As the number of COVID-19 cases in the US is fast approaching 150,000 mark, home quarantines have forced the masses to take up gaming as a means of entertainment. As a result, gaming shares have performed relatively well following the initial market-wide slump.

In the past 10 days, Activision Blizzard (NASDAQ: ATVI) has gained 9.6%, Electronic Arts (NASDAQ: EA) has increased 9.5% and Take-Two Interactive Software (NASDAQ: TTWO) has jumped over 11%. However, the positive impact on the gaming industry is unlikely to cure GameStop’s (NYSE: GME) degenerating health.

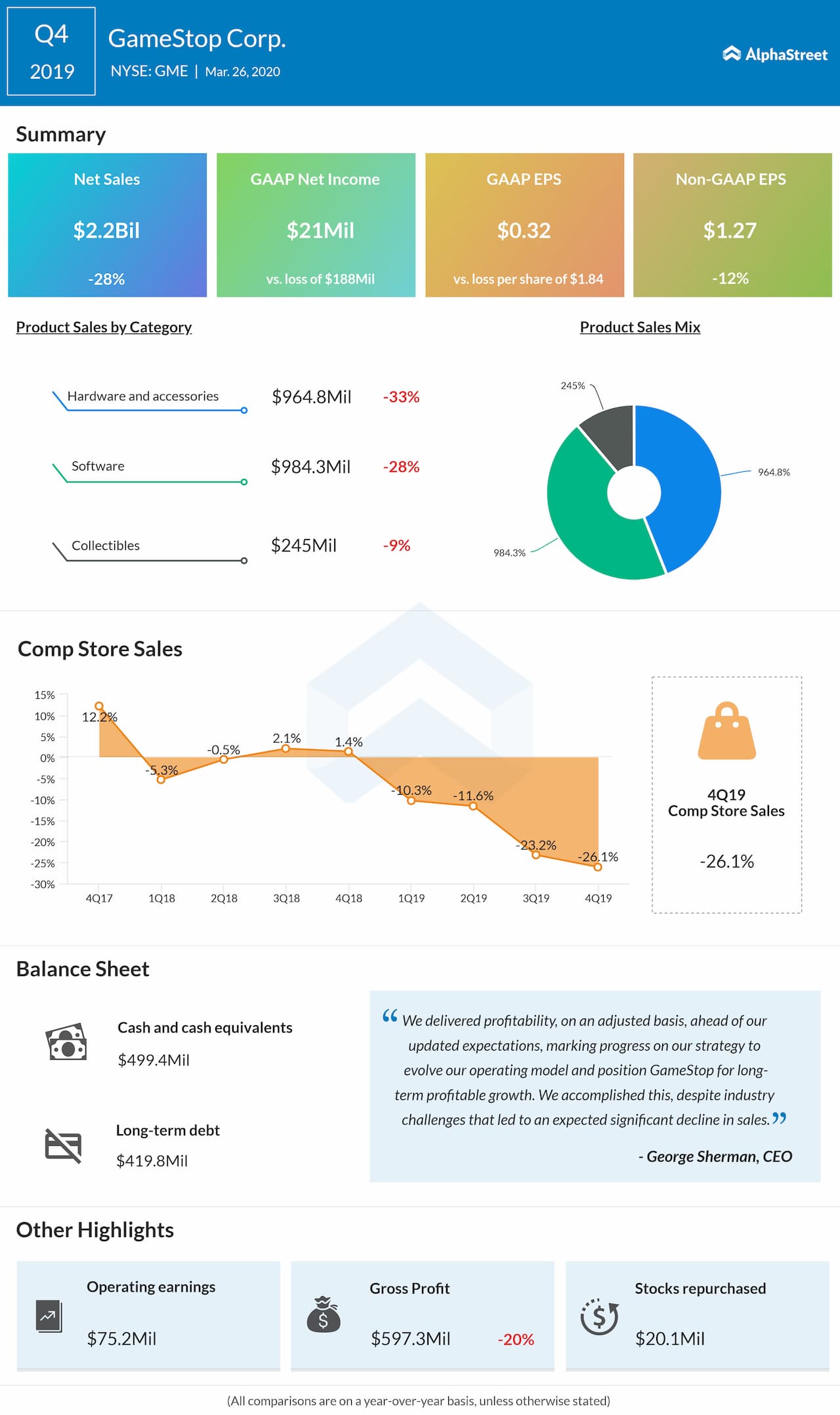

When the video game retailer reported earnings last week, it managed to swing to a profit, even as revenues declined 28%. The bottom-line was helped by its massive cost-reduction initiatives, which included the closure of 321 stores and a slew of layoffs. Comparable store sales fell a drastic 26.1%, despite it being a holiday quarter, sending out signals that the firm is far from a recovery.

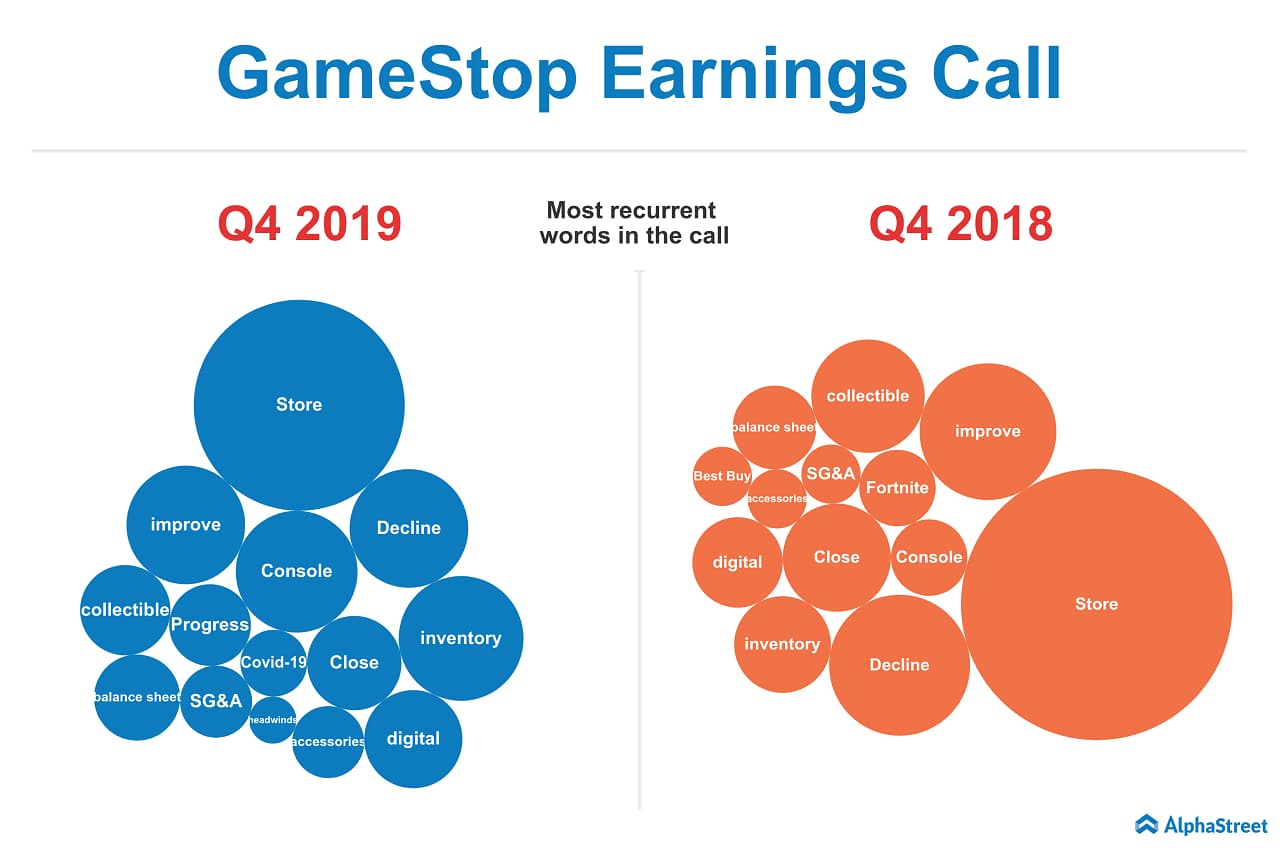

CEO George Sherman had acknowledged some industry headwinds in the

earnings release. He said:

“As we begin fiscal 2020, we remain focused on our key priorities, yet recognize that we continue to face the temporary headwind of lower current generation console hardware and software sales as consumers delay purchases in anticipation of new platform launches expected later in the year.”

However, things could be worse than that. During the earnings conference call, the management had confirmed that there would be 320 more store closures, or even more in this financial year. Responding to a question by Jefferies analyst Stephanie Wissink on profitability relating to this “de-densification” of stores, CFO Jim Bell optimistically said:

“We haven’t really quantified

publicly the effects, but suffice it to say the percentage of transfer needed

to breakeven is fairly low and while that’s the case, we’re significantly

exceeding that in those stores that we’ve closed and what we’ve seen in terms

of our transferability.”

However, when companies start hiding figures that it had been reporting for a long time, that shows signs of fatigue. During the fourth quarter, the specialty retailer remained shy of providing segment gross margin break-up. With investors blind about the performance trend of its high-margin used games segment, meriting the firm has become cumbersome.

Desperate measures

Separately, GameStop said it would continue to operate during the pandemic crisis as a curbside pickup, despite the retailer not falling in the “essentials” category, highlighting the desperate need to pull off any available sales. According to Boston Globe, the company has directed its staff to wrap plastic bag around hands and sell to customers by “opening the door a crack,” a move that hasn’t been taken well. These desperate measures certainly do not add investor confidence in the firm.

GameStop’s hopes are currently pinned on new console releases from Microsoft (NASDAQ: MSFT) and Sony (NYSE: SNE) later this year. Even though both these companies have maintained that the launches are on schedule, there is a fairly good chance to see delays given the current scenario. Bell had said during the conference call:

“As George already mentioned, we anticipate the cyclicality of the console business to continue to impact sales through the first three quarters of fiscal ’20 until the launch of Gen 9 consoles from Sony and Microsoft.”

Delays could mean that the retailer will be forced to drag further with low sales figures.

Read

the full transcript for better insights into GameStop stock.