Like most tech companies, Salesforce (NYSE: CRM) is probably moving into a new era, with the coronavirus outbreak setting a new paradigm for the business. The subscription-based model has been quite successful – a concept pioneered by the Silicon Valley firm that provides cloud-based software solutions with focus on customer relationship management.

[irp posts=”63035″]

With cloud adoption picking pace amid social distancing, Salesforce can expect busy days ahead and achieve its ambitious revenue target of $35 billion, though it requires extensive planning and heavy investments. No wonder analysts overwhelmingly recommend buying the stock, which has returned to growth mode after slipping to a two-year low in March. It is considered fairly valued, given the solid growth momentum. Experts predict a further uptick in market value going forward.

Biz Expansion

Despite the looming uncertainty, it is very likely that the company would continue with the strategy of acquiring businesses having the potential to create value for its wide-ranging clientele that includes both corporates and governments. Most of the credit for Salesforce’s steady expansion goes to the efforts of founder and long-term CEO Marc Benioff.

During his post-earnings interaction with analysts, Benioff said, “Companies and organizations and governments around the world have a digital transformation imperative like never before and many are accelerating their plans for digital-first, work from anywhere environment. …And I believe that Salesforce has never been more relevant or more mission-critical to more organizations. No one is better positioned than Salesforce to accelerate out of this crisis and bring customers into the new normal.”

High Demand

According to Benioff, demand is pouring in from enterprises and federal agencies for solutions to an array of issues linked to the pandemic and the related shutdown. As a result, the company clinched/expanded partnerships with several business entities including top corporates. It is certain that the trend would gather momentum in the coming months, with the Tableau and Einstein platforms playing a crucial role in offering new solutions. Needless to say that work.com will continue to be a much sought-after platform for managing corporate performance.

Stumbling Blocks

But Salesforce is not fully insulated from the unprecedented crisis the business world is facing and that is evident from the downward revision of the full-year revenue guidance that comes in below Wall Street’s projection.

The management might need to relax the contract terms for cash-starved customers, resulting in payment delays. Similarly, prospective customers, mainly in the small-scale category, might defer their plans for signing new contracts. The estimated Current Remaining Performance Obligation (CRPO) for the second quarter is lower compared to the preceding quarter, indicating a drag on near-term revenue performance.

Having said that, the strong fundamentals and favorable pricing strategy would help the company maintain the positive cash flow and strong margins, which has stayed close to 75% in recent years.

Q1 Results Beat

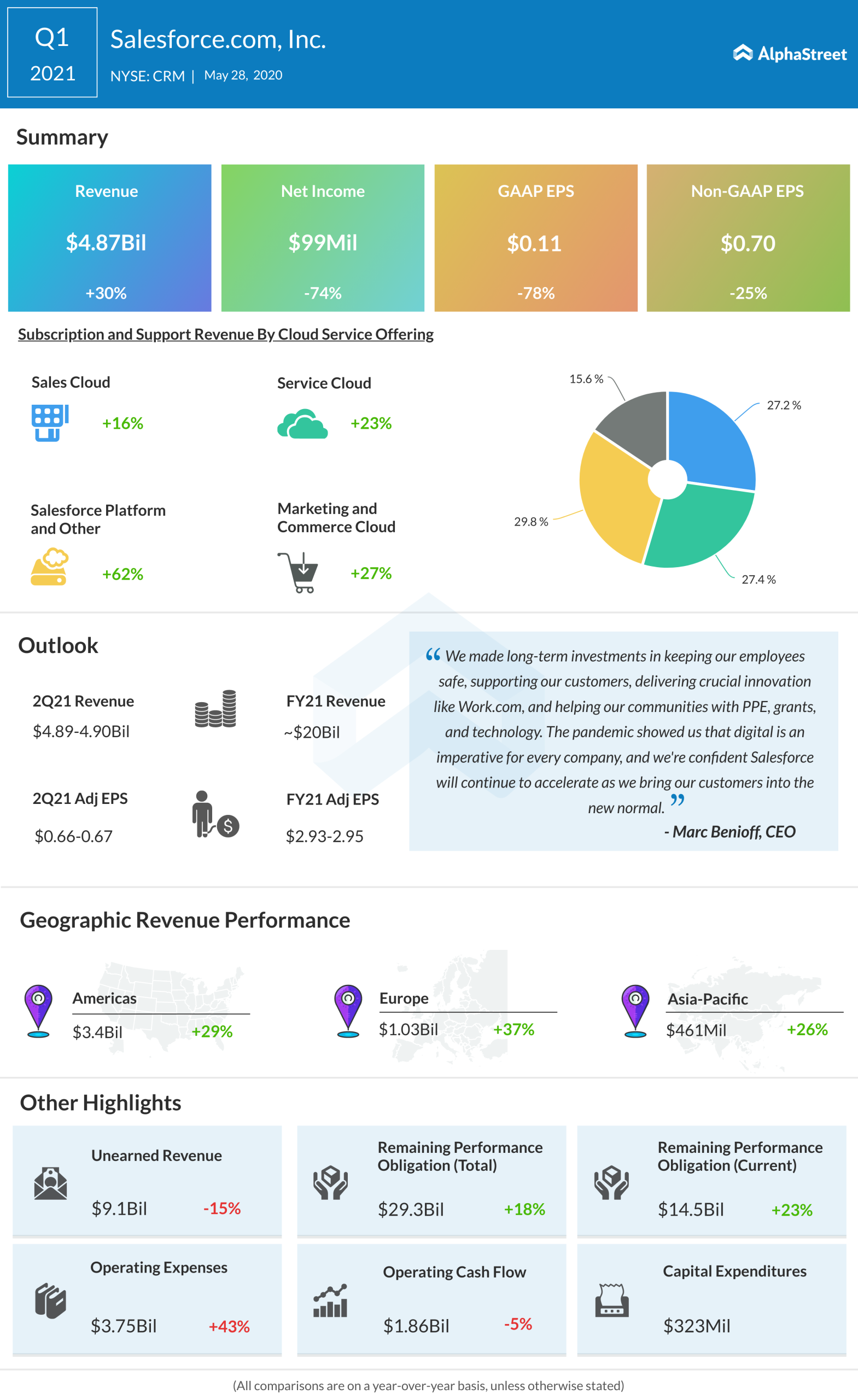

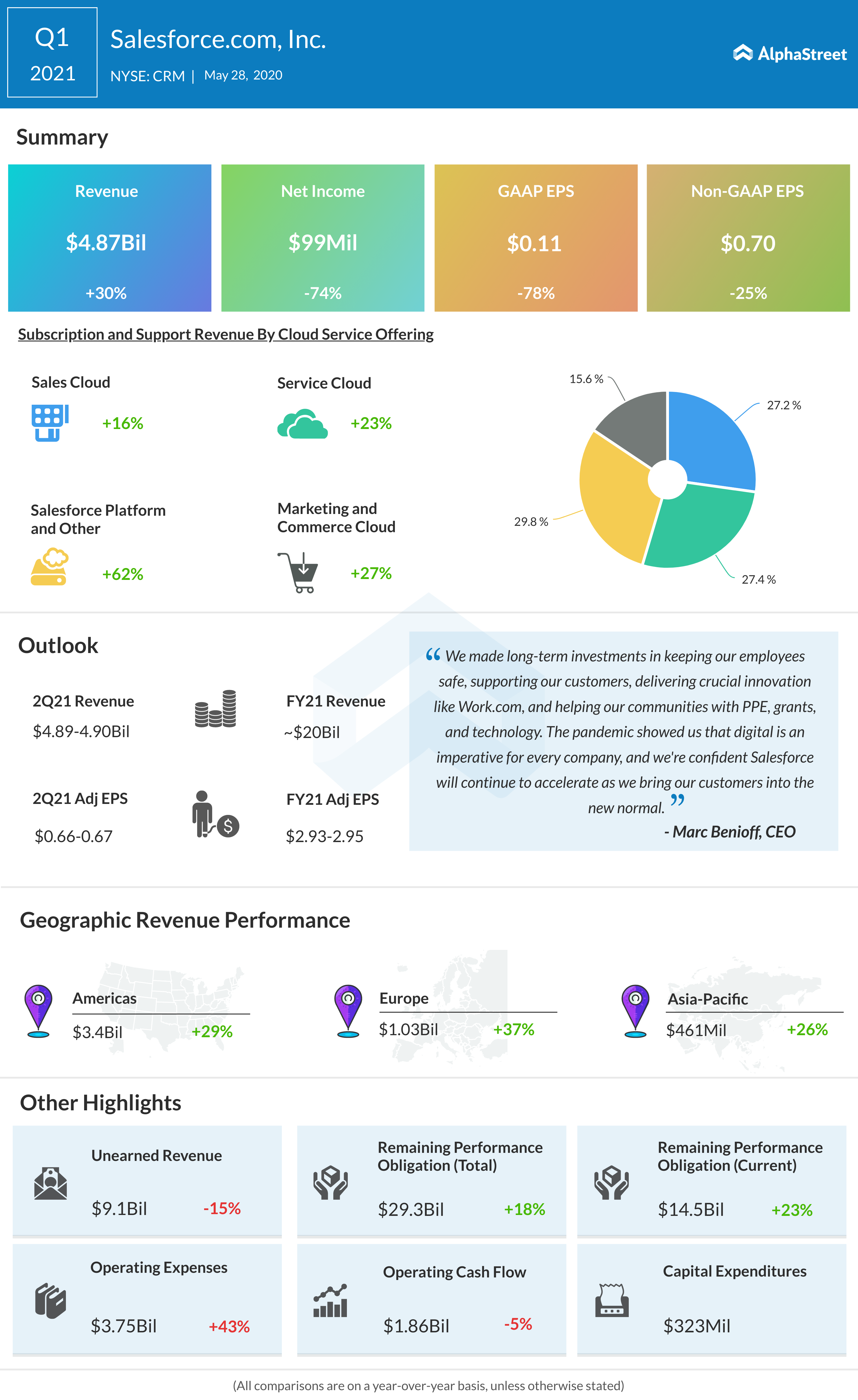

Last week, the unimpressive full-year guidance took the sheen off the positive bottom-line performance that exceeded the estimates. In the first quarter, earnings dropped 25% year-over-year to $0.70 per share. At $4.87 billion, revenues were up 30% from last year. It needs to be noted that Salesforce doubled its revenue in less than four years, an achievement the company is capable of repeating.

“First, our guidance assumes our revenue attrition rises from less than 9% now to less than 10% temporarily for the rest of the fiscal year. Second, the guidance reflects the adjustment to incremental new business expectations that we made due to the COVID pandemic. Another important consideration when thinking about our FY ’21 guide is of the magnitude of the above when applied to our term license products.”

Mark Hawkins, chief financial officer of Salesforce

Of late, the company is experiencing an interesting shift in revenue performance, with the Platform & Other segment outshining the core SaaS business in recent quarters. Tableau and Mulesoft, which joined the Salesforce fold in recent years has been contributing steadily to revenues, while the effective use of advanced technologies like artificial intelligence makes the offerings stand out.

[irp posts=”51591″]

Shares of

Salesforce bounced back pretty quickly after falling from the peak two months

ago when the market witnessed a mass selloff. Despite the general weakness, the

stock is currently trading up 9% from last year and 6% above the levels seen at

the beginning of the year.