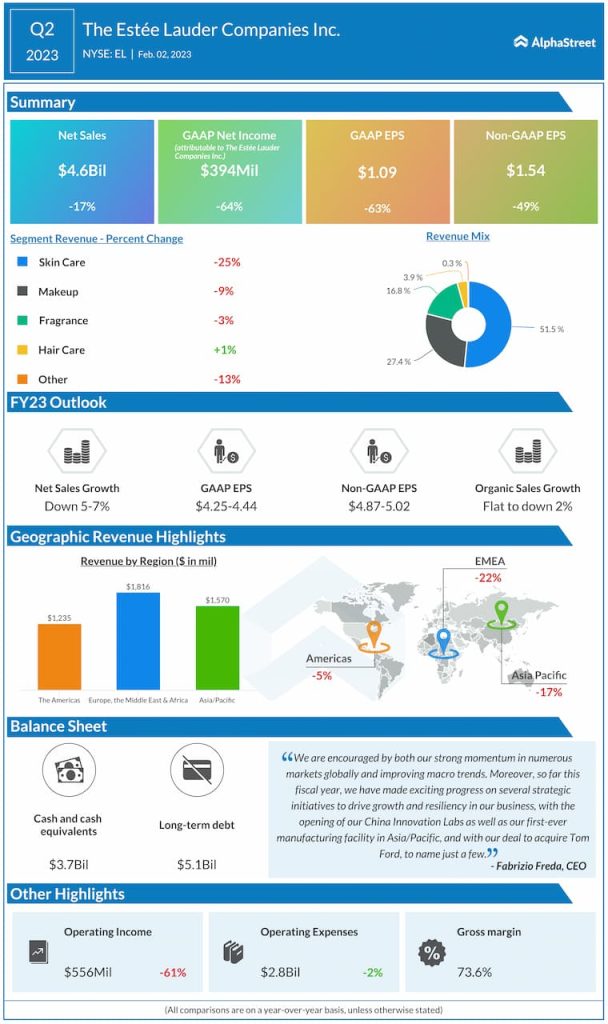

Sales and earnings decline

The company’s performance during the quarter was impacted by COVID-related headwinds, mainly in China, as well as lower shipments of replenishment orders in the US and the stronger US dollar. However, better-than-expected performance from many developed and emerging markets helped partly offset these challenges.

Category performance

In the second quarter of 2023, Estee Lauder saw reported net sales decline across all its categories except Hair Care, which inched up just 1%. Sales in the Skin Care category fell due to COVID-related headwinds in China and lower replenishment orders in the US. On an organic basis, Skin Care and Makeup saw sales declines while Fragrance and Hair Care posted increases.

The company saw sales decline, both on a reported and organic basis, across all its geographic regions during the quarter. Sales in the Americas declined 3% organically due to lower replenishment orders in the US while sales in Europe, the Middle East & Africa (EMEA) and Asia/Pacific were hurt by COVID-related impacts.

Bleak outlook

Estee Lauder expects its sales to decline both for the third quarter as well as full year of 2023. It also expects certain headwinds to persist thereby delaying its return to growth by another quarter. The company expects net sales for the third quarter of 2023 to decline 12-14% on a reported basis and 8-10% on an organic basis. Adjusted EPS is expected to range between $0.37-0.47, which is below the consensus estimate of $0.51.

For FY2023, net sales are expected to decrease 5-7% on a reported basis while organic net sales are expected to be flat to down 2% versus last year. Adjusted EPS is expected to range between $4.87-5.02.

Estee Lauder lowered its full-year guidance due to higher-than-expected inventory levels in Hainan caused by travel disruptions and in-store staffing levels, as well as near-term pressures related to Korea duty free. This has created greater-than-expected headwinds for the third quarter, offsetting positive impacts from the resumption of international travel by Chinese customers as well as strong performance across several developed and emerging markets globally. As a result of all these factors, the company now expects to return to growth in the fourth quarter instead of the third quarter.

Click here to read the full transcript of Estee Lauder’s Q2 2023 earnings conference call