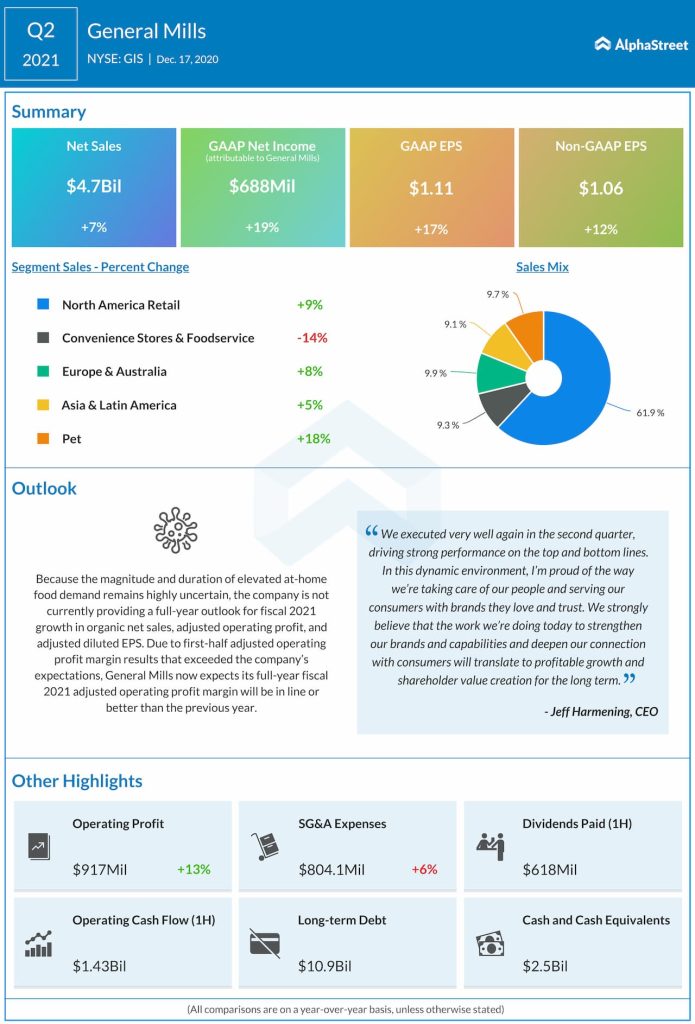

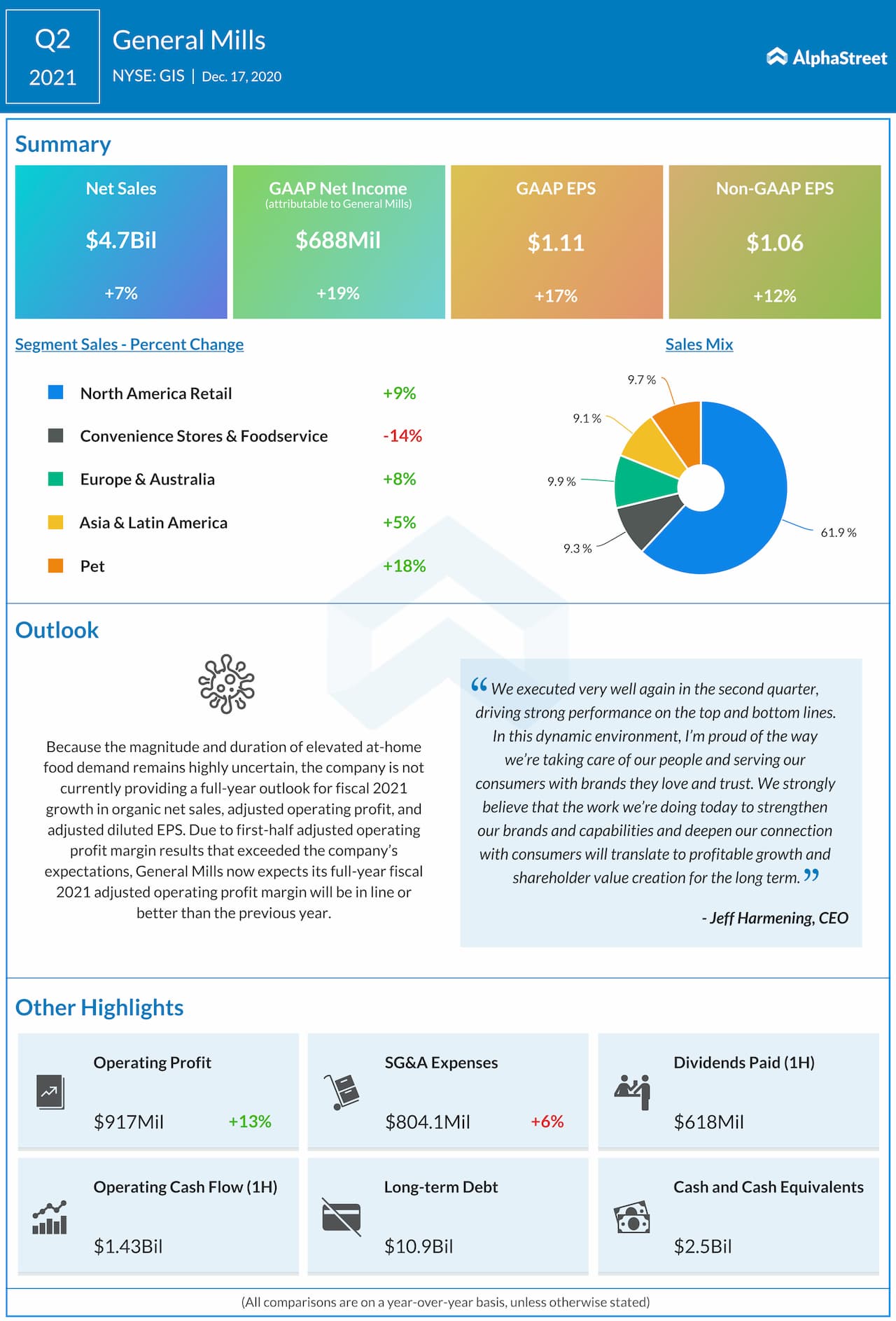

Quarterly performance

Net sales during the quarter increased 7% to $4.7 billion from the prior-year period. Adjusted EPS jumped 12% to $1.06. The company saw growth across all its segments except Convenience Stores & Foodservice.

Strong at-home food demand

At-home food consumption remains strong amid the pandemic and this has driven sales growth and market share gains for General Mills. In its North America Retail segment, the company saw growth in the Meals & Baking, Cereal and Yogurt categories.

On its quarterly conference call, the company said it has seen variations in consumer behavior across its key markets depending on the pandemic situation in those regions. In the US, at-home food categories have seen consistent growth in the high single-digits while demand for away-from-home has been down in the low double-digits range.

In places like France and the UK, at-home food saw a rise due to restrictions while Brazil saw a moderation as the situation eased. In China, the situation is pretty much normal but at-home demand remains at healthy levels.

General Mills believes that the trend of eating at home is likely to continue for the foreseeable future as people become accustomed to working and spending more time at home which in turn leads to more cooking and eating at home. The company also believes it will take a while for the vaccination process to have an impact and that at-home food demand will remain robust in the meantime.

General Mills believes that the economic downturn will drive at-home food demand as people prefer to eat home-cooked meals in order to save money. The company is also seeing strength in ecommerce and believes this trend will continue going forward.

Pet food

General Mills is seeing strong momentum in pet food. During the quarter, the Pet segment saw sales growth of 18%, with particular strength in the BLUE brand. The company saw sales increase over 25% in wet food and around 40% in treats under the BLUE brand.

On its call, General Mills stated that wet cat food is a roughly $5 billion product segment in the US and wholesome natural products represented only about 15% of segment sales thereby providing a vast opportunity for expansion. The company plans to take advantage of this opportunity through its BLUE brand.

Outlook

General Mills expects at-home food demand to remain strong for the rest of fiscal year 2021. This is expected to drive strong revenue and earnings for the third quarter. Organic net sales growth in the third quarter is expected to be similar to that of the second quarter. For the fourth quarter, net sales are expected to rise above pre-pandemic levels but are projected to be lower than the year-ago quarter.

Click here to read the full transcript of General Mills Q2 2021 earnings conference call