Highlights

Since Fundamental Research’s initial report, the company has secured two new U.S. patents and one Brazilian patent for drug and vaccine candidates targeting malaria and cancer treatment. For raising the target price, the research firm also considered the positive results from an independent study demonstrating that Ocean Biomedical’s antibodies can suppress glioblastoma (brain) tumor growth by 60%.

Dr. Chirinjeev Kathuria, co-founder and executive chairman of Ocean Biomedical, said, “We are pleased to see our cumulative efforts and growing strengths recognized by Fundamental Research Corp.’s analyst coverage, especially the diverse potential of our core cancer, fibrosis, and infectious disease programs.”

(Source: Ocean Biomedical, Inc.)

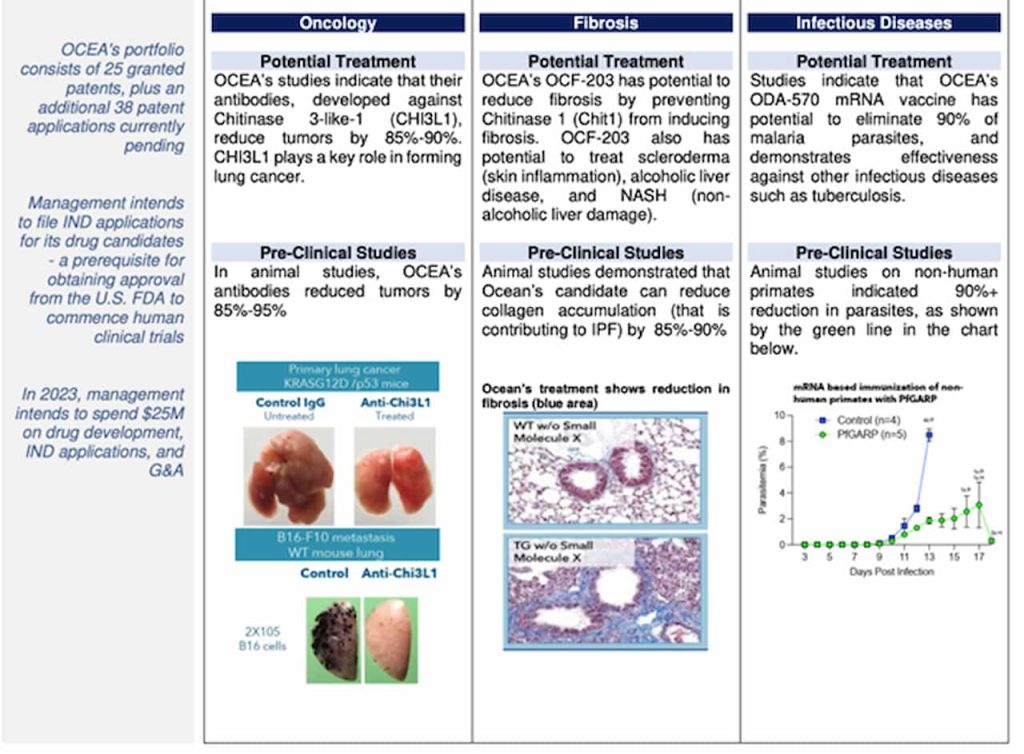

In addition, Ocean Biomedical is planning to progress the manufacturing and IND-enabling studies needed to submit applications to the FDA to initiate human clinical trials and its diversified development pipeline. The pipeline includes three drug candidates for oncology, one for fibrosis, and three for infectious diseases.

Impressive Track Record

“Our research indicates that approximately 19% of drugs advance from phase I clinical trials to approval,” stated the report referring to Ocean Biomedical’s efforts to move multiple assets towards clinical trials. The research note also provided a detailed overview of Ocean Biomedical’s primary drug candidates to highlight the potential value of the company’s multi-pronged approach.

“We appreciate Fundamental Research Corp.’s close attention to our financial and research news, and we will continue our efforts to meet and exceed both shareholder and stakeholder expectations,” said Suren Ajjarapu, a director of Ocean Biomedical.

25 Patents

With regard to Ocean Biomedical’s portfolio, the report said the company has already received 25 patents and has an additional 38 patent applications currently pending. It also summarized the potential treatments the company is developing in the areas of oncology, fibrosis, and infectious diseases.

“Our team of experienced biopharma executives and top-tier scientists continue their efforts to move our research programs towards their phase 1 clinical trials as efficiently as possible,” said Elizabeth Ng, CEO of Ocean Biomedical.”

Earlier this month, Taglich Brothers initiated coverage on Ocean Biomedical with a share price target of $20. According to Taglich Brothers, the target price implies that the shares could appreciate nearly four-fold over the next twelve months.