— Revenue in the US increased by 7% as higher volume partially offset lower realized prices.

— Revenue outside the US grew by 10% driven by higher volume which was primarily from key growth products like Trulicity, Jardiance, and Taltz.

— During the quarter, Eli Lilly saw double-digit growth in revenues from Trulicity, Taltz, Basaglar, Cyramza, Olumiant, and Jardiance. Cialis posted the highest decline in revenues of 44%.

— Gross margin declined by 1 percentage point to 79% due to unfavorable product mix, the unfavorable effect of foreign exchange rates on international inventories sold, higher intangibles amortization expense, and the impact of lower realized prices on revenue.

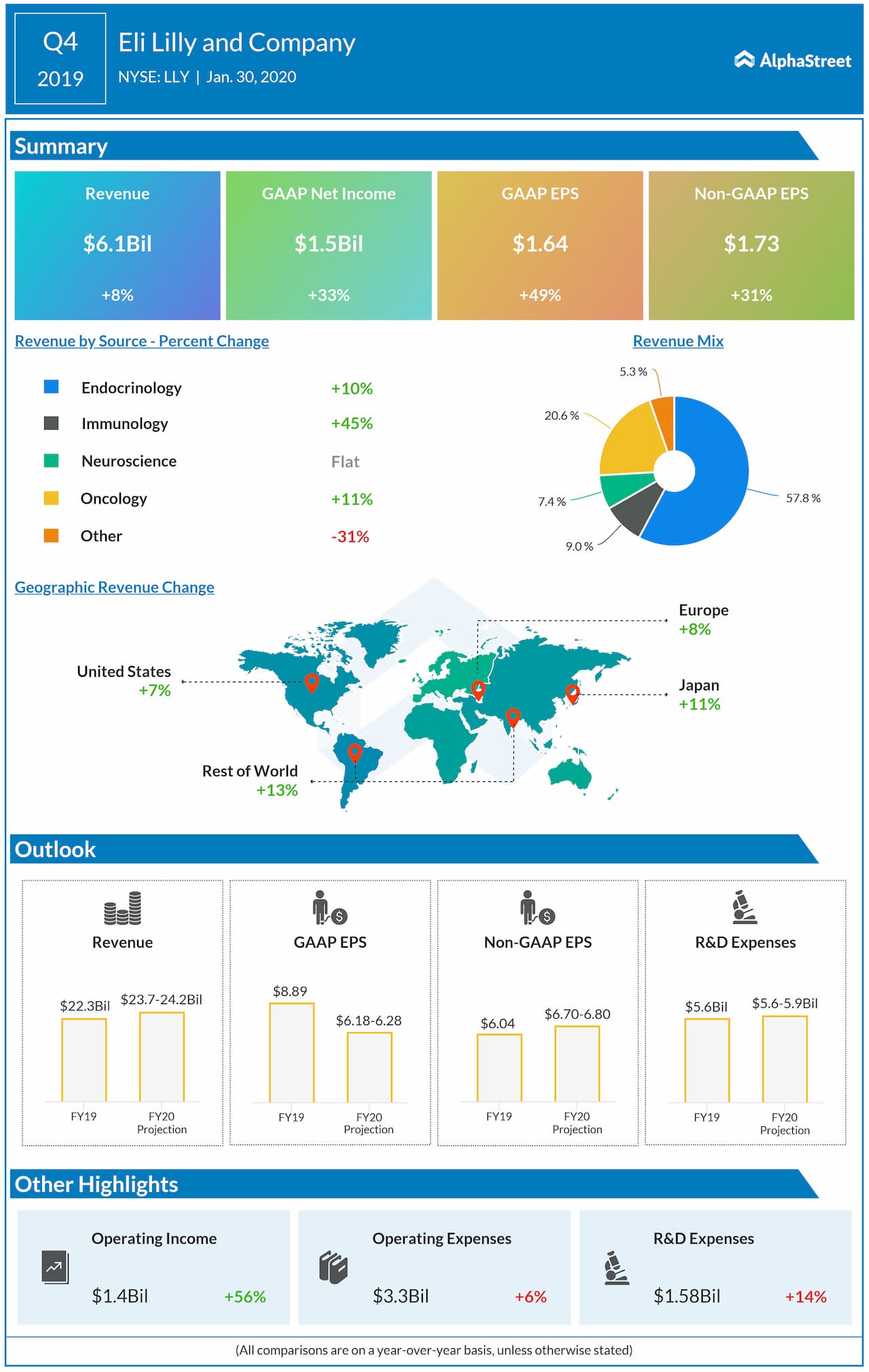

— Looking ahead into the full year 2020, the company lowered earnings guidance to the range of $6.18-6.28 per share from the previous range of $6.38-6.48 per share. The adjusted EPS guidance is reaffirmed in the range of $6.70-6.80. Analysts expect EPS of $6.76.

— Revenue outlook is lifted to the range of $23.7-24.2 billion from previous range of $23.6-24.1 billion. The consensus estimates revenue of $23.82 billion for the full year.