Ford Motor Company (NYSE: F) is partnering with Intel’s (NASDAQ: INTC) Mobileye to roll out driver assistance systems across its products. These will include camera-based detection capabilities that will help in providing collision warning and vehicle and pedestrian detection.

Mobileye will provide its EyeQ devices as well as vision processing software to support driver assistance systems in Ford vehicles. Mobileye’s technology will support features such as lane-keeping system, automatic emergency braking and active drive assist hands-free driving.

Automobile industry and COVID-19

The automobile industry is undergoing rapid changes and many carmakers have been shifting their focus towards electric vehicles and autonomous driving. Several traditional automakers are partnering with technology companies to launch new vehicles with improved autonomous driving capabilities.

Automobile companies like Ford and General Motors (NYSE: GM) have been struggling for a while with falling sales and have revamped their product lines by stopping the production of unprofitable models and focusing on more profitable ones like SUVs. These companies face competition from EV-makers like Tesla that are investing heavily in self-driving technologies.

The coronavirus pandemic exacerbated these troubles as the lockdowns brought vehicle production to a halt and the slowing economy impacted vehicle sales. Financial constraints led people to put off their vehicle purchases. Although the situation slowly began to pick up, a proper recovery is still expected to take time. Based on data by Counterpoint Research, global automotive sales are expected to decline 20% in 2020 to 72 million units compared to 2019.

A weak quarter

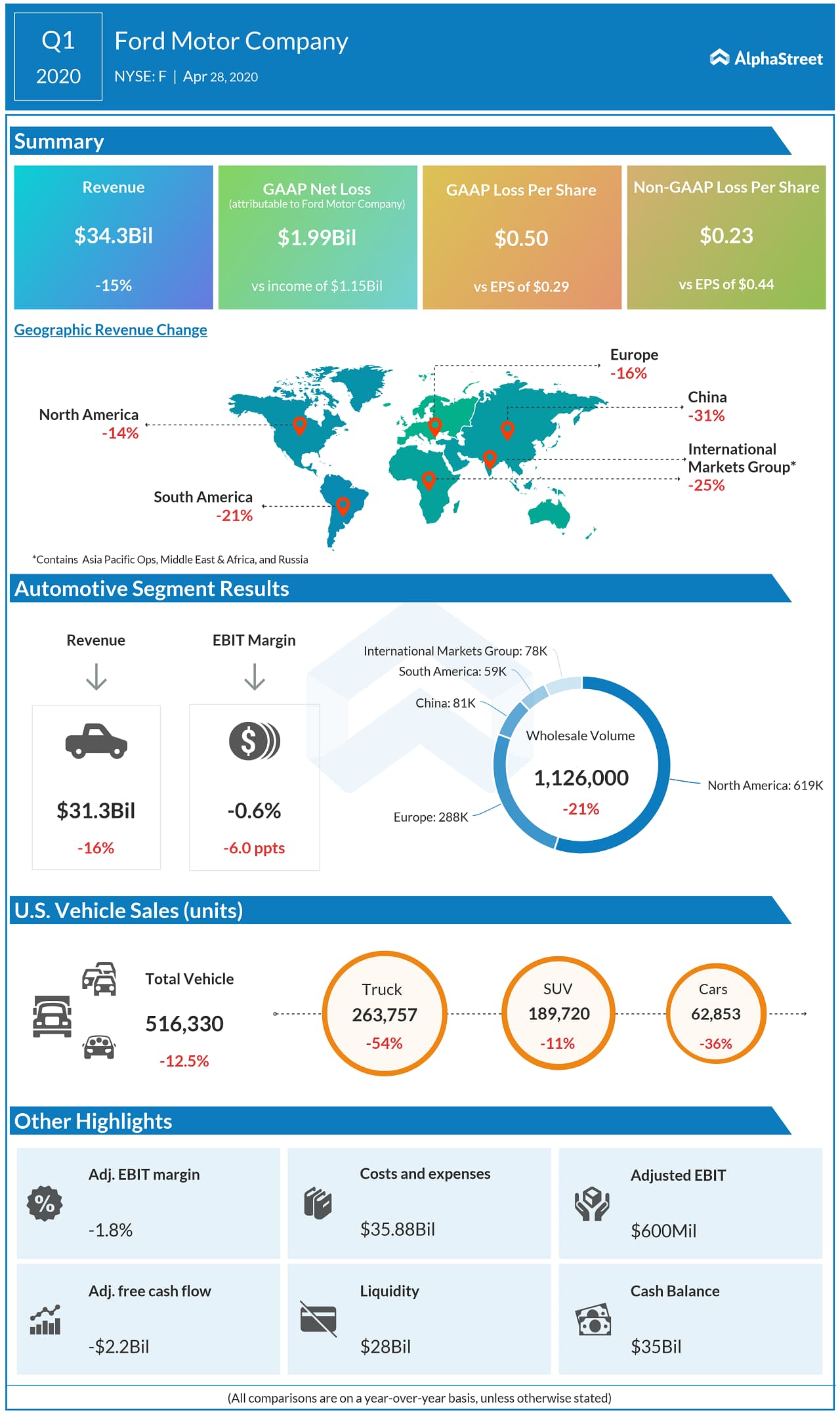

Ford saw its revenue decline 15% in the first quarter of 2020 to $34.3 billion. The company reported an adjusted loss of $0.23 per share. Ford saw its total vehicle sales in the US drop by 12.5% in the first quarter, with declines across all vehicle types. Ford brand vehicle sales fell 13.2% while Lincoln brand vehicle sales increased 2.3%.

Slow recovery

The impact of the pandemic continued into the second quarter of 2020 with total vehicle sales in the US falling 33.3% and retail sales dropping 14.3%. Sales in trucks and SUVs fell nearly 27% and 30% respectively while car sales saw the highest decline of 59.5%.

Both the Ford and Lincoln brands witnessed double-digit sales declines. Fleet sales were impacted the most by shutdowns and shelter-in-place restrictions with daily rental falling 94%. The company’s shift towards online and remote sales helped increase retail share to 13.3%.

Ford is scheduled to report second quarter 2020 earnings results on Thursday, July 30. Analysts estimate sales will decline 57% to $15.4 billion while loss per share is expected to be $1.25.

Ford’s stock has gained 34% over the past three months. Shares were down 1.8% in afternoon hours on Monday.

Click here to read Ford Q1 2020 earnings conference call transcript