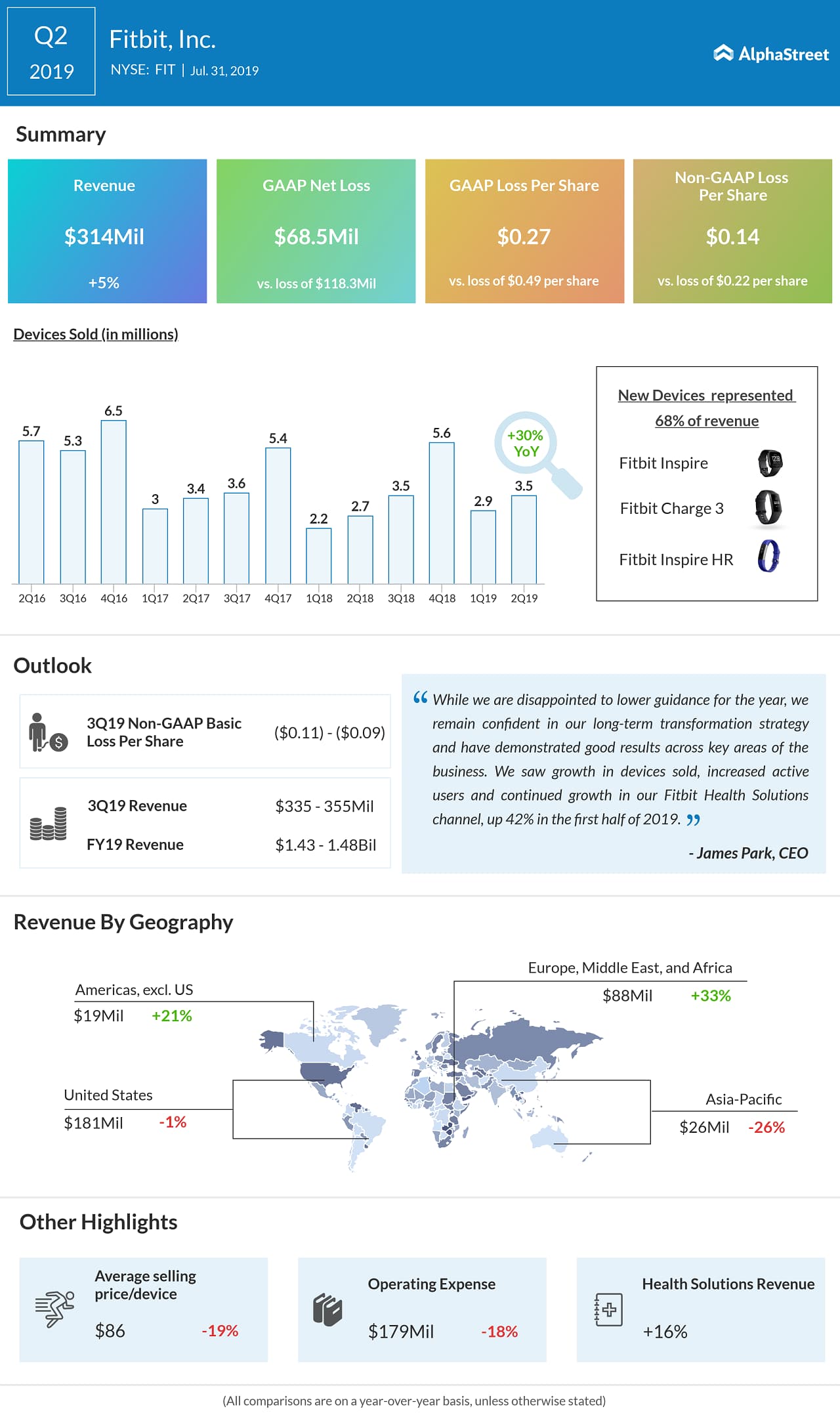

Together, Apple’s smartwatch and home products account for 10% of revenues, which is huge as the tech giant’s average quarterly sales run into several billion dollars. The aggressive wearable push is Apple’s solution to the faltering iPhone sales, while all is not well at Fitbit, which recently slashed its guidance for the remainder of the year amid back-to-back losses and muted revenue growth.

Fitbit is losing market share to its rivals – including Garmin (GRMN) though the functions of their fitness devices vary. The fact that Garmin has consistently achieved earnings and revenue growth shows that its business model is more workable.

Transformation Plan

While Apple has everything that takes to win the wearable race, the market will be curious to know where Fitbit is headed. A key factor that could determine the company’s future will be the effective implementation of the management’s transformation strategy, with focus on the international market where the company is facing tough competition from Chinese tech firms Xiaomi and Huawei.

Competition

Also, it needs to be seen to what extent the company’s efforts would help it tackle competition from the revamped Apple Watch. Fitbit generates more than 40% of the revenue from its smartwatch Versa. The company bets on the fitness market to stay afloat as Versa is much cheaper than its closest rival. Also, it is specially designed for fitness tracking.

Analysts estimate that Fitbit’s revenue growth will continue this year and beyond. Though it will translate into an improvement in overall performance, the bottom-line might remain in the negative territory in the foreseeable future, due to continued pressure on margins.

The ‘Sale’ Option

However, the company is currently attracting the market’s attention for a different reason – the management is reportedly in talks with banks to explore a sale, and the potential bidders include Google’s parent Alphabet (GOOG, GOOGL). The stock witnessed an uptick this week following reports that Fitbit might go ahead with the sale plan, which the company is yet to confirm.

Fitbit’s shares have been in a downward spiral for several years now, hitting new lows at regular intervals. Last month, the stock slipped below $3 for the first time. It has lost about 27% since the beginning of 2019.