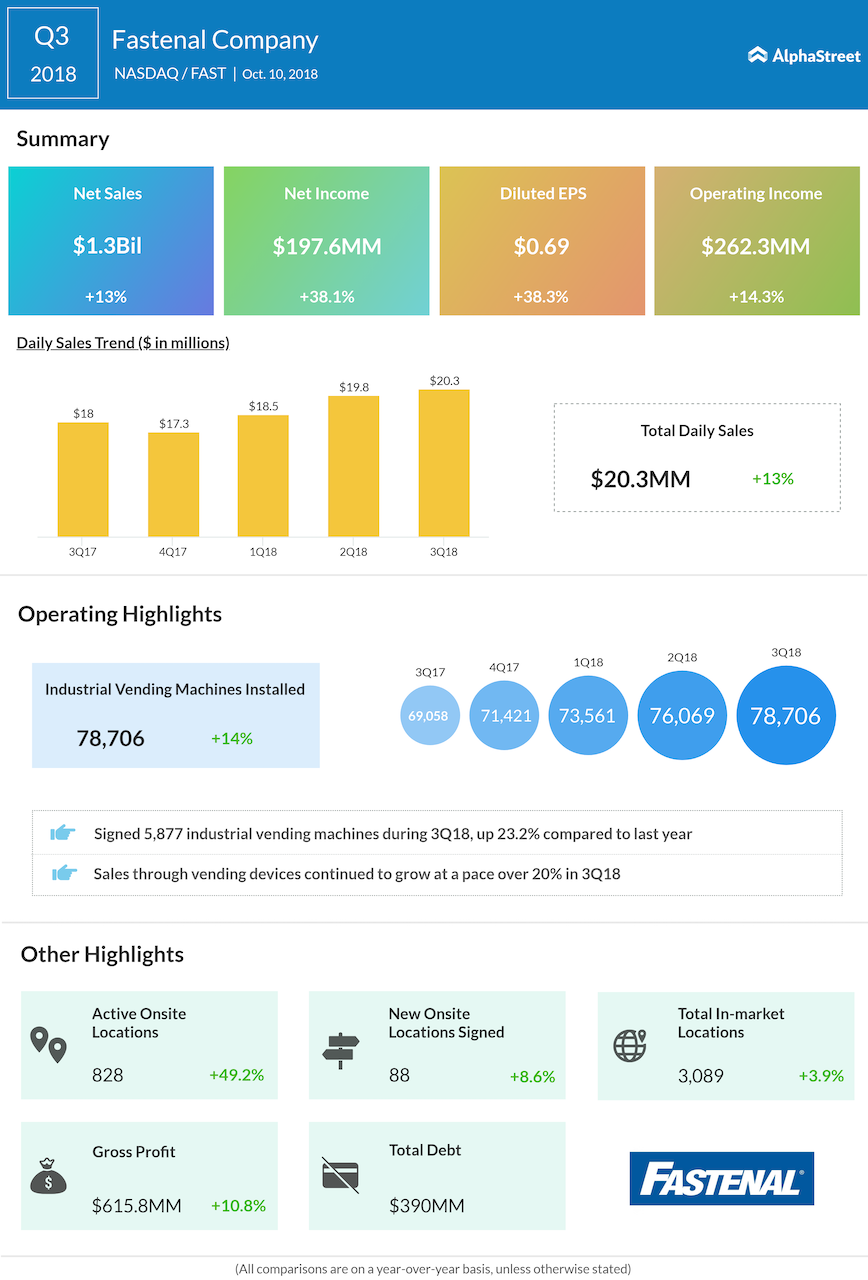

Net income grew 38% to $197.6 million or $0.69 per share from the prior-year period. The quarterly EPS benefited from discrete tax items and a lower tax rate during the quarter.

The company’s gross profit percentage dropped 100 basis points to 48.1% due to the impact of customer and product mix as well as higher freight costs at the branch level.

In a separate release, Fastenal reported a 7.8% increase in net sales for the month of September to $400 million. The company had reported monthly net sales growth of 17.6% and 13.7% for July and August respectively.

Fastenal signed 5,877 industrial vending devices during the quarter, up 23.2% from the same period last year and the company’s installed device count increased 14%. New national account contracts signed during the quarter totaled 41 and daily sales to national account customers grew 18% in the quarter versus last year.

Fastenal returned $367.9 million to shareholders in the first nine months of 2018 in the form of dividends and share repurchases compared to $359.7 million in the prior-year period.

Earnings Preview: Fastenal likely to beat Q3 results on strong demand