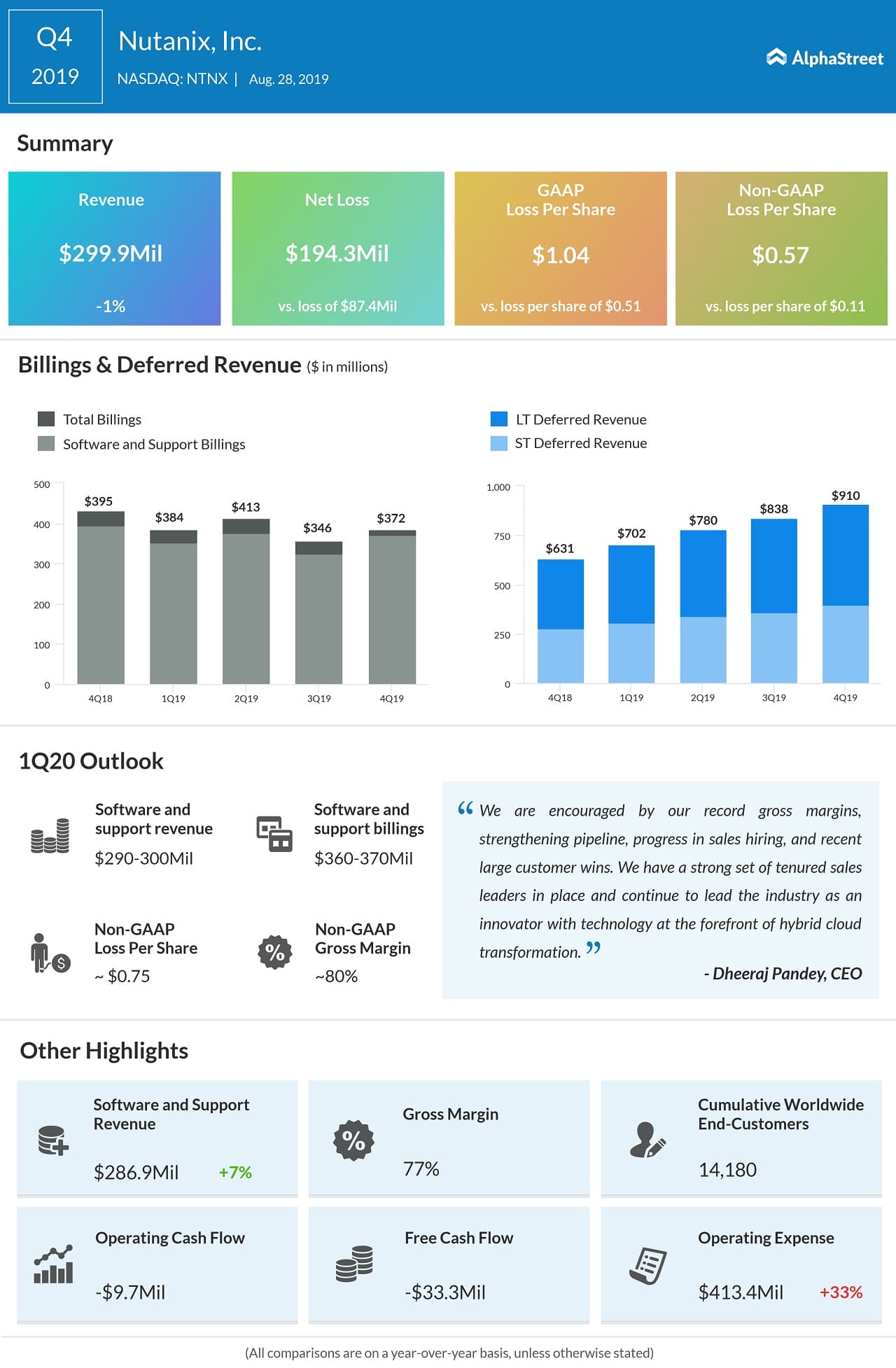

For the fourth quarter of 2019, cloud computing software company Nutanix (NASDAQ: NTNX) reported stronger-than-expected results. The company said its revenues declined to $299.9 million in Q4 from $303.7 million a year ago due to the ongoing transition from hardware-based business to a subscription model. This was slightly better than the average analysts’ estimate of $293.86 million.

Billings for the quarter came in at $371.7 million, down from $395.1 million in the same quarter last year. Software and support revenues were $286.9 million, up 7% year-over-year.

On an adjusted basis, net loss for the quarter came in at 57 cents per share, compared to a loss of 64 cents per share projected by the street.

Nutanix shares jumped 13% immediately following the results. In the past 12 months, NTNX stock has declined 64% and is trading near a multi-year low. During the same period, iShares Expanded Tech-Software (IGV) has gained 10%.

Outlook

Nutanix also provided its guidance for the first quarter of 2020. During this period, the company expects adjusted net loss per share of approximately 75 cents per share. Software and support revenues are estimated to be between $290 million and $300 million.

“Our subscription transition continues to be ahead of schedule with subscriptions growing from 52% of total billings in the fourth quarter of fiscal 2018 to 71% in the fourth quarter of fiscal 2019,” said Duston Williams, CFO of Nutanix.

Last month, the stock got a breather following months of decline, after Jason Ader of William Blair said in a research note that he believes the stock could be on the verge of an upswing.

“According to multiple VARs (value-added resellers), the pipeline expansion has been supported by aggressive sales hiring at Nutanix and increasing sales coverage,” he said, adding their July business saw a higher number of seven-figure deals.

READ: 4 biotech stocks that are ideal takeover targets

ADVERTISEMENT

Yesterday, rival Hewlett Packard Enterprise (NYSE: HPE) delivered Q3 adjusted

earnings of 45 cents per share, beating Wall Street expectation of 40 cents

per share and higher than the management’s projection range. The stock

jumped 8% following the announcement.

Last week, another competitor VMware (NYSE: VMW) reported second-quarter earnings and revenue that surpassed both analysts estimates and the company’s projection for the quarter. The company also announced that it will acquire Pivotal Software and Carbon Black for a total value of $4.8 billion.