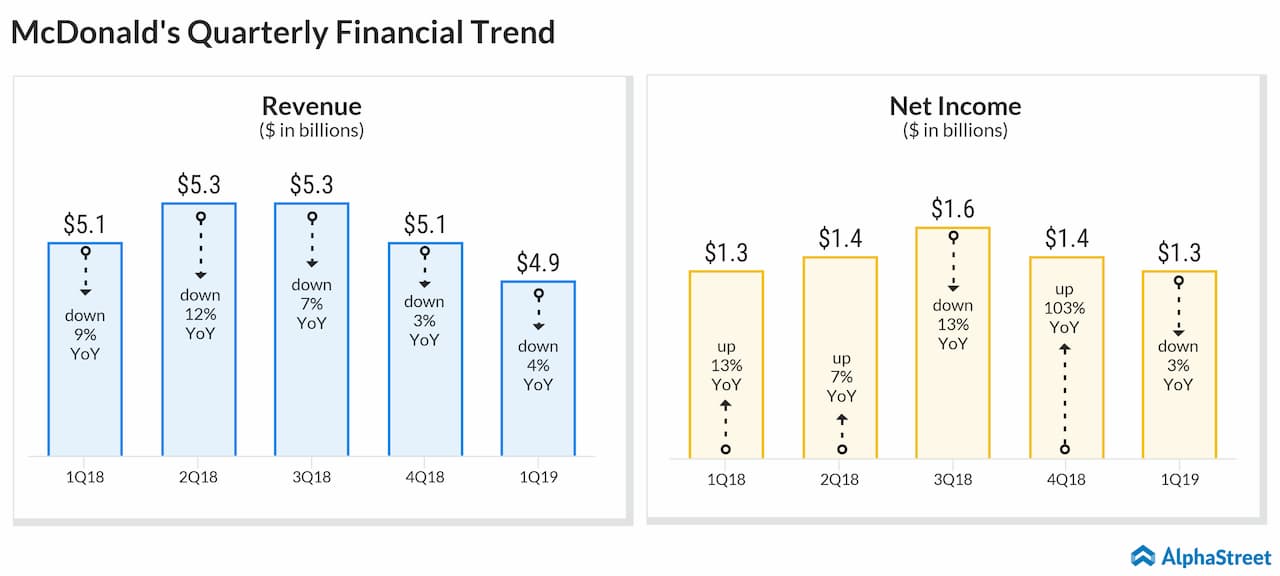

The company’s profits over the last five quarters have fluctuated with most of 2018 seeing increases. The positive results in 2018 were helped by a lower effective tax rate and strong operating performance. McDonald’s global comparable sales have increased consistently during the same period, driven by a growth in average check due to shifts in product mix and menu price increases.

The fast food restaurant chain has managed to reduce

expenses on a year-over-year basis over the past five quarters, barring a 10%

increase in the third quarter of 2018, despite its significant investments in restaurant

technology. The company’s investments in its Experience of the Future restaurants

and in the improvement of its delivery services and digital channels will bode

well going forward.

According to this report by Straits

Research, the global fast food market is estimated to reach a value of $843.4

billion by 2026, registering a CAGR of 5.6% during the period from 2019 to 2026.

Based on food type, burgers and sandwiches are expected to take the largest

market share which is a positive for McDonald’s. As per research

firm Statista, McDonald’s was the most valuable fast food brand worldwide

with an estimated brand value of about $126 billion in 2018.

Over the long-term, McDonald’s expects to achieve annual systemwide sales growth in the 3-5% range and earnings per share growth in the high single digits. The company is scheduled to report its second quarter 2019 earnings results toward the end of July and analysts estimate earnings of $2.05 per share on revenue of $5.3 billion.

Overall, despite the challenges in the fast food industry owing to customer preferences towards healthy options, McDonald’s appears to be holding down the fort well for now. The company’s business growth initiatives are likely to drive growth going forward. McDonald’s shares have gained 19% so far this year and 33% over the trailing 52 weeks.