Five Below (FIVE) is expected to post third-quarter results in after-hours trading coming Wednesday, Dec. 4. The discount store chain is expected to earn $0.19 per share on revenue of $304.1 million.

Competitor Dollar Tree (DLTR) posted quarterly results this Thursday with earnings of $1.18 per diluted share, beating estimates.

Trump effect and trade war: Tariffs imposed by the United States on the world in 2018

The trade war between the Trump administration and China could catch up to Five Below like its competitors and peers, as fresh taxes on imports worth $200 billion have resulted in price escalation affecting the arrival of low-priced consumer items. While usually tariffs were slapped on industrial goods imported from the Asian country, this new predicament has forced Five Below and its peers to sell the products at old prices for losses or pull them from the shelves.

If the taxes are not rolled back, profitability will be under pressure in the long term, resulting in headcount reduction and store closures.

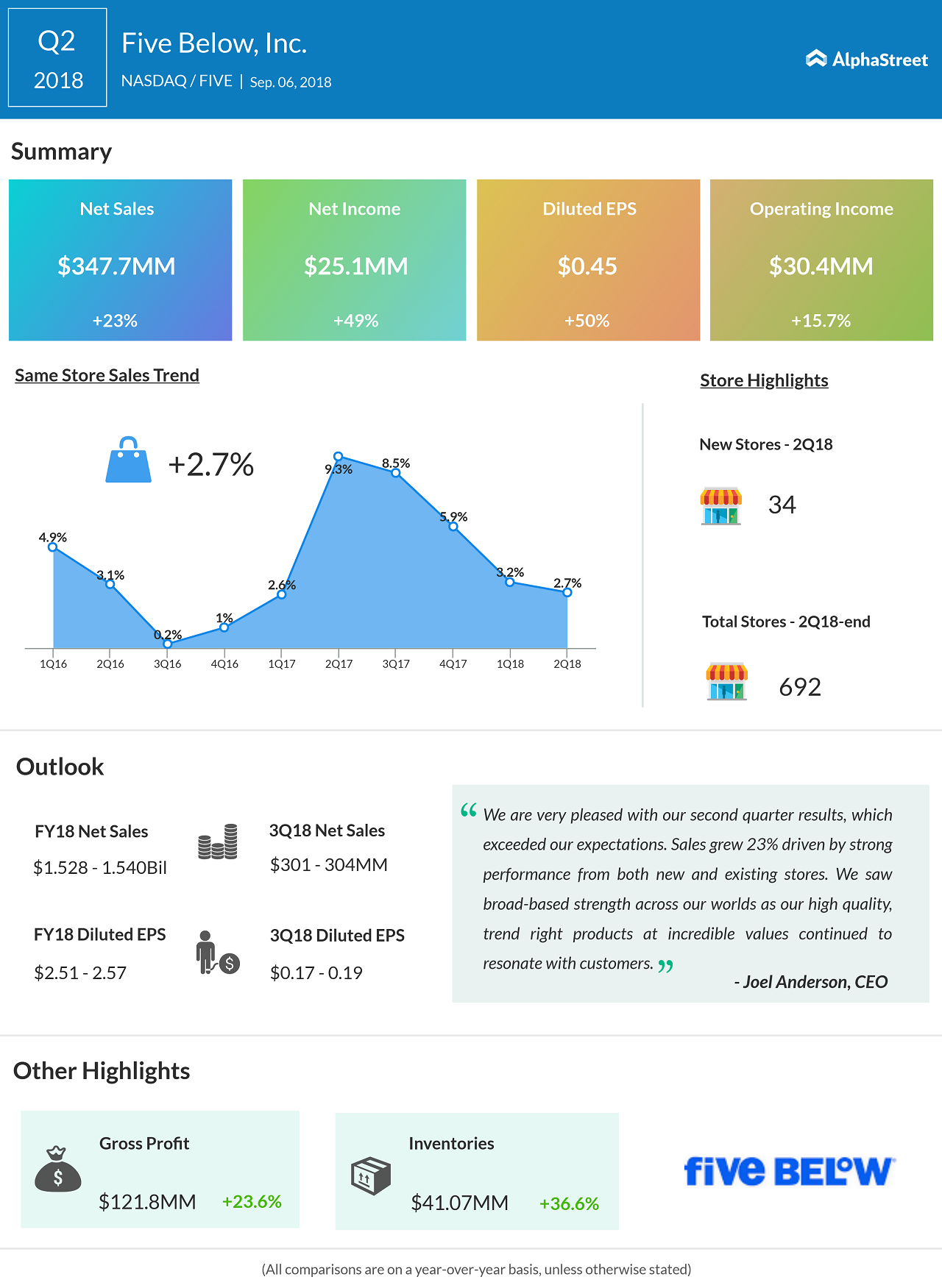

Last quarter, Five Below saw earnings jump 49% helped by new stores performance, healthy comparable sales, strong gross margin performance, and favorable tax rate. The high-growth value retailer’s stock rose more than 8% in the aftermarket on Sep. 6 with both earnings and revenue beating market expectations.