Share Performance & Market Value

Financial Report

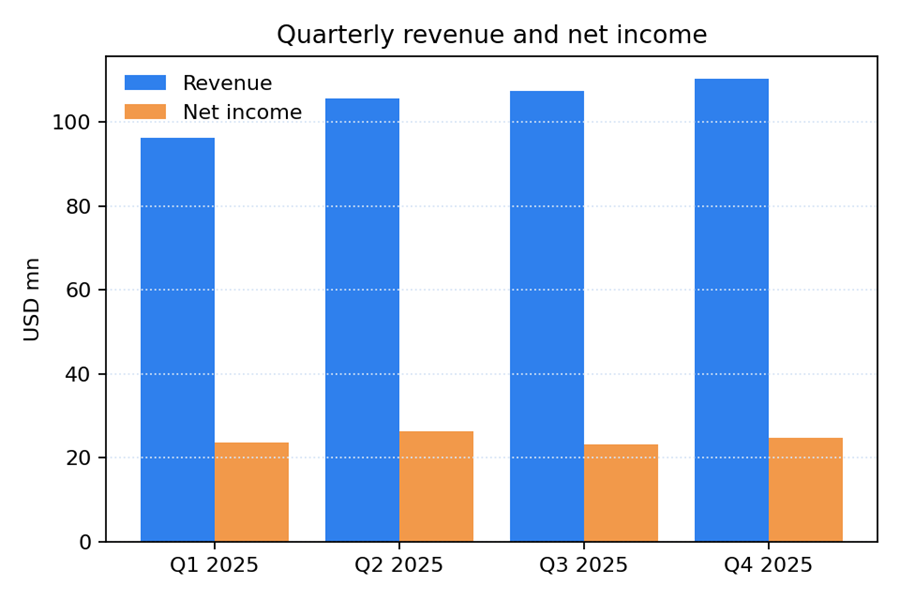

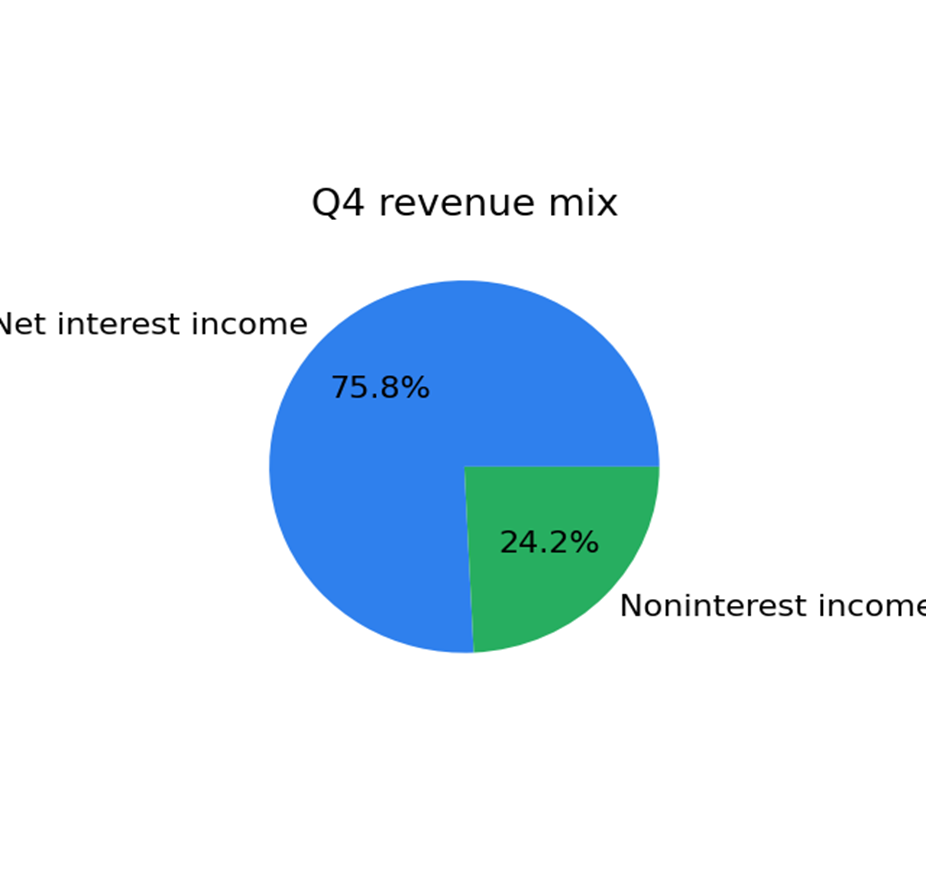

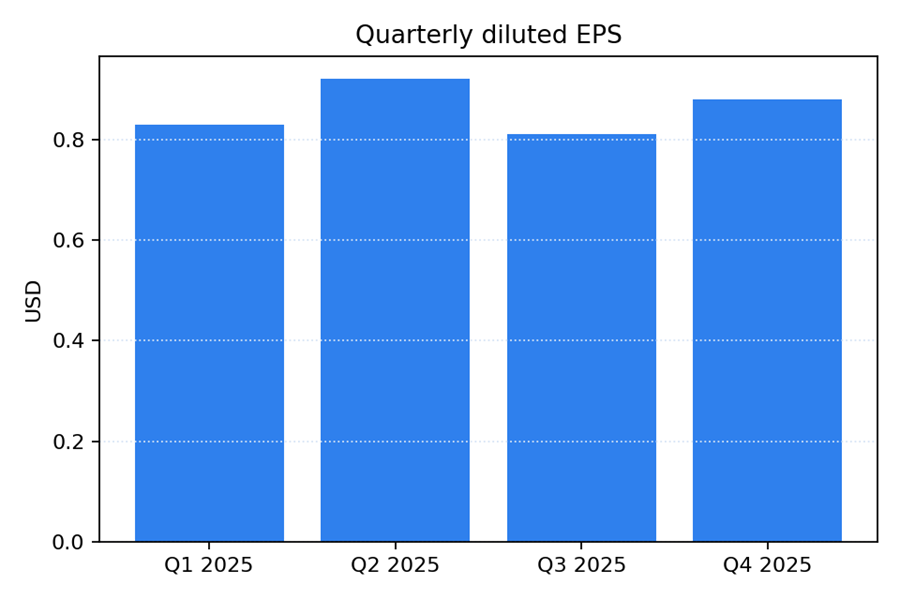

For the quarter ended December 31, 2025, FirstSun reported consolidated revenue of $110.2 million. Net income for the period totaled $24.8 million, compared with the prior-year quarter. Reported diluted earnings per share were $0.88, while adjusted diluted earnings per share were $0.95. Net interest income totaled $83.5 million for the quarter, while noninterest income amounted to $26.7 million, reflecting continued contribution from fee-based revenue streams.

Year-Over-Year & Full-Year Context

Quarterly revenue increased on a year-over-year basis, while quarterly net income also rose compared with the same period a year earlier. For the full year 2025, the company reported total revenue of $419.3 million and net income of $97.9 million, both higher than the prior year.

The full-year performance reflected growth in earning assets and stable operating execution across core banking activities.

Guidance

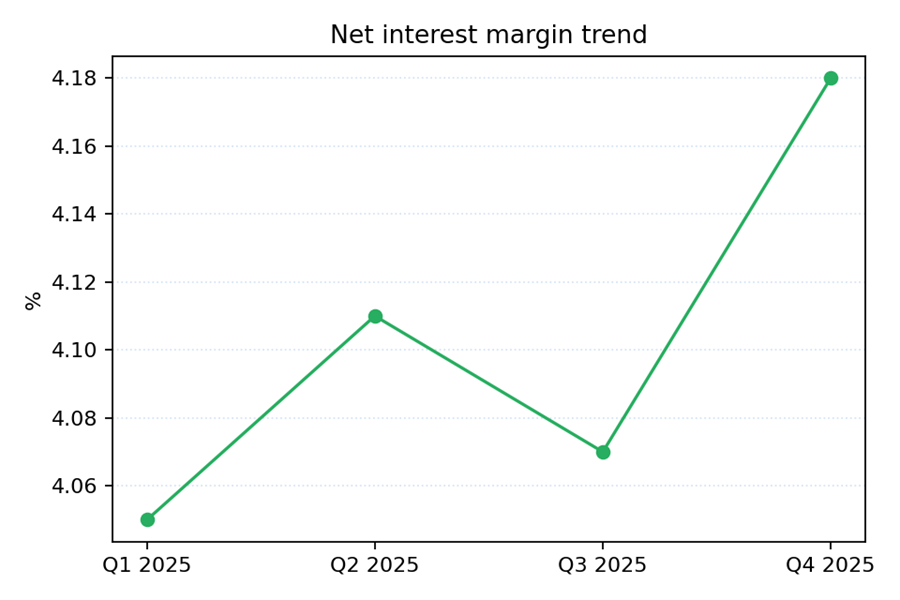

Key items to monitor in upcoming quarters include trends in loan growth, net interest margin behavior under prevailing interest rate conditions, and the composition of noninterest income.

Analysts & Market Reaction

Institutional research commentary following the earnings release focused on revenue trends, margin performance, and balance-sheet metrics, without issuing investment recommendations.

Sector & Macro Backdrop

The quarterly results were released amid ongoing focus on interest-rate expectations, funding costs, and credit quality trends across the regional banking sector.

Competitive Positioning

At year-end, the company reported loan and deposit balances that reflected continued franchise activity, while capital ratios remained above regulatory requirements.

Bottom Line

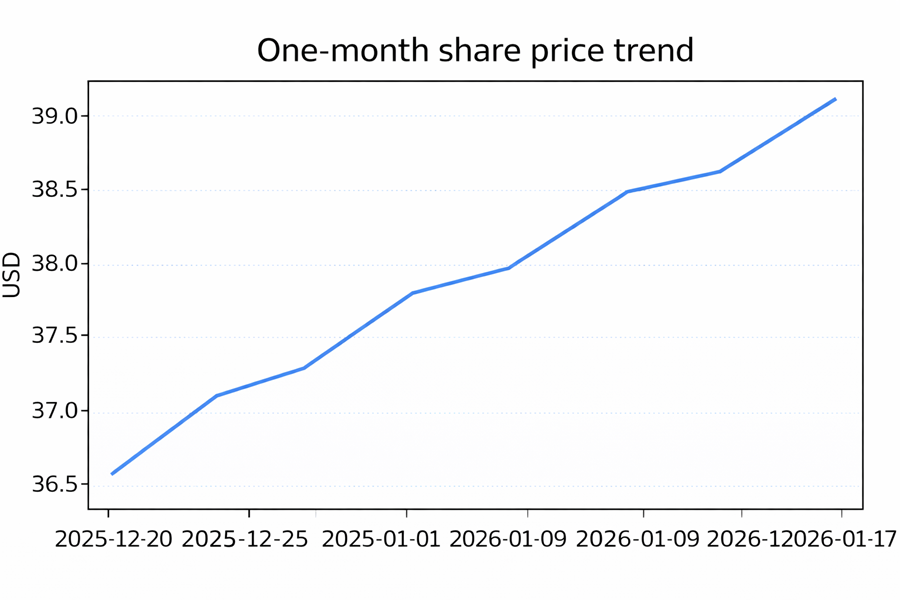

Shares ended the session higher following the release of fourth-quarter results. Revenue totaled $110.2 million for the quarter, with net income of $24.8 million. Full-year revenue and profit increased compared with the prior year.