Revenue

Earnings

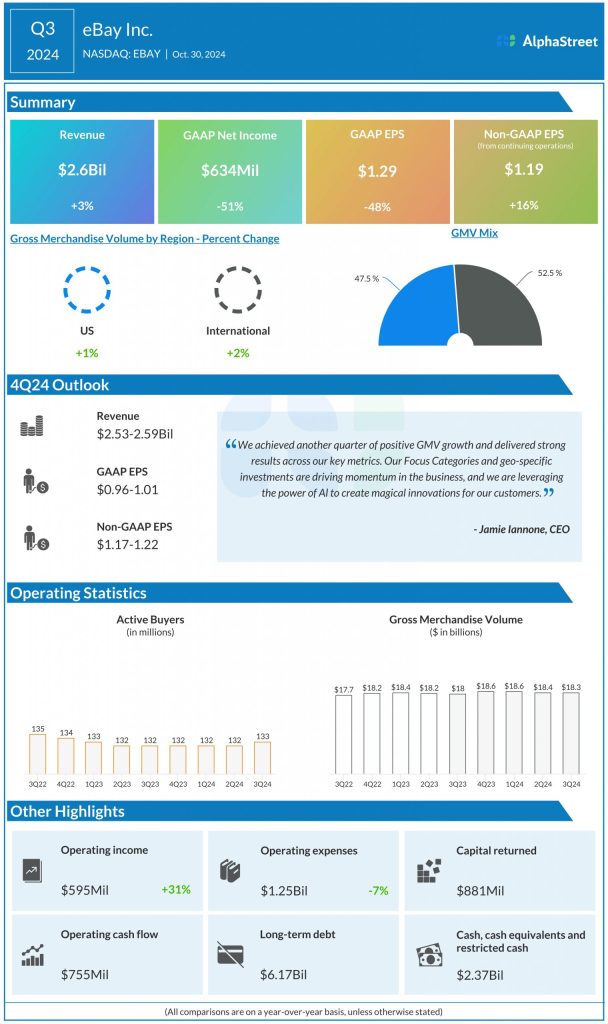

eBay has guided for GAAP earnings per share of $0.96-1.01 and adjusted EPS of $1.17-1.22 for Q4 2024. Analysts are predicting EPS of $1.20 for Q4. This compares to adjusted EPS of $1.07 reported in Q4 2023. In Q3 2024, adjusted EPS grew 16% YoY to $1.19.

Points to note

eBay expects gross merchandise volume (GMV) of $18.9-19.3 billion for the fourth quarter of 2024. GMV is anticipated to benefit from strength in focus categories and investments in regions like the UK and Germany. Meanwhile, the challenging macroeconomic environment is likely to be a headwind for the business.

In Q3, GMV grew 2% YoY to $18.3 billion. Focus category GMV grew nearly 5%, driven by momentum across motors, parts and accessories, collectibles, refurbished, and luxury fashion categories. Collectibles are a strong spot in particular with strength in sports trading cards. Pre-loved fashion is another area that is gaining traction, especially in markets like the UK.

eBay is particularly focused on consumer-to-consumer, or C2C sellers as they bring unique inventory to the platform and are less price sensitive compared to business-to-consumer, or B2C sellers. Roughly 60% of C2C sellers’ GMV comes from used and refurbished items.

eBay expects adjusted operating margin to be 26.5-27.0% in the fourth quarter of 2024. In Q3, adjusted operating margin increased to 27.2% from 26.4% in the year-ago period.

Earlier this month, eBay acquired Caramel, an online automotive transaction solution provider. Caramel’s platform helps handle all the procedures related to vehicle sale online seamlessly. This acquisition gives eBay an advantage by simplifying the process of buying and selling vehicles on its platform. More updates on this deal can be expected in the earnings report.