Focus Topics: Q&A Session

- Export Headwinds & US Tariffs: Analysts questioned the impact of fluctuating US trade policies on export volumes. Management noted that while international demand is “subdued,” they are mitigating this by pivoting capacity toward domestic defense and aerospace requirements.

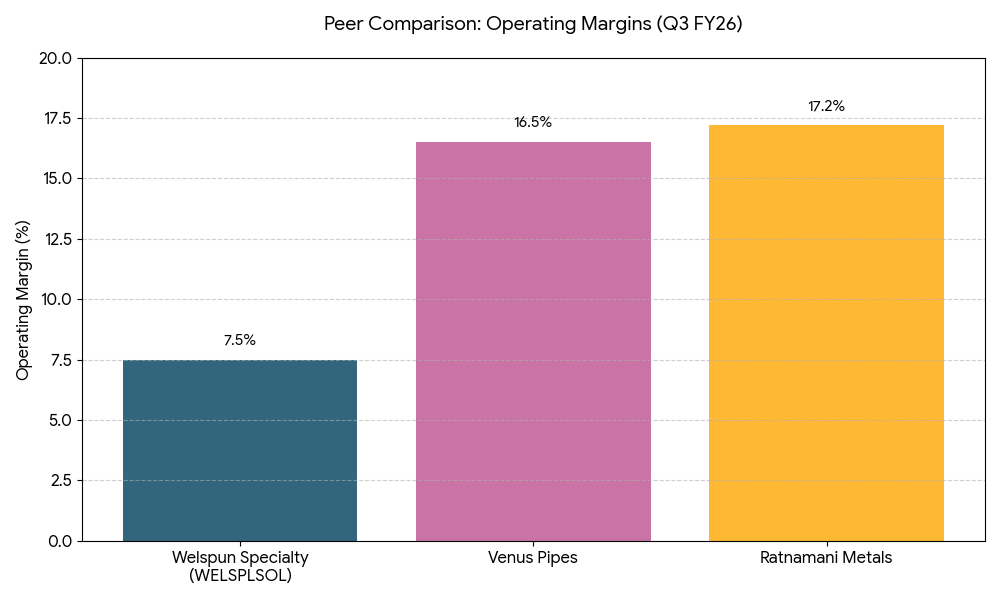

- Integrated Production Advantages: A key discussion point was the efficiency of their Jhagadia facility. Being an integrated producer (from steelmaking to finished pipes) has allowed the company to maintain a competitive margin profile even as raw material costs fluctuated.

- Order Book and Sectoral Mix: Management highlighted a diversifying order book, with increased traction from Oil & Gas, Petrochemicals, and Space sectors. They emphasized that stainless steel bars and seamless tubes are seeing higher “stickiness” in domestic public infrastructure projects.

- Debt Profile: Investors welcomed the update on the company’s deleveraging journey. Management confirmed that WSSL is now effectively debt-free (Total Debt to Equity at ~0.05x), providing significant balance sheet flexibility for future capacity debottlenecking.

- New Wage Code Provisioning: Similar to other industry peers, the company accounted for a one-time provision (approx. ₹66 lakh) related to the new labor code implementation, which management clarified as a non-recurring expense.

Management Guidance for FY27

- Capacity Utilization: The company aims to reach 85%+ utilization at its integrated pipe mill by the end of FY27.

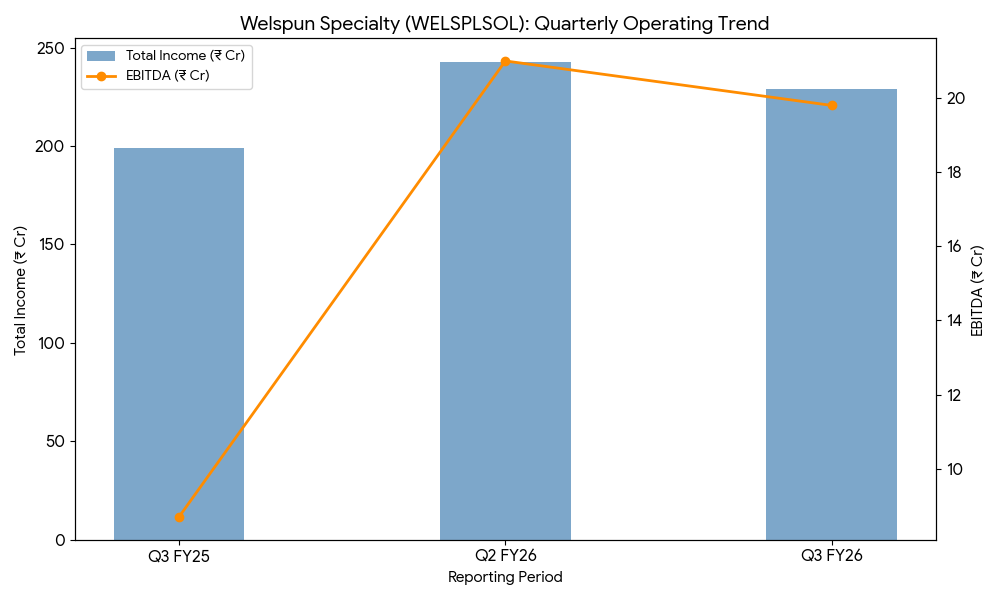

Product Premiumization: Management expects the share of “Value Added Products” (VAP) to increase from the current 25% to 40% of the total mix by next year, targeting a steady-state EBITDA margin of 10–12%.