The Yoplait yogurt maker saw its earnings slide in the previous quarter. The stock soon saw a selloff as the top line missed estimates as well. The profitability was also impacted by a 160-bps fall in gross margin due to cost inflation and charges related to the acquisition of Blue Buffalo.

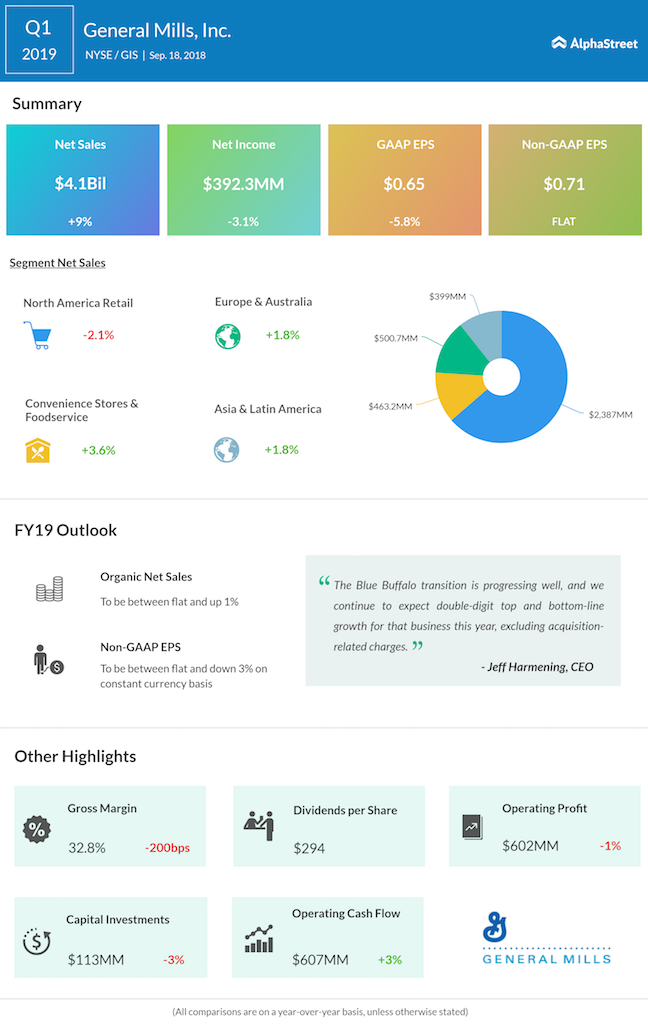

While posting earnings, General Mills also reiterated its FY2019 outlook of adjusted earnings between flat and down 3% year-on-year, while expecting a full-year net sales jump of 9-10%.

Back in February, Blue Buffalo Pet Products was acquired by General Millsm for about $8 billion ($40 per share) in cash.

Blue Buffalo was a leading pet food company that saw growth in the green over the past few years through its natural treats for dogs and cats. The company’s most prominent brand BLUE tops the list of Wholesome Natural pet foods, posting over $1 billion in net sales last year.