Classifieds business

Over the past three years, revenues in eBay’s Classifieds business have increased steadily, delivering a growth of 13% in 2018 from 2017 and 3% in 2019 from 2018. Classifieds revenues totaled $1.06 billion in fiscal year 2019.

In the first quarter of 2020, revenue from Classifieds fell 3% year-over-year to $248 million. The platform was impacted by auto dealer closures in international markets, lower traffic to horizontal classifieds sites, and lower advertising revenues, all of which were brought on by the coronavirus pandemic.

Strategic review

eBay began a strategic review of its operations under pressure from its activist investors who were pushing for ways to improve profitability. As part of this review, the company decided to put its Classifieds and StubHub businesses up for sale. eBay completed the sale of StubHub to viagogo for $4.1 billion earlier this year.

With the sale of Classifieds, eBay can now shift its full focus onto its Marketplace business, which accounts for the major part of its revenue. Revenues from Marketplace increased 7.5% in 2018 versus 2017 but remained relatively flat in 2019 versus 2018 at $8.6 billion.

In the first quarter of 2020, Marketplace delivered $2.1 billion in revenue, which was down 1% on a reported basis and up 1% on an FX-neutral basis year-over-year. The platform saw momentum in traffic, conversion, GMV, sold items and buyer acquisition during the period due to the pandemic-related shelter-in-place orders in many regions.

Quarterly performance

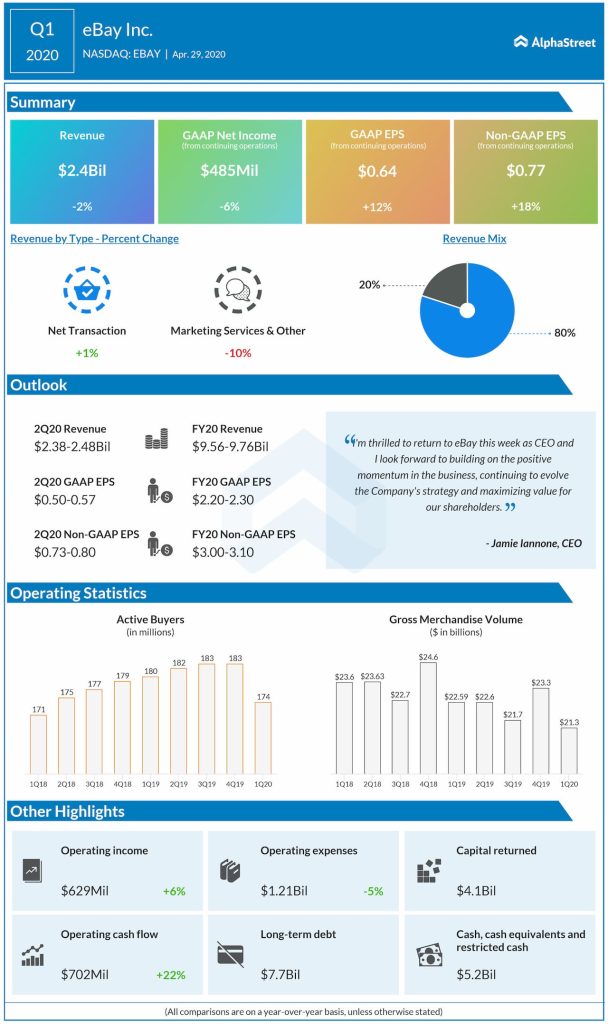

In the first quarter of 2020, eBay’s total revenue fell 2% on a reported basis to $2.4 billion while gross merchandise volume (GMV) decreased 1% to $21.3 billion. Active buyers grew by 2% to 174 million global active buyers.

Outlook

Last month, eBay updated its outlook as its business performed better than expected. GMV saw continued momentum through April and May and the company now expects Q2 volume growth to be 23-26% versus last year. eBay is seeing a pickup in active buyer growth with around 6 million new and reactivated buyers added in April and May.

eBay now expects revenues in Q2 2020 to grow 13-16% year-over-year to $2.75-2.80 billion and adjusted EPS to increase 54-60% to $1.02-1.06.

eBay is scheduled to report second quarter 2020 earnings results on Tuesday, July 28. Shares have gained over 56% since the beginning of this year and 50% over the past three months. The stock was down 3% in afternoon hours on Tuesday.

Click here to read eBay Q1 2020 earnings conference call transcript