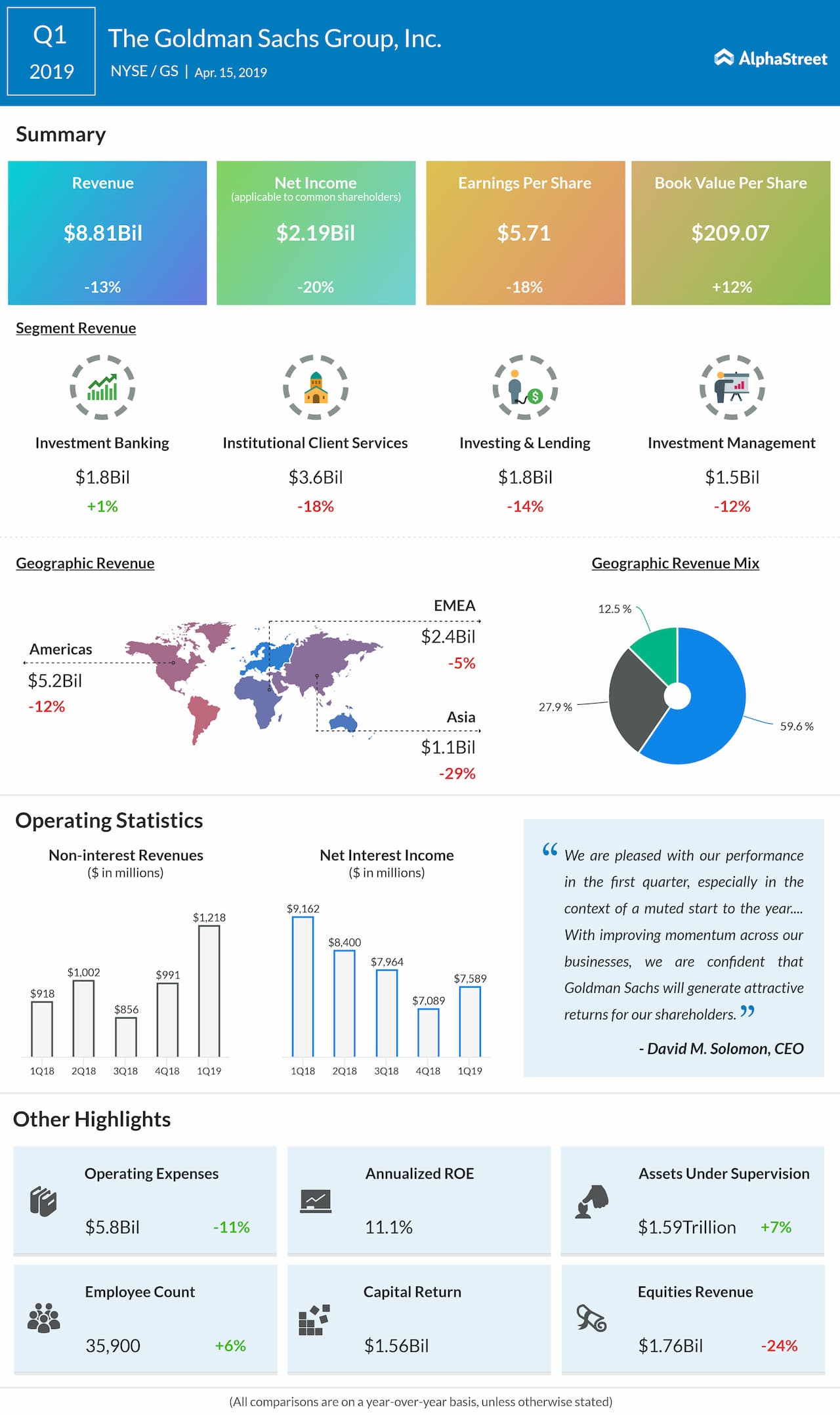

Net applicable income was 20% lower year-over-year at $2.19 billion, with earnings falling 18% to $5.71 per share. Book value per share, however, rose 12% to $209.07 in the same period.

Net revenues in Institutional Client Services fell 18% to $3.61 billion in the period, while the top-line in Investing & Lending decreased by 14% to $1.84 billion.

Operating expenses for the period was 11% lower at $5.86 billion, with an efficiency ratio of 66.6%.

The Standardized common equity tier 1 ratio jumped 40 basis points during the quarter to 13.7% and the Basel III Advanced common equity tier 1 ratio improved by 30 basis points during the quarter to 13.4%.

In the three-month period, Goldman Sachs returned $1.56 billion of capital to common shareholders, including $1.25 billion in share repurchases and $306 million in common stock dividends.