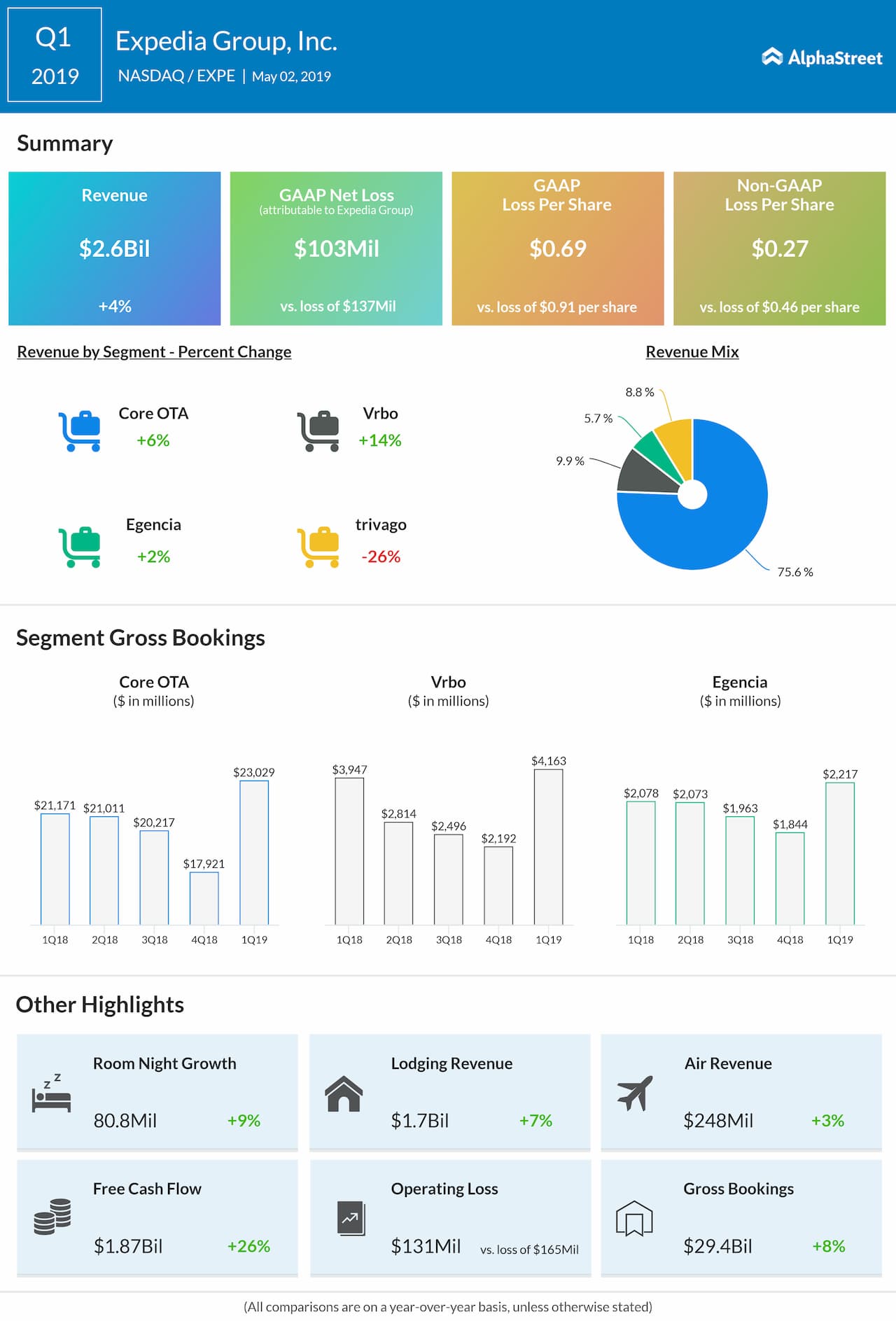

Net loss attributable to shareholders, on a reported basis, was $103 million or $0.69 per share during the quarter, compared to a loss of $137 million or $0.91 per share in the year-ago period. The improvement was due to a 4% increase in revenues to $2.61 billion, which however missed the Street view.

The positive top-line performance reflects contributions from Expedia Partner Solutions and Brand Expedia. At Vibo, Expedia’s short-term rental business, growth slowed for the second straight month. Domestic revenue was up 9%, while international revenue decreased 2% due to weakness in the performance of the Trivago business division.

The positive top-line performance reflects contributions from Expedia Partner Solutions and Brand Expedia

During the quarter, gross bookings increased 8% and total stayed lodging room nights rose 9%. At the end of the quarter, the company has more than 1.1 million properties available on its core lodging platform.

In the fourth quarter, there was a 10% growth in revenues to $2.55 billion, with strong contributions from both Brand Expedia and Expedia Partner Solutions. Consequently, earnings jumped 49% to $1.24 per share, beating the estimates.

In a separate statement, the company revealed the rechristening of its alternative accommodations division from HomeAway to Vrbo. In the coming months, the management plans to invest in Vrbo as the main global alternative accommodations brand.

Last month, Expedia signed an agreement to acquire Liberty Expedia Holdings in an all-stock transaction, pursuant to which around 3.1 shares are expected to be retired.

Expedia’s competitor TripAdvisor (TRIP) is scheduled to publish third-quarter results on May 7, after the closing bell. It is widely expected that earnings will remain unchanged at $0.3 per share on revenues of $387 million.

Expedia shares moved up 16% since last year and 14% so far this year. The stock traded slightly lower during Thursday’s session and lost further after the earnings report.