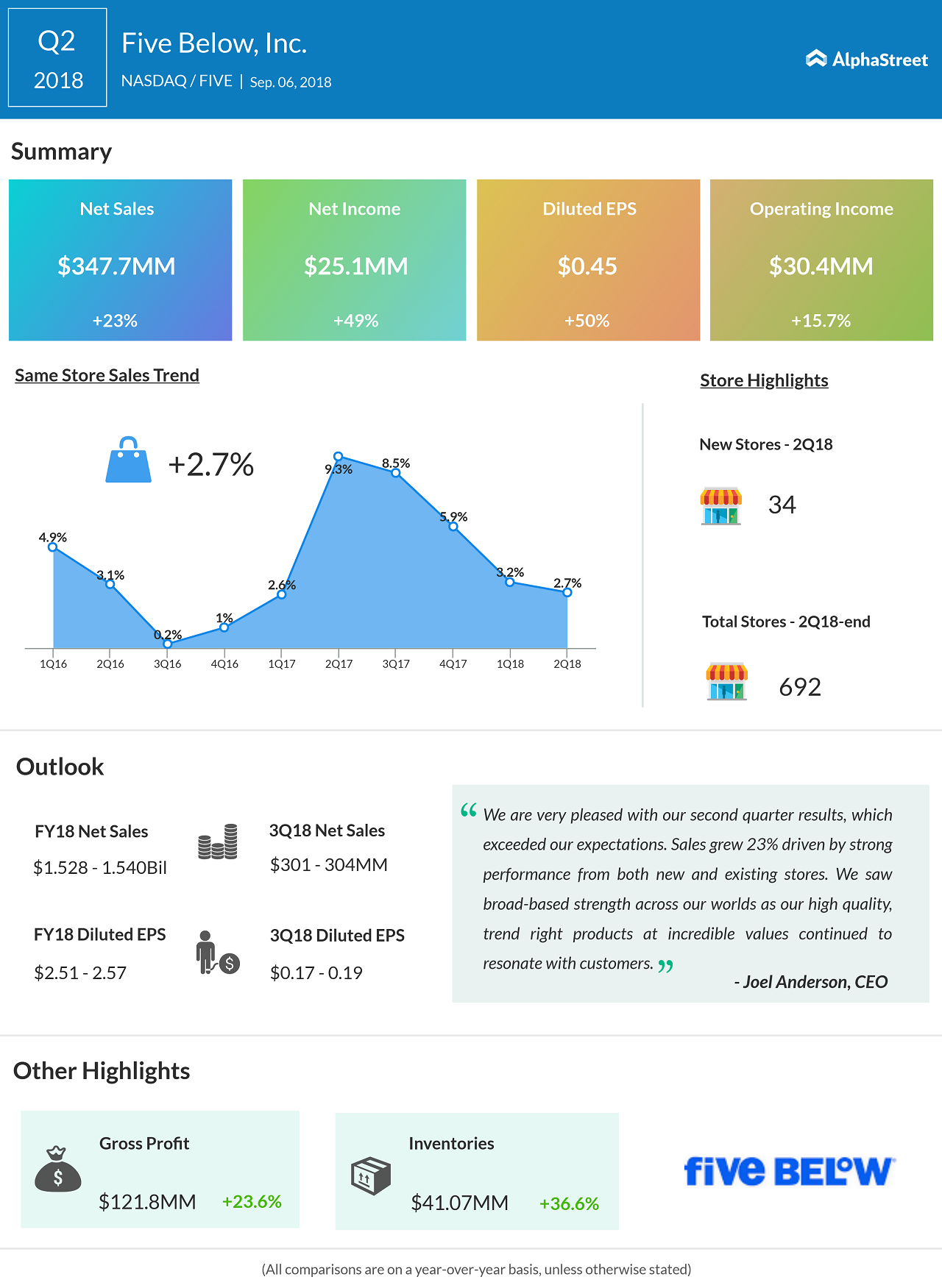

The company opened 34 new stores and ended the second quarter with 692 stores in 33 states. This represents an increase in stores of 18.5% from the end of the previous year quarter.

Looking ahead into the third quarter, Five Below expects net sales of $301 million to $304 million and EPS of $0.17 to $0.19. The sales outlook is based on the opening of about 50 new stores and assuming a 3% to 4% increase in comparable sales. Net income is predicted to be $9.7 million to $10.7 million.

For the fiscal year 2018, Five Below lifted its net sales outlook to a range of $1.528 billion to $1.540 billion from the range of $1.502 billion to $1.517 billion, and its EPS guidance to the $2.51 to $2.57 range from the prior estimate of $2.42 to $2.48. The sales forecast is based on the opening of about 125 new stores and assuming a 2.5% to 3% rise in comparable sales.

Shares of Five Below ended Thursday’s regular trading session up 0.65% at $115.51 on the Nasdaq. The stock had surged 74% so far this year and a whopping 136% in the past one year.