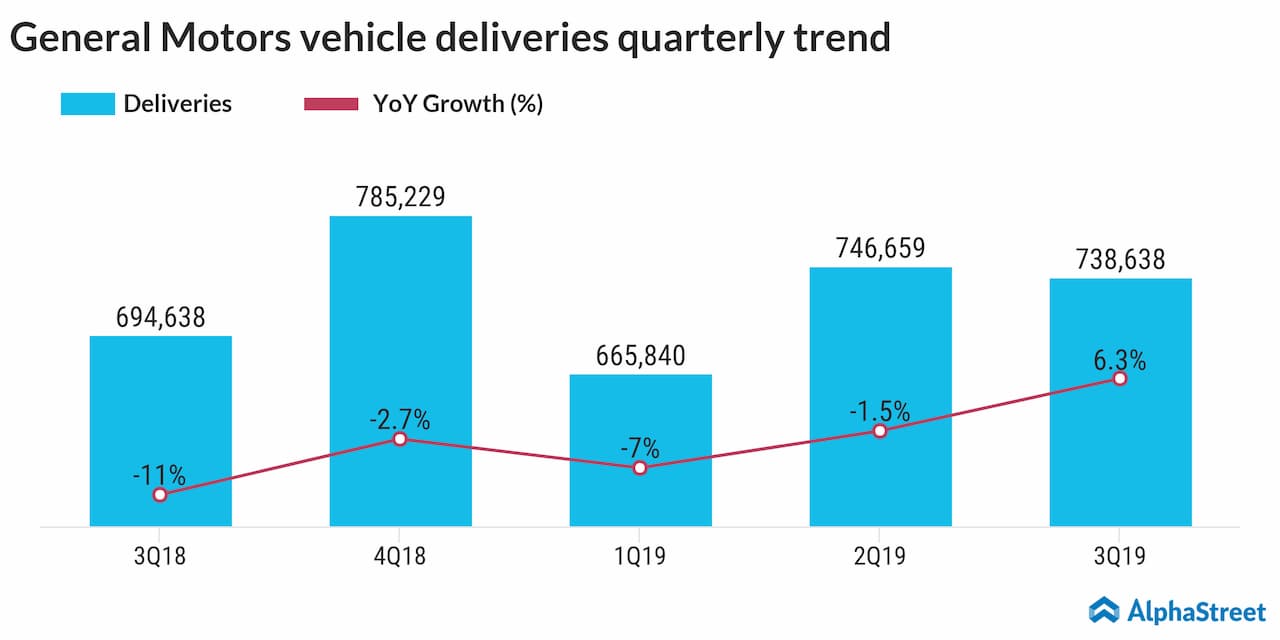

In the third quarter of 2018, GM delivered nearly 700,000 vehicles with average transaction prices reaching a record of $35,974. Sales, however, fell 11% year-over-year as the impact of hurricanes increased sales a year ago and depressed them this year.

In the fourth quarter, deliveries rose sequentially to

785,229, helped by strong sales in crossovers and pickups. However, on a

year-over-year basis, sales were down around 3%. In the first quarter of 2019, 80%

of the company’s deliveries were comprised of trucks, SUVs and crossovers. Sales

were down 7% year-over-year due to a comparably strong year-ago period.

In the second quarter of 2019, deliveries picked up sequentially helped by a 17% increase in crossovers. Deliveries were down 1.5% year-over-year, but truck and crossover deliveries helped offset lower passenger car sales. In the third quarter of 2019, GM reported an increase of 6.3% year-over-year in total deliveries to 738,638 vehicles in the US.

Also read: Companies that announced major restructurings in 2019

GM’s revamp of its model line-up and its increased focus on SUVs, crossovers and trucks helped bring a turnaround in its deliveries over the past one year. However, the ongoing strike is taking a huge toll on its operations in the US. The company has also cut several operations in Canada and has idled a plant in Mexico. The strike is expected to have a meaningful impact on its fourth quarter deliveries.

Shares have dropped 12% in the past one month. The stock was down in afternoon trade on Monday.