EV Shift

The GM leadership is bullish about the growing EV portfolio, mainly the Chevrolet Equinox which is touted as the most affordable car in the segment and purpose-built electric pickups Chevrolet Silverado EV RST and GMC Sierra EV Denali. It is making heavy investments in the EV business in the pursuit of an all-electric future. Meanwhile, there are concerns that the company is probably setting the bar too high considering the recent slowdown in the EV market. There has been a dip in the demand for purely electric vehicles as customers increasingly opt for gasoline-electric hybrid vehicles.

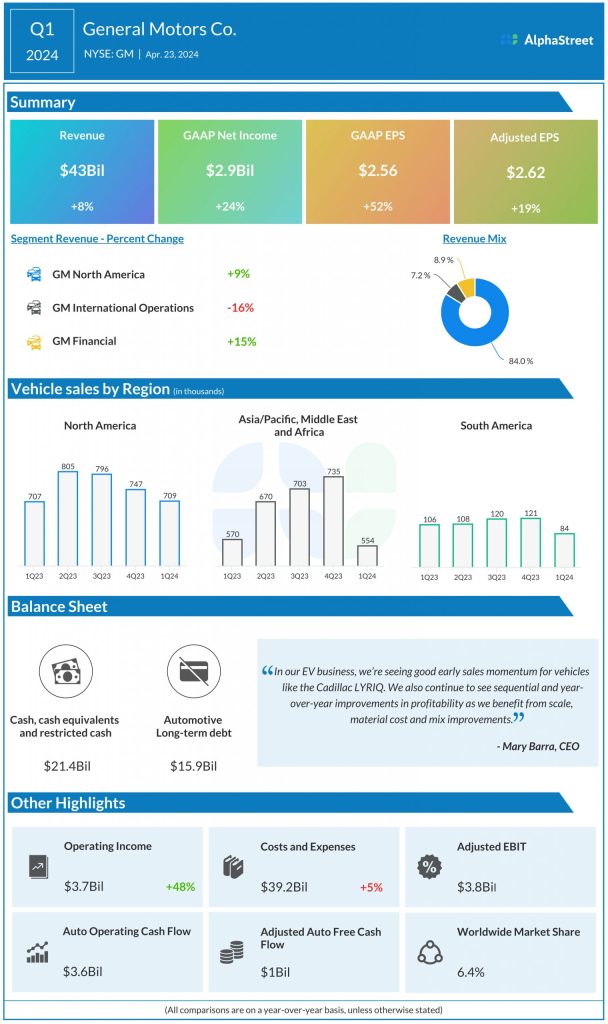

“We continue to see sequential and year-over-year improvements in variable profit and EBIT margins as we benefit from scale, material cost, and mix improvements. Since last year, we have significantly reduced cell costs with a large driver being lower battery raw material costs, especially for lithium. We ramped up our first battery JV plant last year. And as they increased production and made other efficiencies, the cost of cells came down significantly. And cell plant number two in Tennessee is ramping even faster based on the learnings from plant one and is expected to reach full Installed capacity by the end of the year.” GM’s CEO Mary Barra said during a recent interaction with analysts.

GM this week announced a new authorization for repurchasing up to $6 billion of the outstanding stock, as part of its strategy of creating shareholder value consistently. The company has been maintaining healthy cash flows, reflecting strong revenue growth and margin performance, which is good considering the heavy capital spending related to capacity expansion and new vehicle launches.

Q1 Numbers Beat

For the first three months of fiscal 2024, General Motors reported a 7.6% increase in revenues to $43 billion, mainly reflecting a 9% sales growth in the core GM North America segment. That was partially offset by a 16% drop in international sales. The results far exceeded Wall Street’s projections. Taking a cue from the upbeat performance, the management raised its EBIT guidance for fiscal 2024 to $12.5-14.5 billion. Full-year earnings per share guidance was revised to $9-10 from the earlier outlook of $8.5-9.5.

GM’s stock traded up 1.4% on Tuesday afternoon, after closing the previous session lower. It has traded above the 52-week average in recent months.