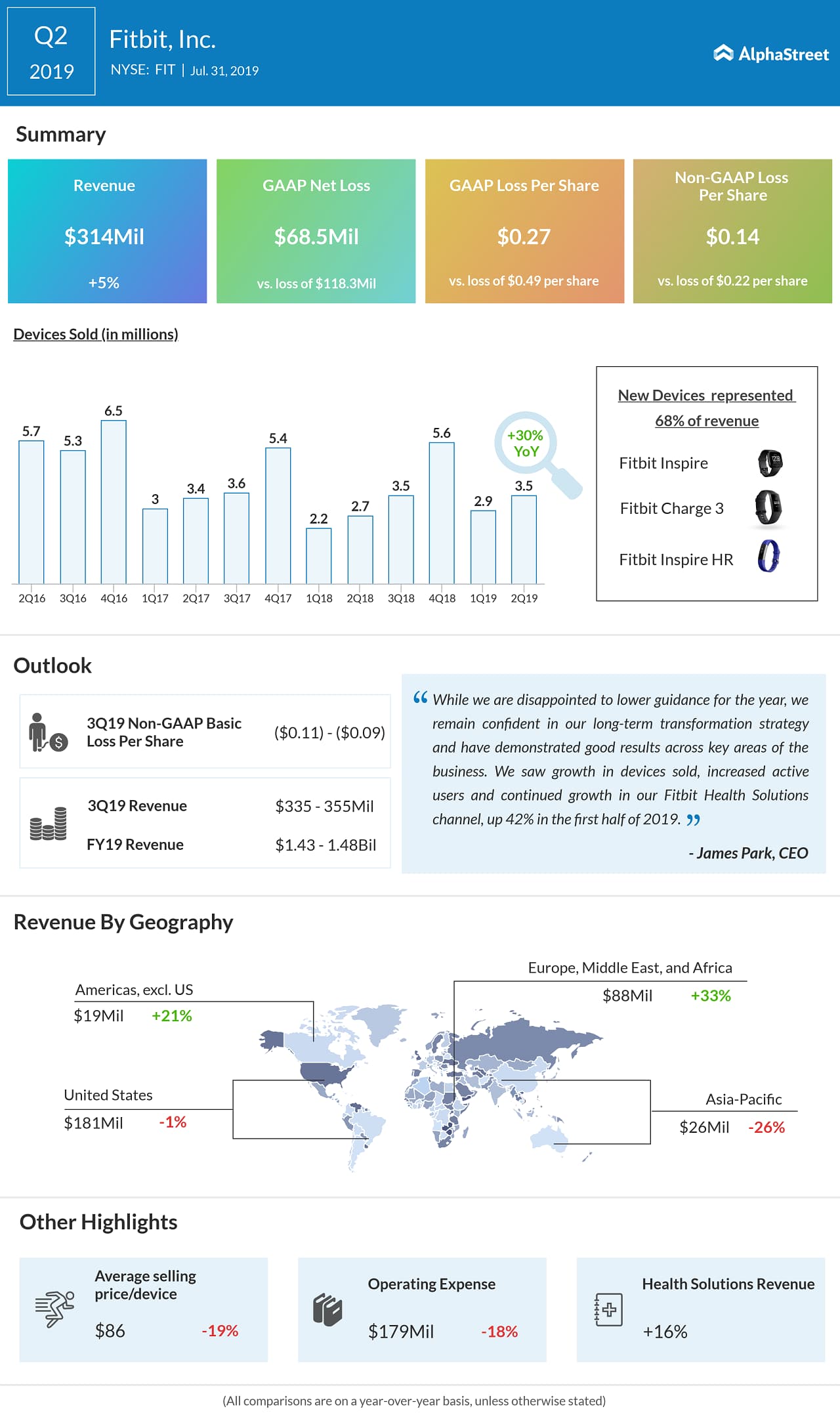

GAAP net loss was $69 million, or $0.27 per share,

compared to $118 million, or $0.49 per share, in the year-ago period. Adjusted

net loss was $36 million or $0.14 per share.

Tracker revenue grew 51% year-over-year and comprised 59% of total revenue. Smartwatch revenue fell 27%, hurt by weaker-than-expected sales of Fitbit Versa Lite Edition. Smartwatches represented 38% of total revenue. Accessory and non-device revenue formed 3% of total revenue.

Devices sold increased 31% year-over-year to 3.5 million. The average selling price was $86 per device, down 19%, due to the introduction of more affordable devices. Tracker devices sold increased 56% year-over-year while smartwatch devices sold fell 7%.

New devices introduced in the past 12 months – Fitbit

Charge 3, Fitbit Inspire, Fitbit Inspire HR, Fitbit Ace 2 and Fitbit Versa Lite

Edition – represented 68% of revenue. Fitbit Health Solutions revenue increased

16% year-over-year, and the segment is on track to achieve its full-year

revenue target of approx. $100 million.

Revenue in the US fell 1% to $181 million while

international revenues rose 14% to $133 million. The EMEA and Americas,

excluding the US, regions saw double-digit revenue growth while APAC recorded a

decline.

For the third quarter of 2019, revenue is expected to decline

10-15% year-over-year to $335-355 million. Adjusted basic net loss per share is

expected to be $0.09-0.11.

For the full year of 2019, the company lowered its revenue

guidance to a range of $1.43 billion to $1.48 billion versus the previous range

of $1.52 billion to $1.58 billion. Adjusted basic net loss per share is

expected to be $0.31-0.38.

Get access to timely and accurate verbatim transcripts that are published within hours of the event.