Q3 numbers

Business performance

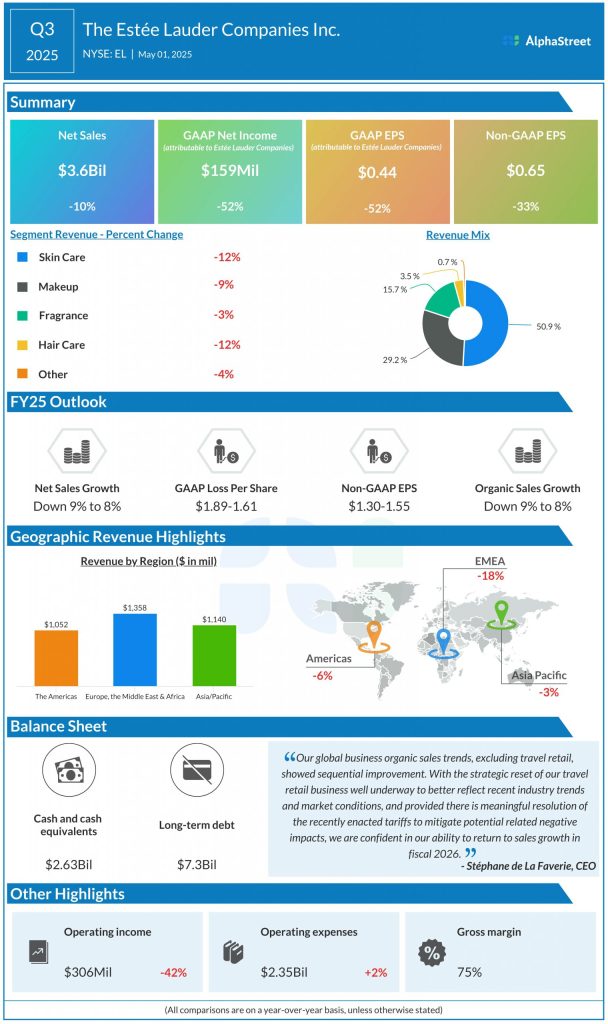

During the third quarter, Estee Lauder saw sales decline across all its segments and geographic regions on both a reported and organic basis. The highest declines were in the Skin Care and Hair Care segments, with both decreasing 12% YoY on a reported basis. The Skin Care segment was impacted by softness in the Asia travel retail business and weak sentiment in China.

Organic sales decreased 5% in the Americas, driven by a mid-single-digit decline in North America. The decline in North America was mainly due to ongoing retail softness for some brands and a drop in consumer confidence as well as operational challenges which impacted certain retailers and timing of shipments.

The biggest sales decline of 16% came from the Europe, Middle East & Africa region, mainly due to a double-digit decline in the global travel business, and a mid-single-digit decline in the region’s markets, primarily driven by challenges in the UK. Asia/Pacific sales dipped 1%, driven by double-digit declines in Hong Kong SAR and Korea.

Outlook

Estee Lauder anticipates a stronger double-digit sales decline in its global travel retail business in the fourth quarter of 2025 compared to the third quarter, due to a shift towards more profitable duty-free business models in Korea and China and weak consumer sentiment in China. The company also expects a high-single-digit organic sales decline in Asia/Pacific in fiscal year 2025 due to the weakness in China.

Based on these factors, EL has forecast its net sales for the full year of 2025 to decline 8-9% on both a reported and organic basis. The company expects a GAAP loss of $1.61-1.89 per share for the year. Adjusted EPS is expected to range between $1.30-1.55, representing a 40-50% decrease YoY.