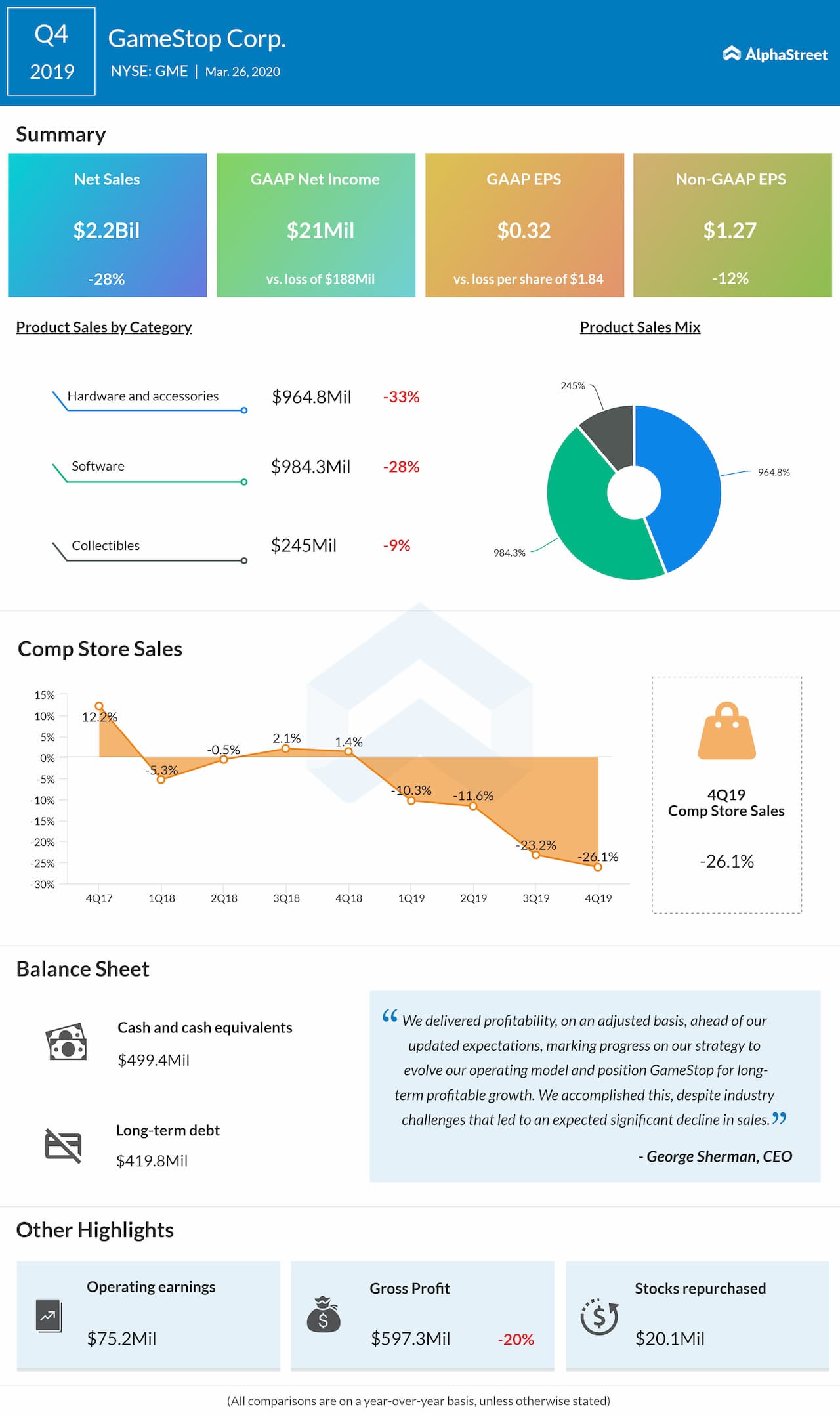

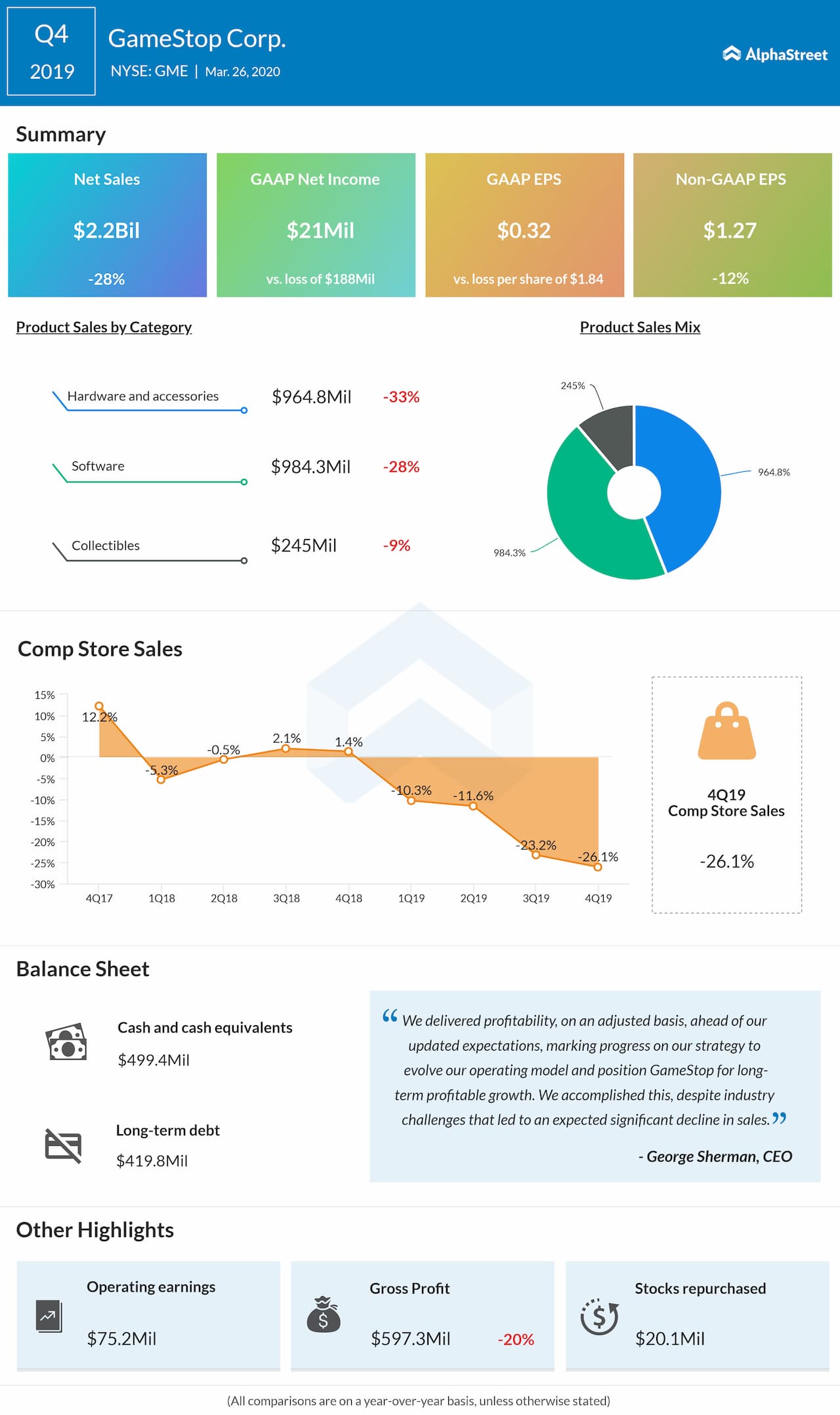

GameStop Corp. (NYSE: GME) swung to a profit in the fourth quarter of 2019 from a loss last year, helped by lower costs and expenses despite a 28% dip in revenue. The bottom line exceeded analysts’ expectations while the top line missed consensus estimates.

Net income was $21 million compared to a loss of $187.7 million in the previous year quarter. Adjusted earnings dropped by 12% to $1.27 per share. Revenue plunged by 28% to $2.19 billion. Analysts had expected EPS of $0.79 on revenue of $2.24 billion for the fourth quarter. Comparable store sales decreased by 26.1%.

The company continues to face the temporary headwind of lower current-generation console hardware and software sales as consumers delay purchases in anticipation of new platform launches expected later in the year. The Covid-19 outbreak has led to changes in how consumers work, play and learn and over the past few weeks, led to increased demand for its products.

The company exit the year 2019 with about $500 million in cash despite a challenging sales environment. GameStop significantly improved its capital structure and optimized its operations by improving inventory.

GameStop is closely monitoring the dynamic situation around Covid-19 and potential impacts on its business. Despite increased demand since the outbreak began as millions of consumers look to GameStop for products that support remote and virtual work and learn settings, given the uncertainty around the evolving situation, the company has suspended further guidance at this time.

The company began fiscal 2020 with increased financial flexibility and continued focus on key priorities to optimize, stabilize and transform GameStop to achieve sustainable profitable long-term growth.

The company continues to focus on maintaining its balance sheet strength, prioritizing the allocation of resources to areas of the business that produce strong cash flow, reducing expenses across the business and intensifying inventory discipline.