“

Expedia Group (NASDAQ: EXPE) reported fourth-quarter 2020 financial results after the regular market hours on Thursday. The travel company reported fourth-quarter revenue of $920 million, down 67% year-over-year and below the Wall Street projection. Net loss of $2.64 per share was also wider than what analysts had anticipated. EXPE shares fell 2.6% immediately following the […]

· February 11, 2021

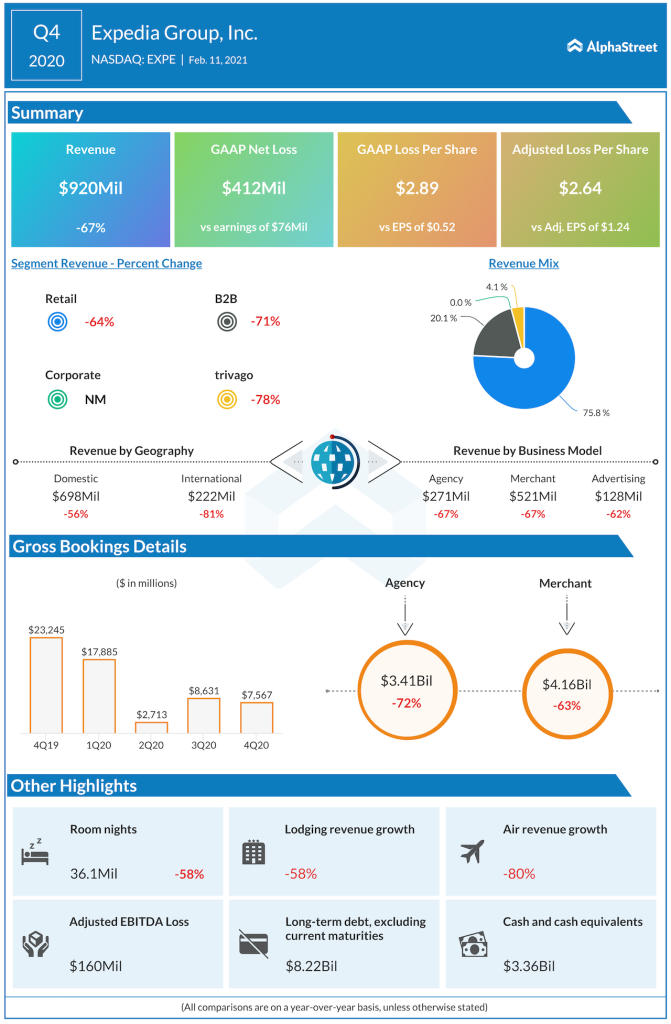

Expedia Group (NASDAQ: EXPE) reported fourth-quarter 2020 financial results after the regular market hours on Thursday. The travel company reported fourth-quarter revenue of $920 million, down 67% year-over-year and below the Wall Street projection. Net loss of $2.64 per share was also wider than what analysts had anticipated.

EXPE shares fell 2.6% immediately following the announcement. The stock has increased over 36% over the past 12 months.