Business restructuring

Long-term guidance

Ford aims to produce more than 2 million electric vehicles annually by 2026. The company plans to invest $5 billion in EVs this year alone, reflecting a two-fold increase from last year. By 2026, the company will have invested over $50 billion in EVs and the development of new technologies. Ford expects to achieve company-adjusted EBIT margin of 10% by 2026.

Plans

Ford has a strong portfolio of new vehicles in North America, its largest market. These include the new Bronco, Bronco Sport, Maverick, and Mustang Mach-E. The company is doing well in international markets as well and its restructuring efforts in Europe and South America will help drive profitability going forward. China remains an important market for electric vehicles.

On its most recent quarterly conference call, Ford said that it has doubled its 2023 planned capacity for EVs to 600,000 units a year. Its Blue Oval City electric truck plant in Tennessee is expected to produce full-sized electric pickups from 2025 while the battery plants in Tennessee and Kentucky will have capacity to produce enough battery cells for more than 1 million vehicles a year.

Ford remains on track to achieve at least a 40% mix of BEVs by 2030 with strong margins. Ford’s sales of electrified vehicles increased 55.3% through February.

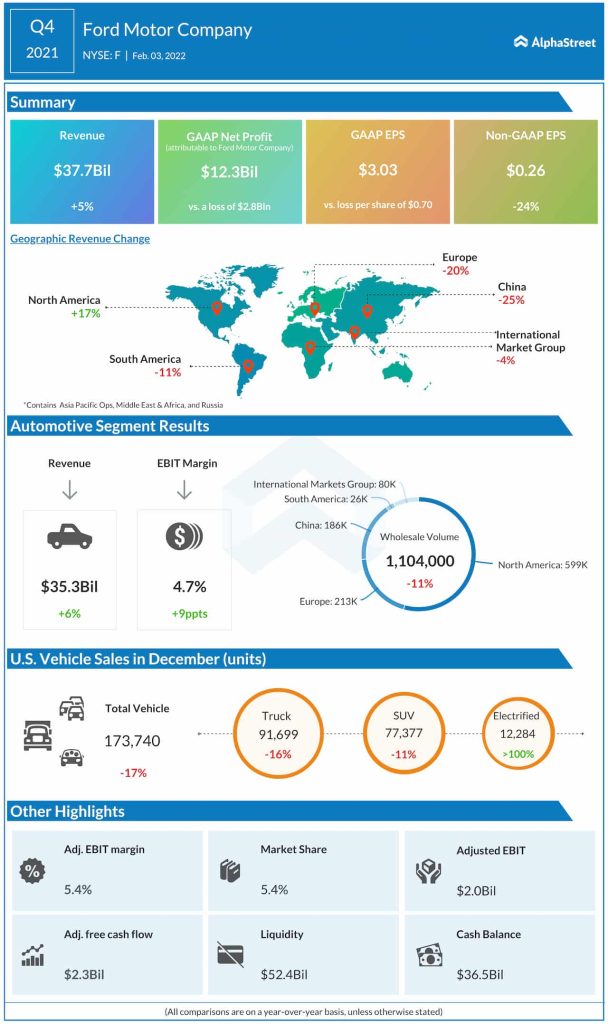

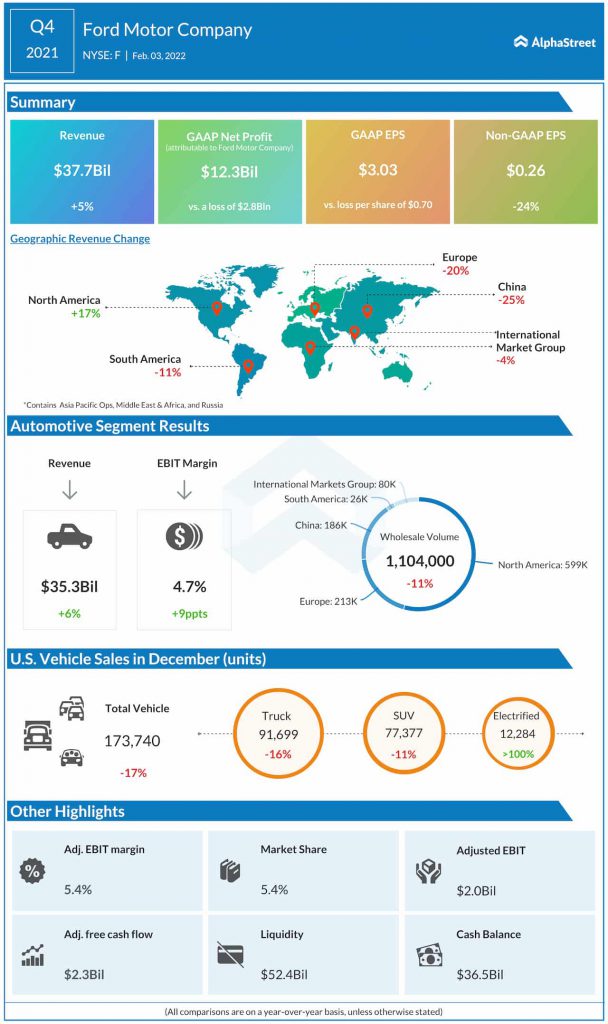

Ford expects supply constraints to remain fluid throughout this year. The company anticipates its full-year wholesales to be up about 10-15% in 2022 with a high single digit to low double digit decline in the first quarter due to supplier shortages related to pandemic shutdowns and semiconductors.

Adjusted EBIT is expected to range between $11.5-12.5 billion, reflecting an increase of 15-25% over 2021. Adjusted free cash flow for 2022 is estimated to be $5.5-6.5 billion.

Despite Ford’s ambitious plans, some analysts remain skeptical about the company being able to achieve its targets, especially amid tough competition from the likes of Tesla (NASDAQ: TSLA) and Rivian (NASDAQ: RIVN). Some experts preferred the spin-off of the EV business. Despite the drop in stock price and concerns raised, it appears there is a general sense of optimism about the long-term opportunity for Ford.

Click here to read more on automobile stocks