Extending the ongoing recovery, cybersecurity firm FireEye (FEYE) Wednesday reported a higher profit for the fourth quarter when revenues climbed to a record high. Despite the stronger than expected results, the company’s stock fell sharply in the after-market hours as its guidance fell short of expectations.

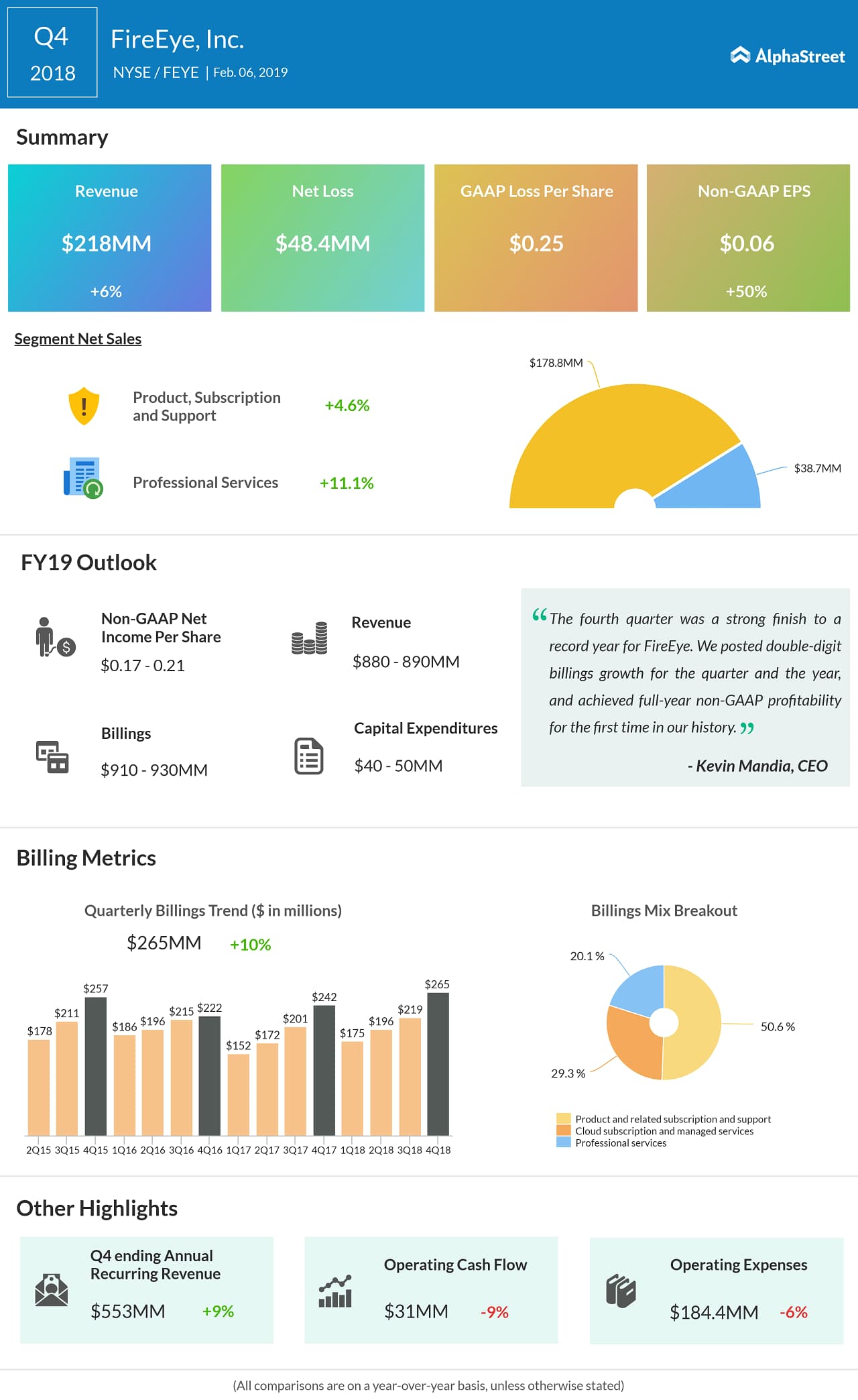

FireEye reported earnings of $0.06 per share for the December quarter, compared to $0.04 per share in the year-ago period. The bottom-line beat estimates by a penny. On a reported basis, net loss narrowed to $48.4 million or $0.25 per share from $70.4 million or $0.39 per share in the fourth quarter of 2017.

Supported by a 10% growth in billings, fourth-quarter revenues climbed 6% to a record high of $218 million, exceeding Wall Street projections and the company’s own outlook. More than 80% of the non-services billings came from recurring subscriptions and support billings last year, which grew about 20% year-over-year.

More than 80% of the non-services billings came from recurring subscriptions and support billings last year

“The fourth quarter was a strong finish to a record year for FireEye. We posted double-digit billings growth for the quarter and the year, and achieved full-year non-GAAP profitability for the first time in our history,” said CEO Kevin Mandia.

In an indication that the growth momentum might have weakened in the early months of 2019, the company currently sees a net loss in the range of $0.02 per share to $0.04 per share for the first quarter, on an adjusted basis. Revenues are expected to be in the range of $208 million to $212 million, and billings between $170 million and $180 million.

Also see: FireEye posts upbeat Q3 results

In the whole of 2019, adjusted earnings are estimated to be between $0.17 per share and $0.21 per share. The management is looking for revenues of $880-$890 million for fiscal 2019 and billings in the rage of $910 million to $930 million. However, the projections are below analysts’ estimates.

FireEye’s rival Symantec (SYMC) last month reported a marked decline in third-quarter earnings as revenues from its enterprise business segment declined. The results surpassed analysts’ forecast.

After staying broadly flat throughout last year, FireEye shares started 2019 on a positive note, gaining about 20% since the beginning of the year. The stock closed Wednesday’s session lower and lost about 7% in the after-market trading hours, following the earnings report.