past couple of quarters.

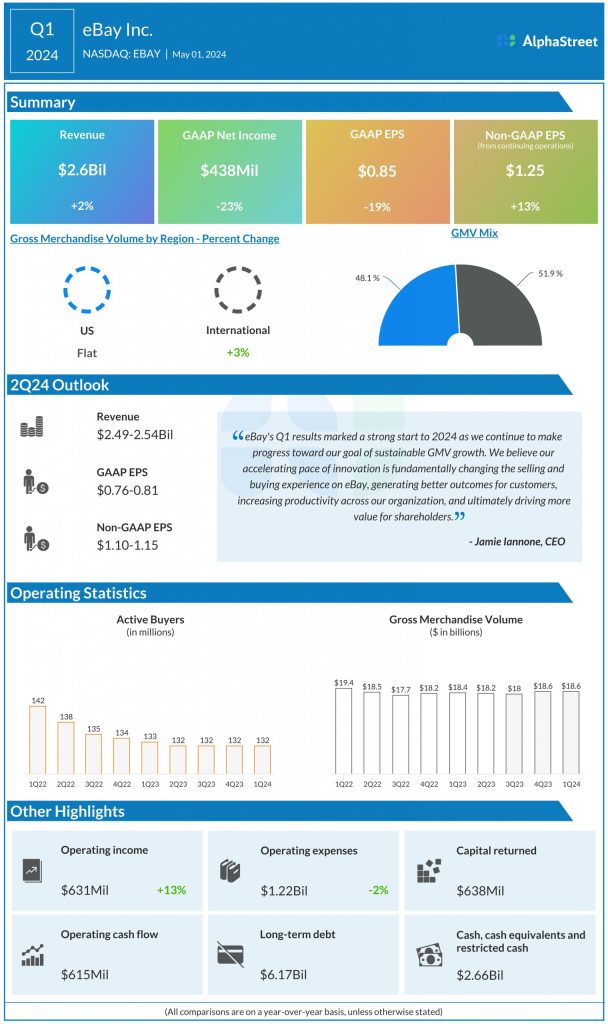

International GMV rose 3% on a reported basis and 1% on an FX-neutral basis in Q1, against a challenging backdrop in discretionary e-commerce, especially in the UK and Germany, which are two of the company’s largest markets.

Focus categories

eBay’s focus categories helped drive significant growth on its marketplace in Q1. Focus categories’ GMV grew nearly 5%, helped by volume growth in P&A, refurbished, collectibles and luxury goods. Alongside P&A, eBay is seeing strength in collectibles, with particular momentum in trading cards. The company continues to roll out new features and enter into new partnerships to improve the overall experience for hobbyists.

Pre-owned goods comprises a key part of the company’s business. In Q1, pre-owned and refurbished goods reached 40% of total GMV, and continued to outpace the sales of brand new goods. In 2024, the company plans to focus on unlocking the potential in pre-owned fashion. It is taking various steps to streamline the buying and selling experiences for pre-owned apparel on its platform.

Advertising

In Q1, eBay’s total advertising revenue grew 20% to $384 million and represented 2.1% of GMV. First-party ads grew 28% to $370 million. Revenues from legacy third-party display ads declined 55% to less than $15 million in the quarter.

On its call, eBay said it expects first party ad revenue growth to decelerate to low double digits YoY in the second quarter of 2024 due to certain one-time factors. The company expects a recovery in advertising growth during the latter half of 2024 helped by continued adoption and optimization of its first-party ad products.

Outlook

eBay continues to face a challenging and dynamic macro environment. For the second quarter of 2024, the company expects revenues to range between $2.49-2.54 billion. GMV is expected to be $17.8-18.2 billion and adjusted EPS is expected to be $1.10-1.15 in Q2.