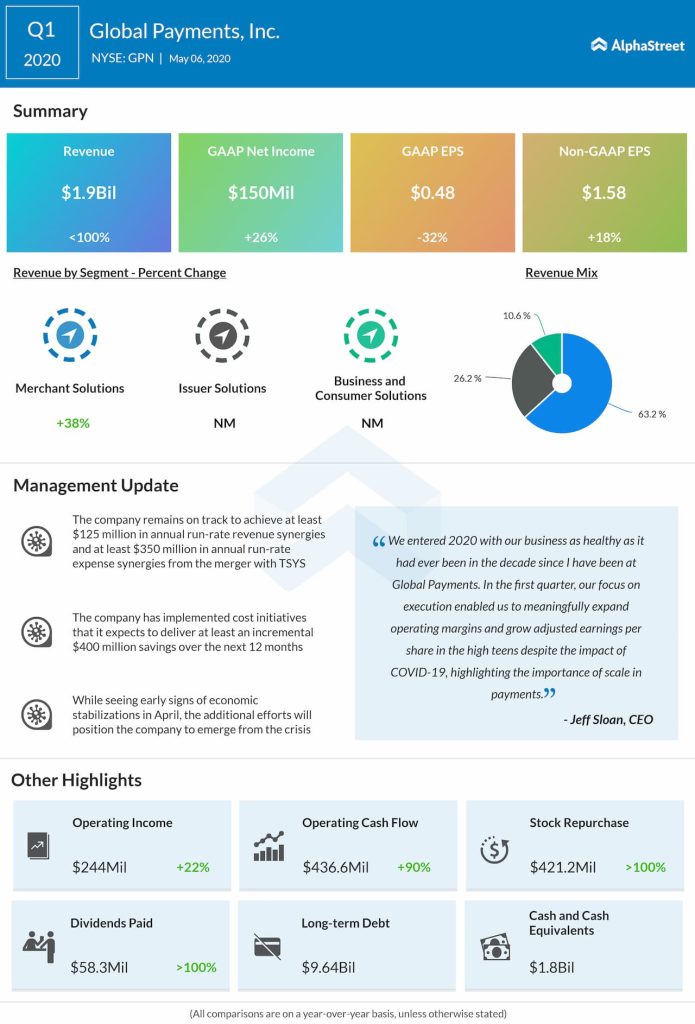

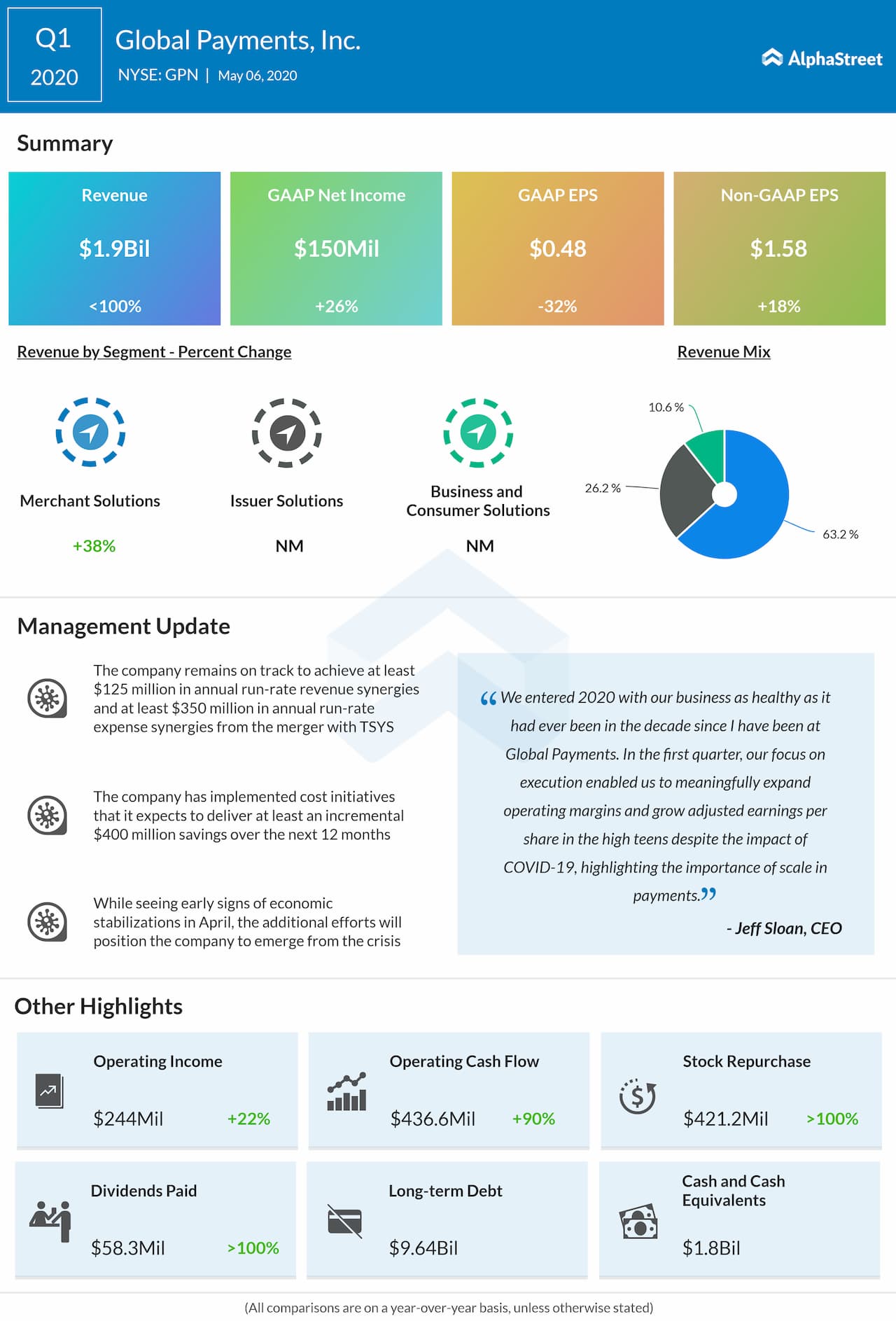

In addition to the existing expense synergy plan related to the merger, the company has implemented cost initiatives that it expects to deliver at least an incremental $400 million of savings over the next 12 months. Despite seeing early signs of economic stabilization in April, Global Payments expects the additional efforts would position it to emerge from this crisis at the same strong position.

The company’s board of directors approved a dividend of $0.195 per share. The dividend is payable on June 26, 2020, to shareholders of record as of June 12, 2020.