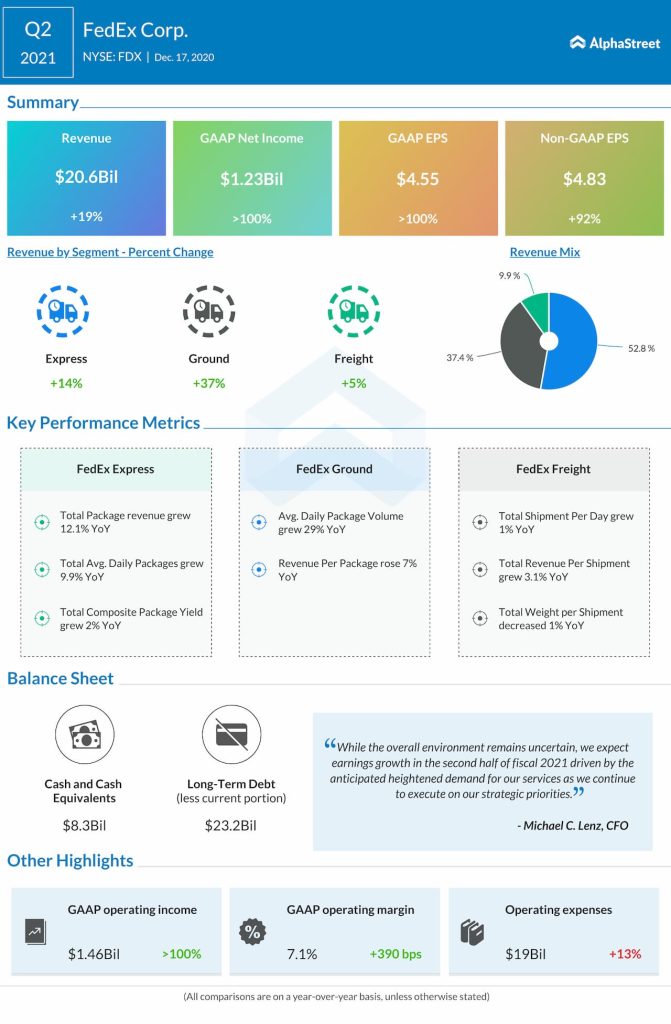

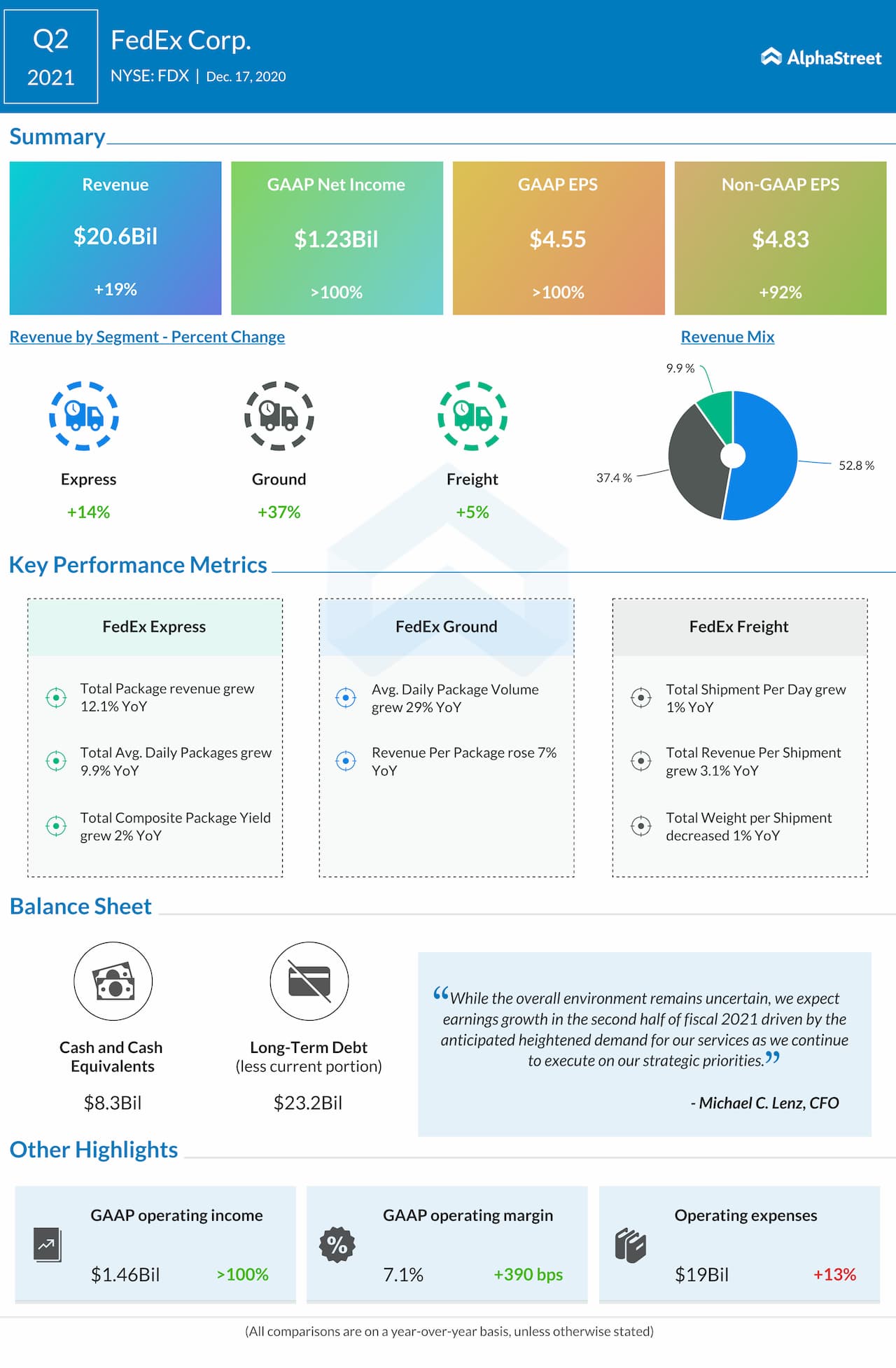

Quarterly performance

Growth in ecommerce

The pandemic has brought about a significant growth in ecommerce which has benefited the delivery services industry meaningfully. FedEx has benefited from this trend. During its quarterly conference call, the company said that during the first nine months of 2020, US ecommerce sales rose 33% year-over-year while traditional retail sales grew a little more than 1%.

The company added that ecommerce package volumes are expected to more than triple to 111 million packages per day by 2026 from 35 million in 2019. To meet the increase in demand, FedEx made several investments in its facilities and retail convenience network and also expanded its FedEx Ground US residential delivery to seven days a week.

In September, the company expanded its Sunday residential delivery to around 95% of the US population and since then has made more than 50 million deliveries. Within its retail network, FedEx saw a 60% increase in average daily volume from October 15 to November 30.

FedEx is one of the two primary carriers of the COVID-19 vaccine in the US and the company will play an important role in the global distribution of the vaccine in the coming months.

As of October, the global air cargo market capacity was down 23% year-over-year due to a reduction in passenger flights. Air cargo demand is expected to return to pre-pandemic levels faster than passenger capacity and this is expected to create an opportunity for the company.

Outlook

Looking ahead, based on current trends, FedEx expects increased demand to drive revenue and operating income growth at FedEx Ground and FedEx Express for the remainder of FY2021. FedEx Freight is expected to benefit from higher productivity and yield management. Capital expenditures are expected to total around $5.1 billion in FY2021. The company expects to invest further in its FedEx Ground network to meet the rise in ecommerce demand and therefore expects Capex to increase further in FY2022.

Click here to read the full transcript of FedEx Q2 2021 earnings conference call