Weakness Persists

Like in the previous quarters, multiple factors worked against ExxonMobil in the final three months of 2019, including the unfavorable demand-supply environment and low crude prices. Initial estimates show that they affected the company’s top-line performance. The upstream business is typically sensitive to low fuel prices. Technically, that should be good news for the downstream business, for which oil and natural gas are the main inputs.

Faltering Demand

Though market conditions have improved since the last quarter, the underlying macroeconomic weakness might weigh on demand. Of late, the company has been investing in its production facilities to boost volume, a move that might add to the oversupply issue thereby putting pressure on oil prices.

Also read: Exxon Mobil Q3 2019 Earnings Call Transcript

ADVERTISEMENT

The company is upbeat about its prospects in South America, especially after a series of successful discoveries along the Guyana coast. And, the management is investing heavily in the new assets, despite the unimpressive cash flow trend. Margins will come under pressure from the high costs.

Meanwhile, the company is on track to divest nonperforming assets worth $15 billion in the next two years.

Looking Back

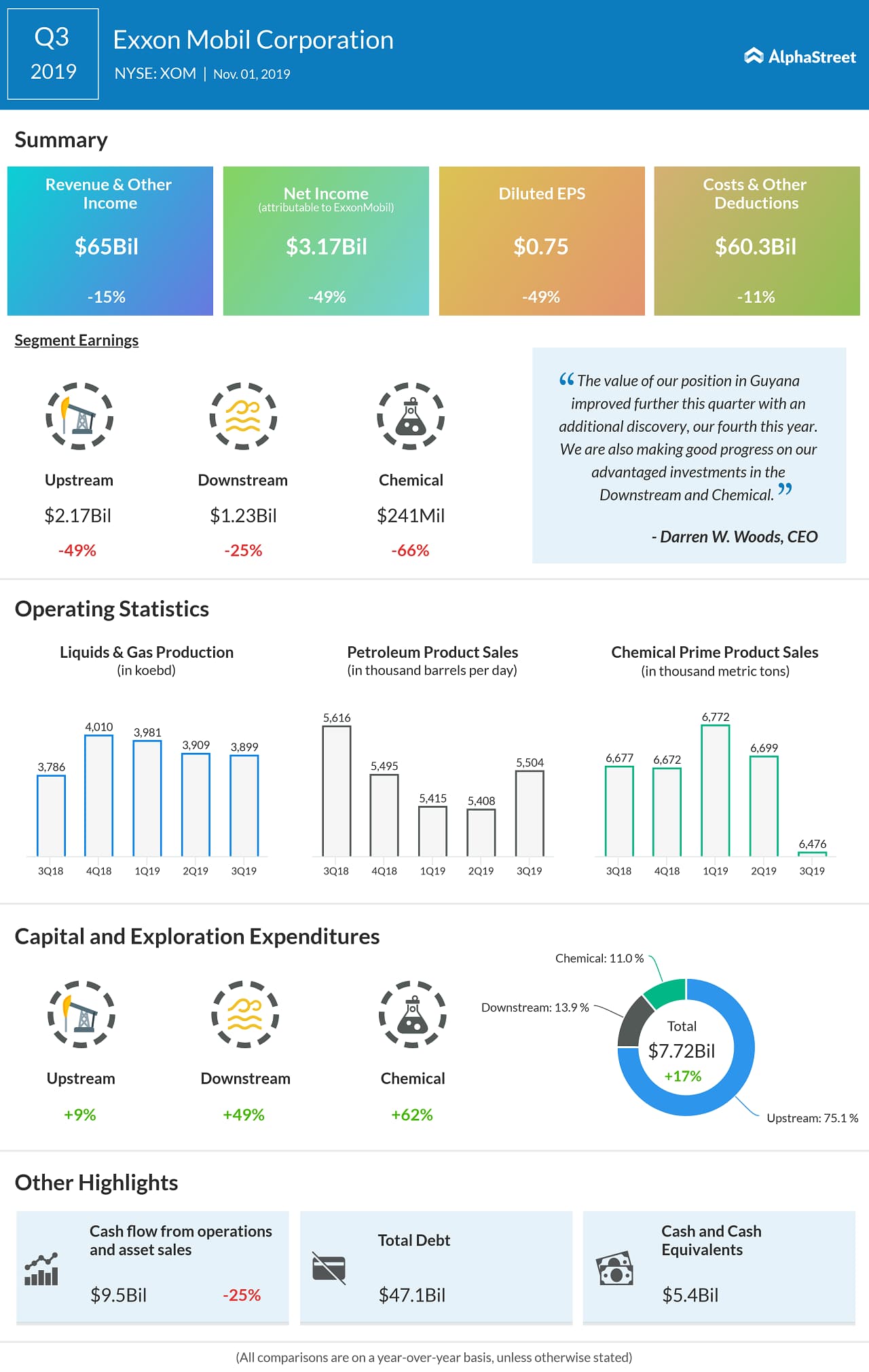

ExxonMobil disappointed the market in the third quarter when earnings and revenues declined in double digits to $0.75 per share and $65 billion, respectively, hurt by the ongoing dip in oil demand. However, the results exceeded the market’s forecast, to the relief of the stakeholders.

The persistent downtrend in ExxonMobil’s stock continued as it entered 2020, and declined around 9% since the beginning of the year. The shares have lost 14% in the past six months.

Listen to publicly listed companies’ earnings conference calls along with the edited closed caption text