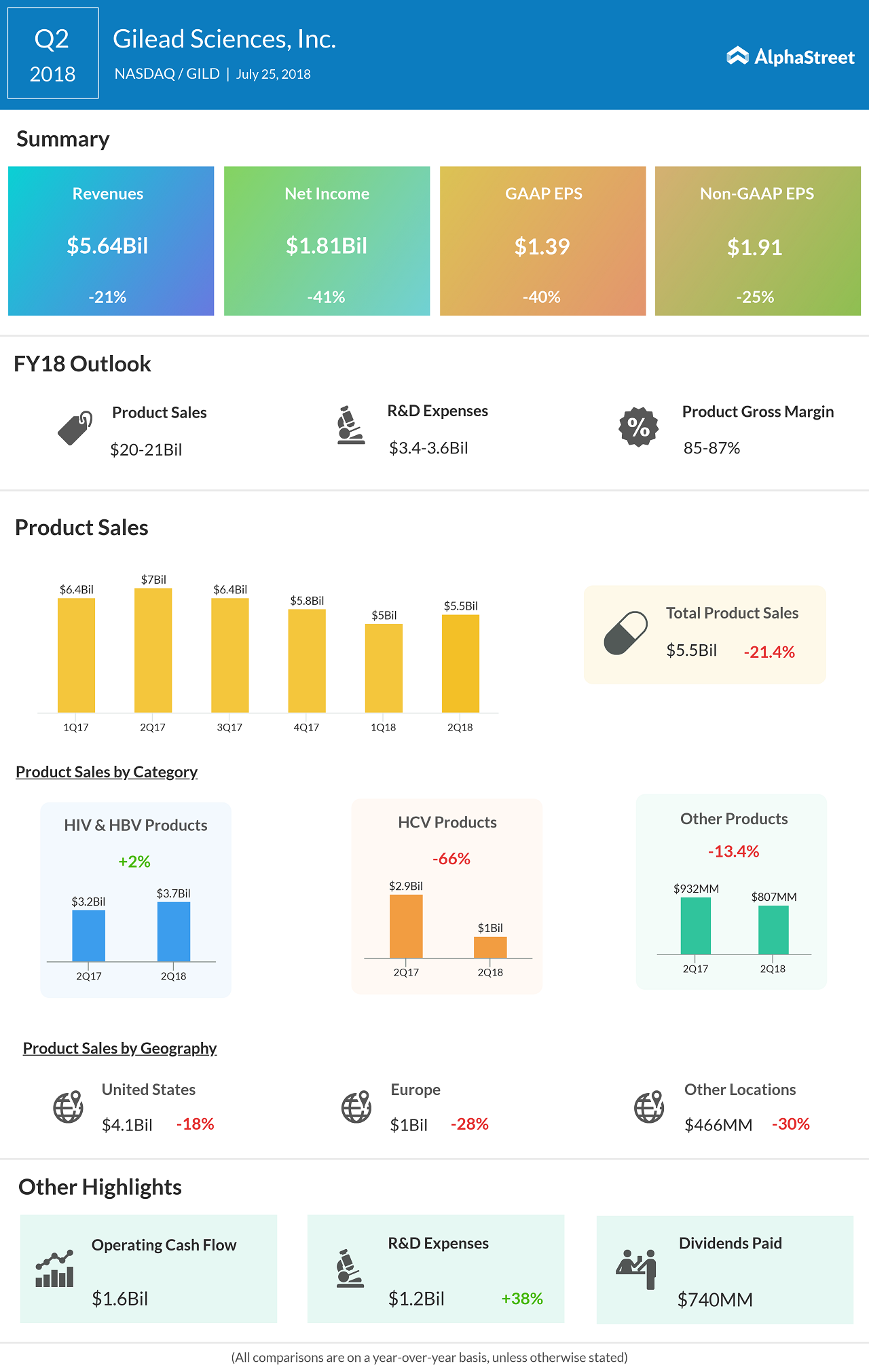

With revenue tumbling 21% to $5.6 billion, the biopharma giant saw a 41% slide in second-quarter earnings to $1.82 billion or $1.39 per share. Non-GAAP EPS plunged 25% to $1.91.

The previous quarter, lower sales of Harvoni and Sovaldi across all major markets and lower sales of Epclusa in the US due to increased competition hurt product sales. This quarter, however, Genvoya sales lifted sales a bit, offset by Truvada.

CEO Milligan stepping down sparks a slide in share price even after upbeat results

Gilead also saw research and development expenses (R&D) skyrocket to $1.2 billion this quarter from $864 million a year ago.

Gilead also tweaked its full-year 2018 guidance, as effective tax rate is now expected to be 19-21%, while the combined impact of acquisition-related, up-front collaboration, stock-based compensation, and other expenses on diluted EPS is touted to be $1.50-1.60 now.

Earlier, the biopharma company said it expects full-year 2018 net product sales of $20 billion to $21 billion and EPS of $1.41-1.51. Gilead continues to expect product gross margin of 85-87%, with R&D expenses in the range of $3.40 billion to $3.60 billion.

With not so impressive results, one can say the CEO stepping down was a long way coming. “Today, Gilead has the right strategy in place to successfully execute on its mission of improving the lives of people with some of the world’s most serious diseases, led by a robust HIV franchise, an industry-leading cell therapy platform and a late-stage pipeline in NASH and inflammation,” said John C. Martin, Chairman of the Board of Directors.

However, CEO John F. Milligan hinted that it was high time for a vacation, who said, “I’m looking forward to a well-deserved break and will then move on to new and different opportunities.” Dr. Milligan will also resign from the Gilead Board by year-end. Chairman John C. Martin also said he would step down from the board when a new CEO joins the company.