Top and bottom line increases

Refurbished and collectibles – significant contributors

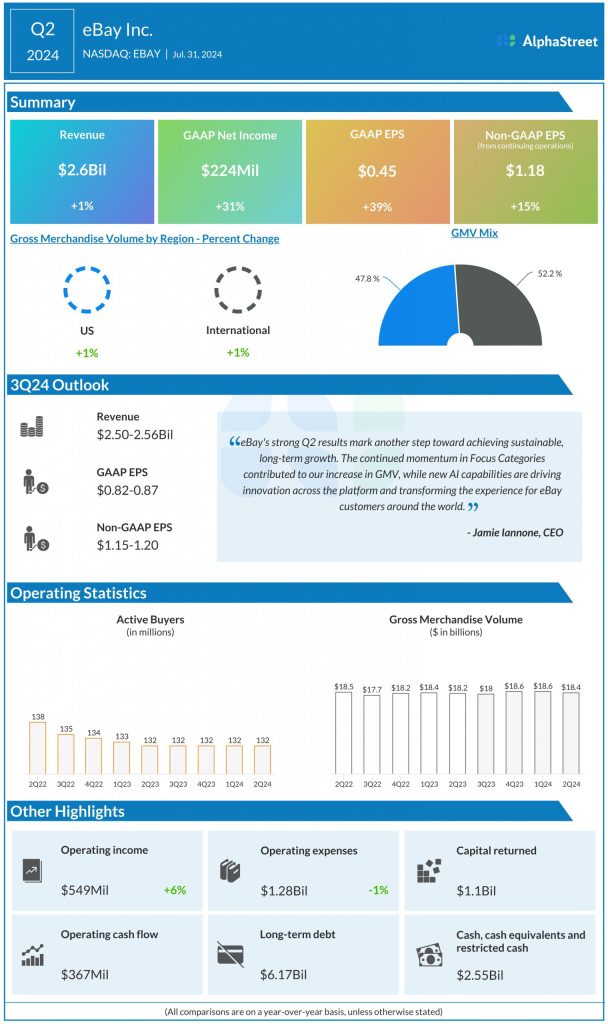

In Q2, eBay’s gross merchandise volume (GMV) grew 1% YoY on both a reported and FX-neutral basis to $18.4 billion. Focus category GMV grew by over 4% in the quarter. Among the focus categories, collectibles and refurbished were significant contributors to GMV during the period.

As mentioned on the quarterly conference call, collectibles, including trading cards, was the second largest contributor to GMV growth in Q2. eBay’s efforts in providing authentication and grading services for collectibles are helping in improving the shopping experience on its platform.

Refurbished was another key contributor to GMV growth in the quarter and it was also the fastest growing focus category on a year-over-year basis. eBay is broadening its range of refurbished inventory through the expansion of existing partnerships and the inclusion of new categories. In Q2, the company added golf clubs and hard drives to its selection of refurbished goods. The company believes refurbished products can provide meaningful value to customers.

Advertising

Total advertising revenue increased 8% to $398 million in the second quarter and represented nearly 2.2% penetration of GMV. First party ads grew over 12% to $384 million. As mentioned on the call, around 3.1 million sellers adopted a single ad product during Q2, and the company ended the quarter with roughly 1 billion live promoted listings out of nearly 2.1 billion total listings. Revenue from legacy third-party display ads declined around 49% to nearly $14 million in Q2.

Outlook

For the third quarter of 2024, eBay expects revenue to range between $2.50-2.56 billion, representing YoY FX-neutral growth of 1-3%. GMV is expected to range between $17.8-18.2 billion, representing FX-neutral growth of down 1% to up 1% YoY. GAAP EPS is expected to be $0.82-0.87 while adjusted EPS is expected to be $1.15-1.20.