Goldman Sachs (NYSE: GS) is slated

to report fourth quarter 2019 earnings on Wednesday, January 15, before the

market opens. Analysts expect earnings to decline to $5.49 per share from $6.04

per share in the prior-year period. Revenues are projected to increase 5% to

$8.5 billion.

The biggest change to look forward to in the upcoming results announcement is the revamping of the company’s segments which was announced last Monday. Goldman made these changes in order to improve transparency and accountability.

The results will be reported in four new segments which are Investment

Banking, Global Markets, Asset Management, and Consumer & Wealth

Management. The Investing and Lending division, which was said to cause earnings

volatility, will cease to exist and its units will be distributed across the

new segments.

Although low interest rates are likely to affect margins, higher trading revenue could be an advantage in the fourth quarter. The company has seen weakness across several of its businesses over the past quarters.

Also read: Goldman Sachs Q3 2019 Conference Call Transcript

On Thursday, Goldman Sachs’ stock reached a 52-week high of

$243.40 after Bank of America and Buckingham upgraded the stock to Buy. Bank of

America’s Michael Carrier cited benefits from a favorable macroeconomic

environment and the strategic repositioning as reasons for the upgrade.

The company’s stock has gained 37% over the past one year

and 18% over the past three months. It has an average price target of $263.63.

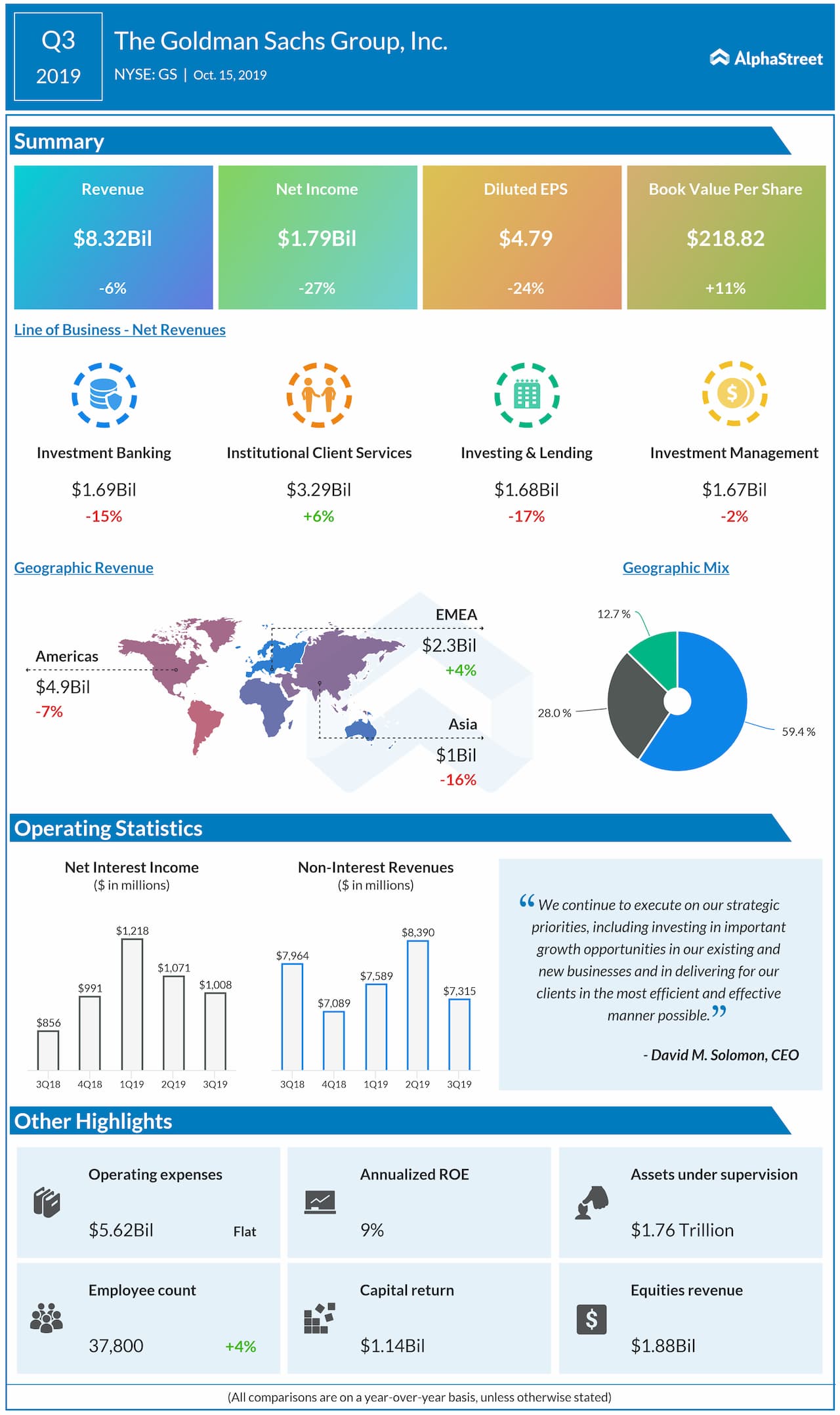

In the third

quarter of 2019, Goldman beat revenue estimates but missed earnings

expectations. Revenues fell 6% to $8.32 billion, hurt by lower revenue in

Investment Banking and Investing & Lending. Earnings fell 24% to $4.79.

A slew of banking companies, including J.P. Morgan (NYSE: JPM), Citigroup (NYSE: C) and Wells Fargo (NYSE: WFC) are set to report earnings this week.