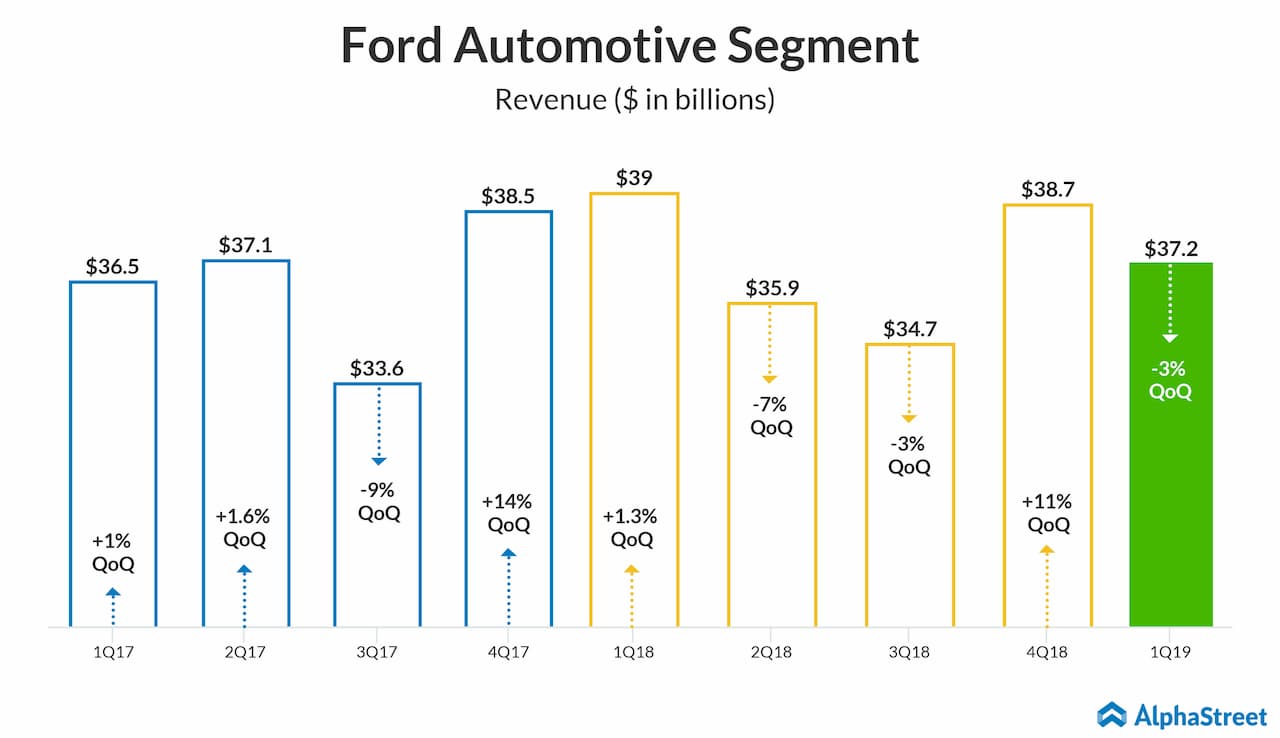

During the first quarter of 2019, the Automotive segment reported a drop in revenue, hurt by decreases across most of its geographies. The Mobility segment posted a loss due to increased investments in autonomous vehicles and mobility services. Meanwhile, the Ford Credit segment generated an increase in earnings helped by favorable lease residuals.

Market share and competition

The second-largest automotive company in America recently embarked on an extensive restructuring that coincided with a similar initiative by arch-rival General Motors (NYSE: GM). The fact that the focus of both the programs was plant closures and layoffs reflect the stressed operating conditions, primarily due to competition from new-age automakers like Tesla (NASDAQ: TSLA) and the growing presence of foreign companies in the local market.

These challenges have impacted Ford’s market share in the last couple of years. In the US, the company accounted for 14.4% of total vehicles sales last year. It marked a deterioration from 14.7% registered in 2017, which was slightly higher compared to the year earlier. At a global scale, the weakness was more pronounced, with international market share slipping to 6.3% in 2018 from 7% in the prior year.

In a similar pattern, the US market share

of General Motors dipped to 17.1% in 2018 from 17.4% in the preceding year.

Last year, GM’s total worldwide market share declined to 8.9% from 10.2%.

Interestingly, statistics show that Toyota was almost equally popular in the

US, with the Japanese auto giant’s market moving close to that of Ford last

year. That restricted Italian-American carmaker Chrysler Group to the fourth

position.

Financials

The changing market dynamics and the volatility in the automobile market have been quite visible in Ford’s financials. The company has twice missed earnings estimates in the trailing four quarters. However, in the most recent quarter, it did manage to surprise the street by a wide margin despite a decline in sales, thanks to its aggressive cost-cutting strategy.

Ford was also forced to close its passenger car production in Russia as investors started questioning its ability to stay profitable. Riding on these measures, the company’s profit is expected to improve to $1.40 per share this fiscal year, from $1.30 per share in fiscal 2018.

Annual revenues are likely to fall over 2%

as Ford continues to struggle in the electric car segment. The Detroit-based

automaker could see further declines in the year after if the situation

continues.

Cash

position

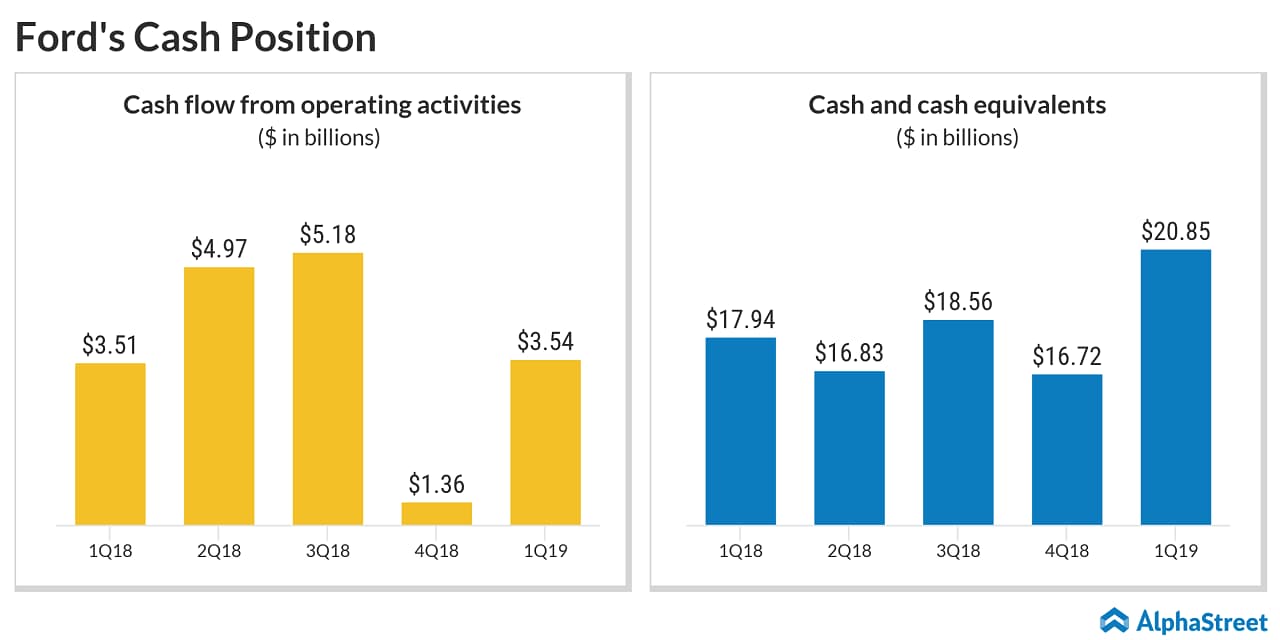

Ford’s cash position remains strong and its liquidity for the first quarter exceeded the company’s expectations. To further strengthen its liquidity and to provide additional financial flexibility, the company relies on the supplemental credit facility, apart from the corporate revolving facility.

For the first quarter, the company saw an increase in payables and other liabilities. However, Ford’s change in cash remained flat from the prior-year quarter as it lowered shareholder distributions, which in turn reduced the debt and distributions expenditures.

The company can be seen accumulating cash to strengthen its electric vehicle plan, including a planned one with Rivian. Also, the company is reallocating capital to higher-return investments to improve operating cash flow with a specific focus on Automotive.

Street

view

The street has mixed opinions on the stock.

Out of the 13 analysts who are tracking the stock, six have Buy rating; six recommend

Hold; while 1 analyst has given Sell rating. The analysts are expecting a 15%

upside in the stock price over the next 12 months to $11.68 vs. today’s level

of $10.

Jefferies analyst Philippe Houchois, who has given a buy rating in his research note, states, “broad-based improvements, guidance upgrade, dividend confirmation, and reduced credit risk should go a long way towards convincing investors to re-visit Ford’s investment case.”

John Murphy of BoA Merrill Lynch said the upbeat profit guidance, strong products line up and the ongoing restructuring are going to be tailwinds for the automaker. Murphy also added in his note, “Ford is just starting to hit a more sustainable inflection in earnings (even more so in 2020), driven by the combination of a favorable product cadence in the all-important US/[North America] market and restructuring efforts.”

Get access to timely and accurate verbatim transcripts that are published within hours of the event.