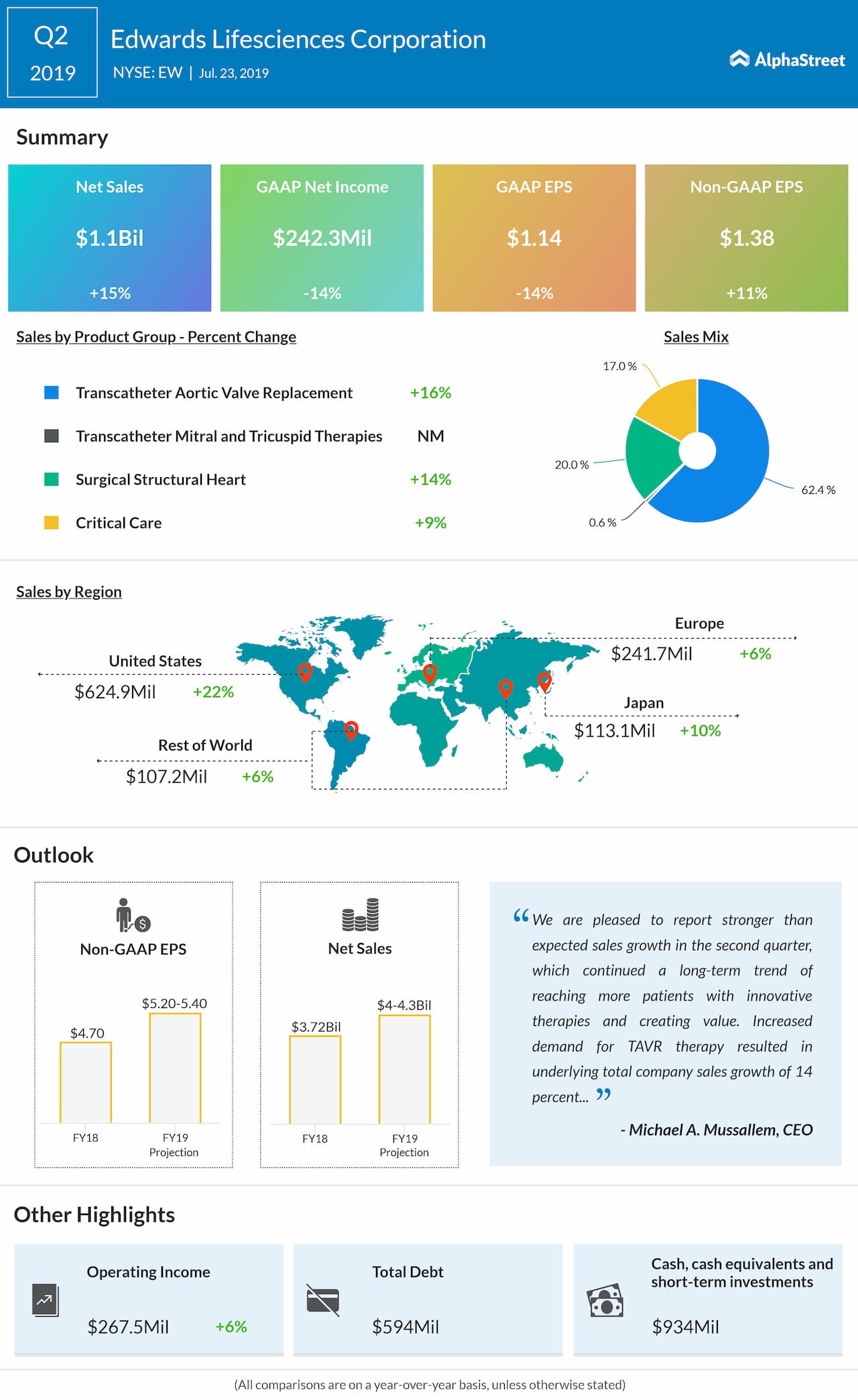

Thanks to solid product sales across the board, sales increased 15% to $1.1 billion while adjusted EPS grew 11% to $1.38. Last quarter, Edwards projected Q2 sales of $1.02-1.08 billion and adjusted EPS of $1.27-1.37.

On the flip side, analysts were expecting sales to grow about 8% to $1.04 billion and adjusted EPS of $1.33 compared to $1.24 reported last year. Edwards reported better-than-expected results on both the top and bottom-line numbers.

CEO Michael A. Mussallem when commenting on the firm’s potential stated: “As patients and clinicians increasingly understand the significant benefits of transcatheter-based technologies, supported by the substantial body of compelling evidence, we remain as optimistic as ever about the long-term growth opportunity.”

ADVERTISEMENT

On the products’ front, Edwards expects the Food and Drug Administration (FDA) to give the nod for SAPIEN 3 valve and SAPIEN 3 Ultra devices in the third quarter for treating patients with low surgical risk.

Outlook Update

Edwards has revised upwards its 2019 guidance. It expects sales in the range of $4-4.3 billion and adjusted EPS of $5.20-5.40. The street is anticipating revenues of $4.16 billion and adjusted earnings of $5.29 per share.

For the Q3 period, the company is expecting the top line to be between $1.02-1.06 billion and adjusted EPS of $1.13-1.23. However, analysts are expecting sales to improve 10.6% to $1.02 billion and adjusted earnings of $1.25 per share, which is 2 cents more than the high-end EPS forecast provided by the firm.

Get access to timely and accurate verbatim transcripts that are published within hours of the event