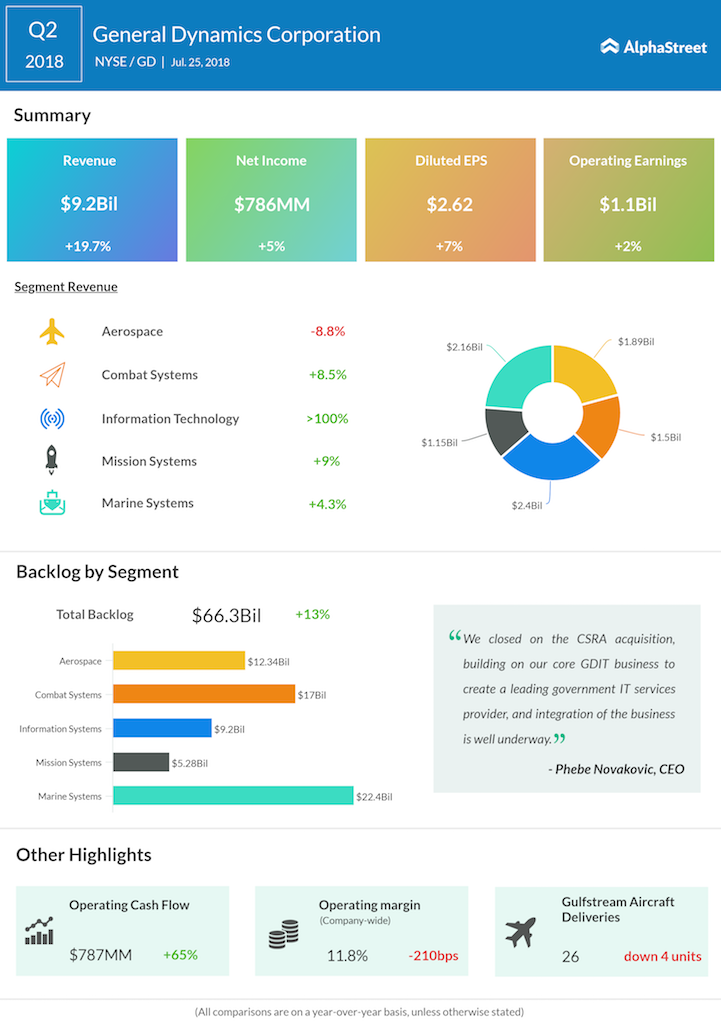

General Dynamics (GD) beats revenue and earnings estimates for the second quarter 2018. Despite earnings and revenue topping the estimates, the stock inched down 0.4% in the pre-market trading. Revenue climbed 19.7% to $9.2 billion from the same period last year, fueled by strong defense volumes and the acquisition of CSRA. The defense businesses saw a revenue increase of 7.1% on an organic basis.

Net earnings increased 4.9% to $786 million and diluted EPS grew 6.9% to $2.62 compared to last year. Excluding a one-time charge of $0.20 per share related to the CSRA acquisition, EPS would have improved 15.1% from last year.

CEO Phebe Novakovic said, “We closed on the CSRA acquisition, building on our core GDIT business to create a leading government IT services provider, and integration of the business is well underway. Our Combat and Marine segments continue to have reliable growth with strong operating performance. And the FAA certified the G500 and we look forward to delivering this newest Gulfstream aircraft to our customers in fourth-quarter 2018.”

The defense contractor had a total backlog of $66.3 billion at the end of the second quarter. The estimated potential contract value, representing management’s estimate of value in unfunded IDIQ contracts and unexercised options, was $32.7 billion. The total potential contract value was $99 billion at the end of Q2. Gulfstream unit orders saw a 21% increase from last year.

During the quarter, General Dynamics received several significant contract awards across its segments. These include a $440 million order from the US Army for the upgradation of Abrams tanks awarded to the Combat Systems division and a $615 million order from the Medicare and Medicaid agencies for contract center services awarded to the Information Technology division.

Rivals Lockheed Martin (LMT) and Northrop Grumman (NOC), both reported their quarterly results today and topped profit estimates. Shares of General Dynamics hit a new 52-week low ($184.21) on June 28 and were up 1.82% at $196.75 at the end of Tuesday’s regular trading session.