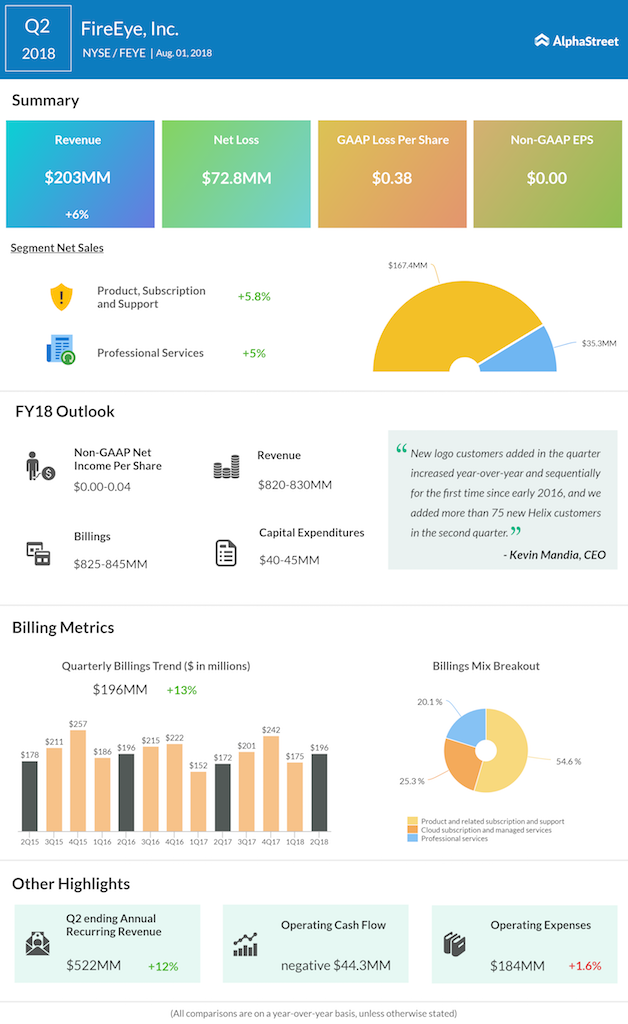

Revenue increased 6% to $203 million. Sales growth was broad-based across all geographies and product families, and demand for its differentiated security products and services is increasing as it enters the second half of 2018.

The company’s billings, one of the key indicators for future growth, jumped 13% year-over-year to $196 million. This is the second time billings has risen after a slowdown in billings had troubled the company for many quarters. Billings narrowly beat the forecast of $180 million to $195 million.

Looking ahead into the third quarter, the company predicts total revenue of $206 million to $210 million, billings of $210 million to $220 million, and non-GAAP EPS of $0.01-0.03.

For the full year 2018, the company still expects revenue of $820 million to $830 million, billings of $825 million to $845 million, and non-GAAP EPS of $0.00-$0.04. Capital expenditures are still predicted to be $40 million to $45 million.

Shares of FireEye ended Wednesday’s regular trading session up 1.03% at $15.69 on the Nasdaq. The stock has risen more than 10% for the year-to-date and more than 6% for the past year.

Related Infographics: Q1 Earnings