GE shares were up 1.2% during pre-market trading as investors seemed convinced with the long-term benefits of the move.

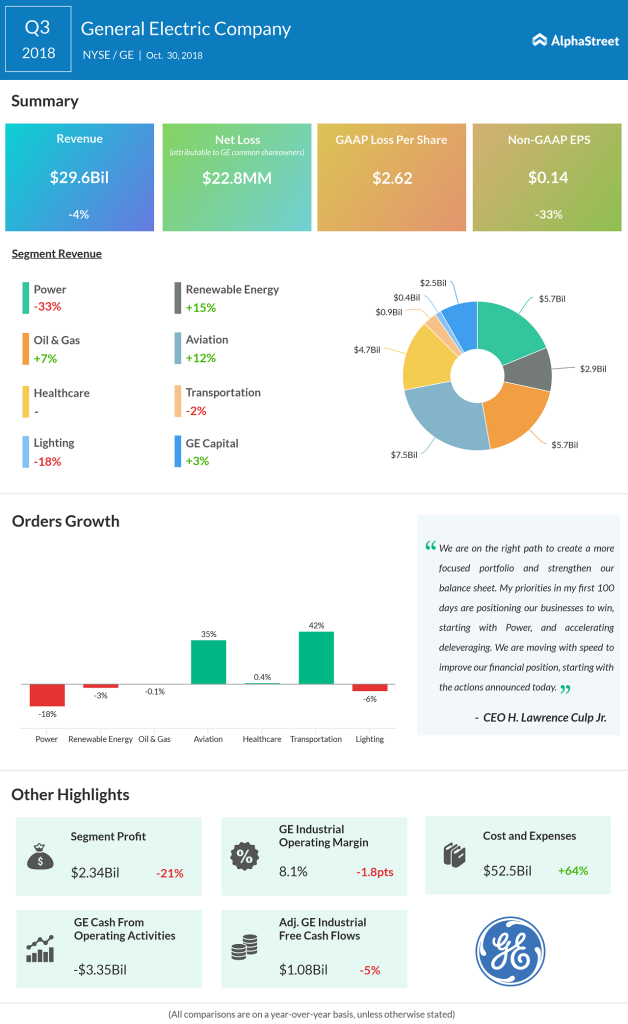

The Boston-based industrial mammoth reported third-quarter non-GAAP earnings of 14 cents a share, 7 cents short of what the street expected. Revenue of $29.57 billion was also below the market consensus of $29.88 billion.

“After my first few weeks on the job, it’s clear to me that GE is a fundamentally strong company with a talented team and great technology. However, our results are far from our full potential,” CEO Culp said in a statement.

Dividend cut in the cards as General Electric reports Q3 earnings next week

“My priorities in my first 100 days are positioning our businesses to win, starting with Power, and accelerating deleveraging,” he added.

The company also provided insights into how it is planning to restructure its ailing power segment. GE said it would split the segment into two separate entities – one relating to gas products and services business, while the other will handle the rest of the operations including nuclear, steam etc.

Larry Culp was appointed CEO of the industrial conglomerate on October 1 after the Board was unimpressed with John Flannery’s restructuring activities. John Flannery stepped down as the CEO less than a year after he took up the post.