Transaction details

Under the terms of the deal, Glu stockholders will receive $12.50 in cash for each share of Glu stock, which represents an equity value of $2.4 billion. The total enterprise value is $2.1 billion, including Glu’s net cash of $364 million. The deal is expected to close in the quarter ending June 30, 2021. The acquisition will be immediately accretive to EA’s net bookings and is expected to grow underlying profitability beginning in its first year.

Valuable partner

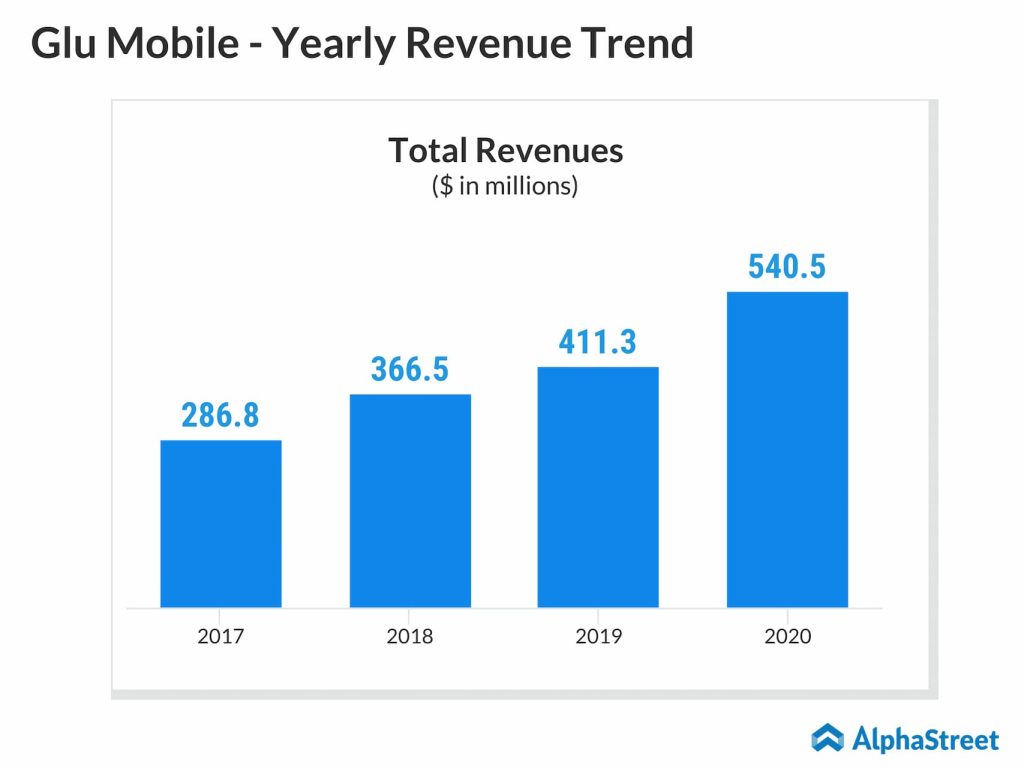

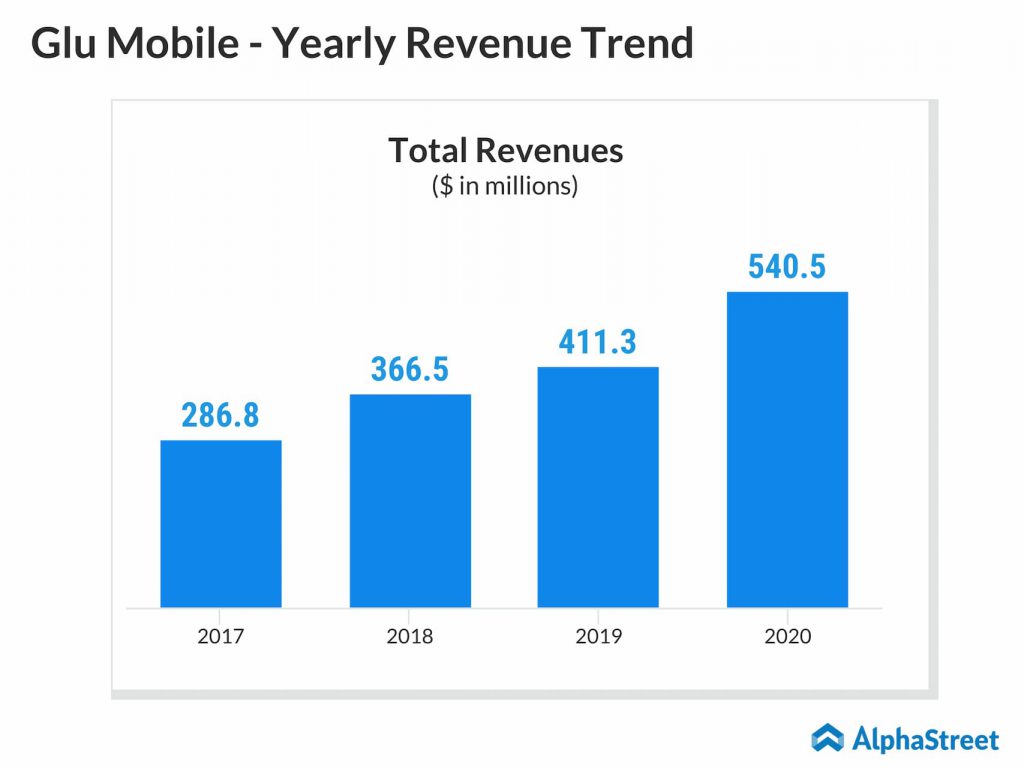

Glu has posted consistent revenue growth over the past five years. For FY2020, total revenues increased 31% year-over-year driven by the strong performance of its Growth Games. Bookings for the year grew 32% to $560.6 million.

Mobile games

Mobile games are a fast-growing segment which continues to outpace the PC/consoles gaming sectors. Mobile games are easy to play and have a larger user base compared to the other two sectors.

According to Udonis, mobile games comprise 51% of the total global gaming industry revenue. By 2021, the number of mobile gamers worldwide is projected to grow to 2.7 billion and the mobile gaming market is projected to reach $180 billion. Within mobile gaming, the hyper-casual game market is worth over $2 billion.

This gives an idea on the opportunity that lies ahead of Electronic Arts. Glu’s core games such as MLB Tap Sports Baseball, Disney Sorcerer’s Arena, and Design Home will be good additions to EA’s Bejeweled and Plants vs. Zombies games. Glu also brings with it 500 mobile game developers whose expertise will be a valuable factor to EA’s development and expansion efforts.

The combination of EA and Glu will create a mobile product portfolio of over 15 top live services with a combined $1.32 billion in bookings over the last 12 months.

User base

The combined entity will build on EA’s network of 430 million players, including more than 100 million monthly active players in mobile. Glu’s mobile baseball game will be a welcome addition to EA’s popular sports games portfolio which include its FIFA and Madden. Sports games enjoy a loyal fan base.

Apart from this, Glu brings with it a different set of users who play its Design Home and Diner Dash games. This opens up opportunities for EA to cater to a whole new audience and paves the way for further game development ideas.