Shares of Netherlands-based tech firm Elastic NV (NYSE: ESTC) continued its rally on Thursday, a day after it smashed past Wall Street estimates for the first quarter of 2020. Elastic stock, which had gained 21% so far this year till market close on Wednesday, shot up 15% during morning trade on Thursday.

A SaaS leader that offers solutions in data analytics and security, Elastic went public last year.

The company said its first-quarter revenues rose 58% to $89.7 million on strong customer momentum. Analysts had projected Q1 revenues of $86 million.

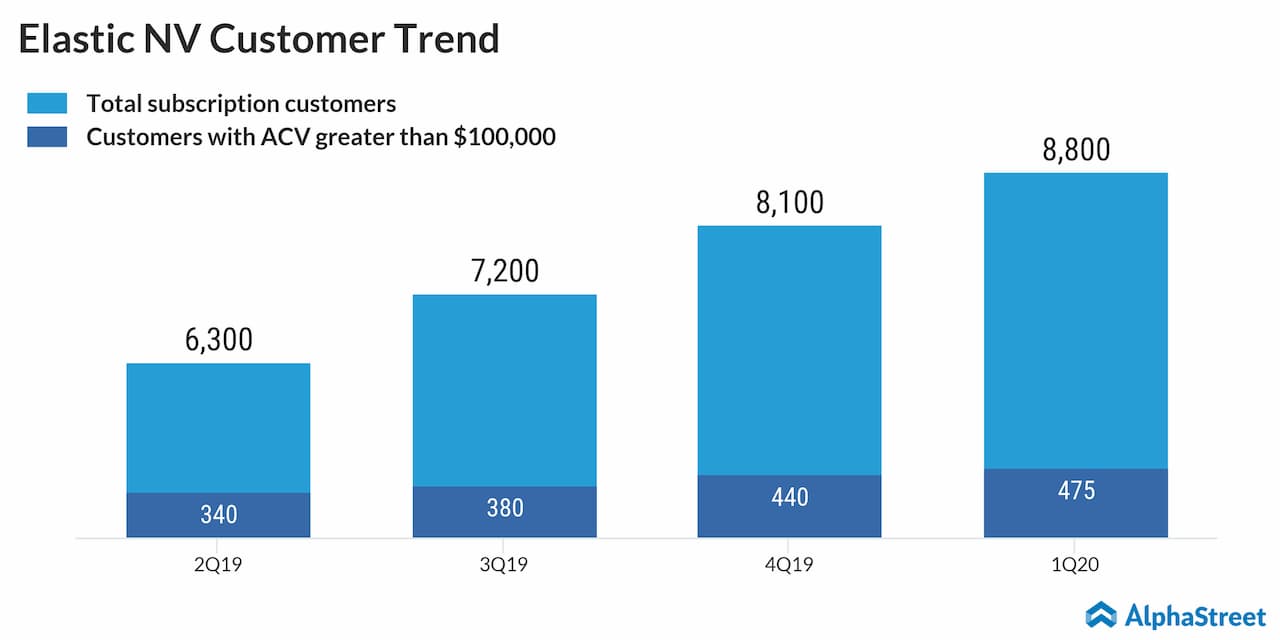

Subscription revenues accounted for 92% of total revenues. Subscription customers increased to over 8,800 in Q1, compared to around 8,100 in the prior sequential quarter.

Calculated billings improved 51% year-over-year.

Down the line, adjusted loss per share was narrowed by 6 cents to $0.32 in Q1, compared to $0.41 expected by the street.

Outlook

For the second

quarter, the company expects total revenues between $95 million and $97 million

and adjusted loss per share between $0.32 and $0.30.

For the full year, the company gave better guidance. For this period, revenues are expected in the range of $406-412 million, compared to the earlier estimate of $397-403 million.

Adjusted loss per share of $1.40 – $1.24 is expected in the place of the prior projection of a wider loss of $1.49 – $1.33.

Get access to timely and accurate verbatim transcripts that are published within hours of the event.