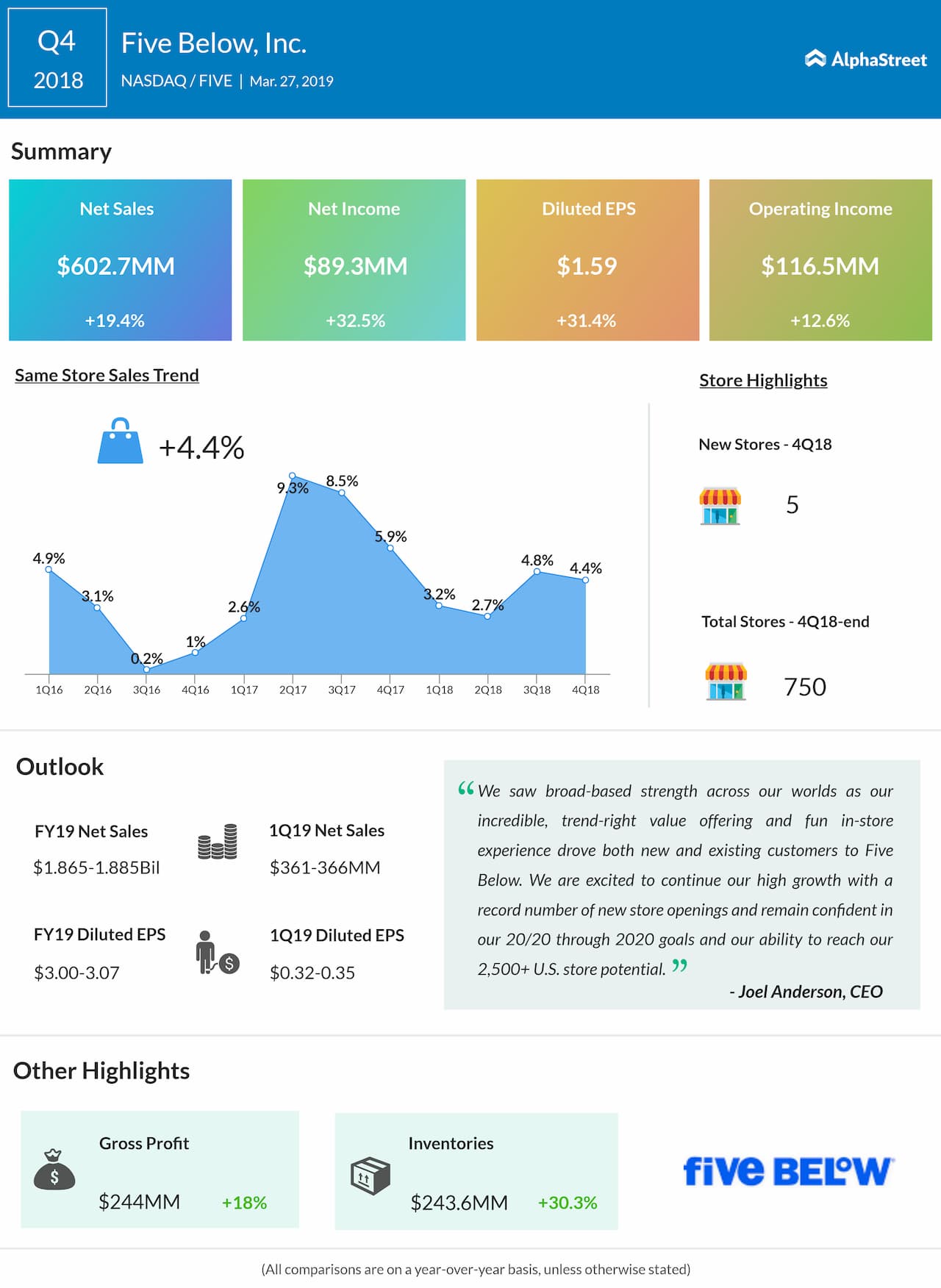

Looking ahead into the first quarter of 2019, the company expects sales in the range of $361 million to $366 million with about 35 new stores are planned to be opened. Comparable store sales are estimated to grow in the 3% to 4% range, while earnings are anticipated to be in the range of $0.32 to $0.35 per share.

For fiscal 2019, the company predicts sales in the range of $1.865 billion to $1.885 billion and earnings in the range of $3.00 to $3.07 per share. The sales outlook is based on opening about 145 to 150 new stores and assuming about 3% increase in comparable sales.

The company continued its high growth with a record number of new store openings and remained confident in its 20/20 through 2020 goals and its ability to reach 2,500-plus US store potential. For 2019, the company is focused on elevating its customer experience, delivering even better WOW products, and further enhancing the supply chain.

For the fourth quarter, the company opened 5 net new stores and ended the quarter with 750 stores in 33 states. This represents an increase of 20% from the end of the fourth quarter of fiscal 2017. The company saw broad-based strength across its worlds as its incredible, trend-right value offering and fun in-store experience drove both new and existing customers to Five Below.

Shares of Five Below ended Wednesday’s regular session up 2.37% at $120.01 on the Nasdaq. The stock has risen over 72% in the past year and over 21% in the past three months.